-

-

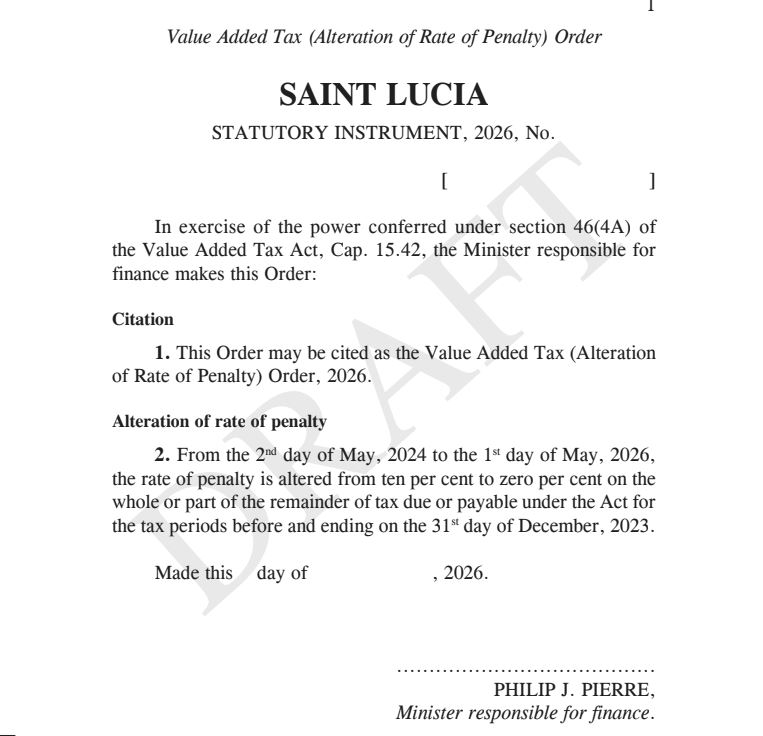

- Government reduces rate of interest on non-collection of VAT – May 2, 2024 – May 1, 2026, the rate of penalty from ten percent to zero percent on the whole or part of the remainder of tax due or payable under the Act for the tax periods before and ending on the 31st day of December, 2023

- Income Tax Act: Amendment to the Income Tax Act, Cap. 15.02 and for related matters.

-

Caribbean News Global ![]()

CASTRIES, St Lucia – The government of Saint Lucia continues to face challenges in the collection of Value Added Tax (VAT) paid by consumers in trust to businesses, for onward remittance to the government. This is not uncommon due to the VAT collection system of the Customs and Excise Department, the Inland Revenue Department (IRD) and the application of the law.

VAT represents the biggest share of government revenue, yet the attention to detail and collection is spotty. The unpaid VAT and its collection method prove the continued inefficiency of the Inland Revenue Department and law enforcement.

This is a recurring decimal that the brain trust of government needs to address and stop going around the issues.

The collection of VAT and non-remittance is a type of tax fraud and revenue loss for the government. This carries legal penalties.

However, to rectify such trends on political consequences to which political policy has applied, and to which the economic consequences and legal jeopardy are unresolved, raises eyebrows.

The measures to solve VAT non-remittance are not legislative redefinitions and lax laws, but the enforcement of what already applies and due to the state.

The underpinning of VAT collection and the application of the law reflects the inability of the state to enforce basic laws of business and statutes. Moreover, the institutions of the state, primarily the Customs and Excise Department, and the Inland Revenue Department (IRD), lack institutional capacity – backbone!

Last month, Prime Minister Phillip J Pierre said in part, “We are very disappointed,” and called on citizens and businesses to meet their obligations with the government. The prime minister indicated that his administration has been “very generous” under the tax amnesty programme, but admitted that “we are not getting the results we expected.”

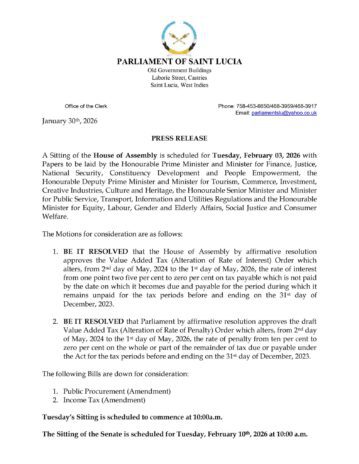

At the sitting of parliament scheduled for Tuesday, February 3, 2026, a resolution will be read:

“BE IT RESOLVED that Parliament by affirmative resolution approves the draft Value Added Tax (Alteration of Rate of Penalty) Order which alters, from the 2nd day of May, 2024 to the 1st day of May, 2026, the rate of penalty from ten percent to zero percent on the whole or part of the remainder of tax due or payable under the Act for the tax periods before and ending on the 31st day of December, 2023.”

The government resolution is attempting to collect VAT revenue; however, is this revenue still available on demand?

Read CNG Business report – ‘Historic tax amnesty, millions in tax exemption for all St Lucians,’ but according to science, these tax amnesty gimmicks are trading tax schemes. …these amnesty schemes don’t work.

For years, preceding governments and the Inland Revenue have been awkward in the collection of taxes. The Saint Lucian public is well aware and has adapted to crafty resolutions. It has become acceptable to delay and, in most cases, not pay taxes. There is also creative accounting for non-compliance.

Why?

- The repercussions and consequences are none!

- Is it a situation where the political directorates get involved on behalf of the commerce bosses?

- Is it a situation where personnel at IRD are frustrated?

- Hence, why pay taxes, “IF and WHERE” government institutions, statutes and law enforcement are negotiable, and non-compliance to amnesty leads to government capitulation?

Read CNG Business report – St Lucia’s 2023/24 budget: Re-positioning mid-term for general elections and St Lucia legislates selective 12.5 percent VAT reduction for two years.

Stabilising public finances

The IMF January 2026 consultation reads:

“Reforming the tax system would boost revenue, improve equity, and reduce distortions. St Lucia’s tax system has high tax expenditures which weaken collection. Tax measures could include rationalising corporate income tax incentives, broadening the VAT base (including digital services)—accompanied with targeted support to vulnerable households, improving personal income tax progressivity, shortening property exemptions, reforming fuel taxes and increasing excises on alcohol and tobacco. Tax administration priorities include strengthening audit and inspection, accelerating digitalisation of processes, enhancing compliance and improving transparency.”

The results of VAT policy, collection methods and statutes require special attention to detail and monitoring, if economic buoyancy and ‘public debt, at around 77 percent of GDP in the medium term’ and 2.3 percent growth in 2026 is expected to materalise.

If VAT revenue is not available as intended for the 2026/27 budget (economic, social and infrastructure projects), borrowing becomes a viable option at high interest rates. Or worse, reduced government expenditure, increasing the VAT pool, and/or increased VAT!

The government should, however, introduce several immediate VAT changes to collection and enforcement with legislation.

Among papers to be laid on Tuesday are:

- Saint Lucia Bureau of Standards, Annual Report 2021-2022

- Saint Lucia Bureau of Standards, Annual Report 2022-2023

- Invest Saint Lucia, Annual Report 2024-2025.

VAT has been previously declared, “oppressive and punishing”- “opportunistic and bizarre,” hitherto successive governments have not bargain a more creative way and less onerous way of raising revenues generated by VAT, ”without compromising the revenue base.”

Determinedly, an economist commented on the VAT matter, specific to Saint Lucia, stating: “16-1. There is enough brain power. They can handle that.”