- Intervention, when appropriate, should be used as part of an integrated policy approach that incorporates other policy levers to mitigate risks

By Suman Basu, Sonali Das, Olamide Harrison, and Erlend Nier

With major central banks now cutting policy rates, the global interest rate cycle is turning. This shows how far the fight against inflation has come in many advanced economies. But with economic uncertainty still high, it also raises concerns over possible spillovers. Lower policy rates could spur capital flows as investors search for yield. And such flows can reverse sharply when adverse shocks lead to renewed tightening of financial conditions.

To safeguard their economic and financial stability, our Integrated Policy Framework can help calibrate the best possible policy mix in the face of such volatility. In a more shock-prone world, policymakers must be even more agile in using tools that are well-calibrated and suited to specific circumstances. Our framework shows that, in the absence of market frictions, monetary and fiscal policies are often enough to address the impact of external shocks. But it also shows how employing additional tools can be helpful under certain circumstances.

For example, should rapid capital outflows cripple crucial funding markets and cause a sharp drop in the exchange rate, a central bank can sell foreign exchange reserves, or lend them out, to stabilize markets and safeguard financial stability. Foreign exchange intervention, however, can come with costs and involve important trade-offs. Intervening too often can lead to complacency about growing exposure to exchange-rate moves. And it should not be used as a guise to gain unfair competitive trade advantages.

Our principles for foreign exchange intervention, or FXI, detail when it may help countries with floating exchange rates – in other words where the exchange rate is otherwise predominantly determined by the market. They also highlight when intervention isn’t well-advised.

We are working to incorporate these principles, first published in December, in our annual economic health checks of member nations, known as Article IV reviews. And we’ll explore these issues during events and discussions with members at the upcoming Annual Meetings of the IMF and World Bank in Washington.

FXI in the toolkit

Countries with floating exchange rates typically choose a target for inflation and use interest rates to achieve it. Exchange rates in these cases are allowed to freely adjust to help better balance demand for imports and exports and help maintain external balances.

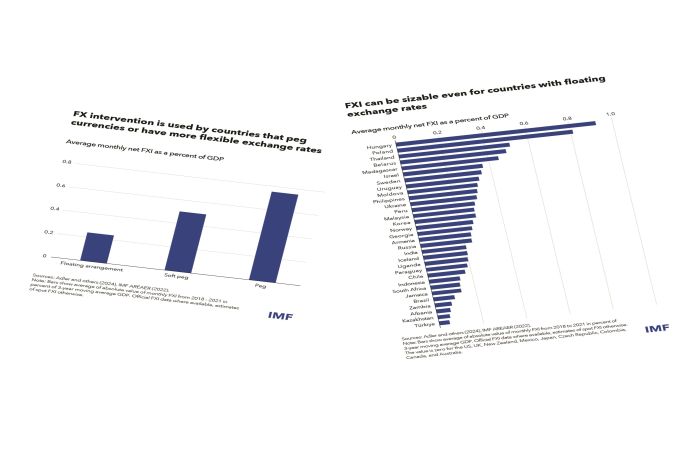

On the other end of the spectrum, about two-thirds of countries peg their currency to another one or otherwise manage the exchange rate. In these cases, central bank interest rates closely track those set by the anchor country, and they can’t be used independently to respond to domestic demand or supply shocks. Intervention is typically used in parallel to maintain the peg.

The principles focus on countries with flexible exchange rates. Most advanced economies have fully flexible exchange rates, known as free-floating. Some, like Canada, the United Kingdom, and the United States, almost never intervene. Instead, they let markets determine their currency values, even during times of stress. However, central banks in other floating regimes do still intervene at times.

Our Integrated Policy Framework, or IPF, recognizes that financially open economies may be more vulnerable to shocks, so fully flexible exchange rates may not always work well. That’s why we identify three circumstances in which central banks could consider FXI to address a large shock:

- When foreign exchange markets become illiquid, a central bank can use FXI to manage sharp changes in financial conditions that may arise from capital flow and exchange rate pressures and that threaten macroeconomic and financial stability.

- For unhedged currency exposures, a central bank can use FXI to counteract a sharp drop in the currency that would otherwise lead to a crisis, such as one involving large-scale private sector defaults on dollar-denominated debt.

- Where a sharp depreciation is likely to cause not just a temporary increase in the prices of goods and services but also raise inflation expectations, the central bank can consider FXI along with raising interest rates to contain those impacts. The complementary use of FXI can reduce the adverse growth impact from the tighter monetary policy.

These cases are embedded in the Fund’s conceptual and quantitative IPF models, and also draw on empirical work and considerations from outside the models.

Drawbacks of intervention

Our framework also recognizes that FXI may forgo some benefits of full exchange rate flexibility when it comes to macroeconomic adjustment, such as people and businesses switching between domestic and foreign goods and services. Another important consideration is that accumulating and holding reserves for FXI is costly.

Intervention can also have unintended side-effects. Overuse may hinder development of FX markets by reducing incentives for private sector currency trading or hedging. Expectations that the central bank will step in to stem losses can also create moral hazard. Moreover, poorly communicated FXI may cause confusion about the central bank’s policy reaction function and main instrument for achieving its inflation target.

Putting it all together

Given such drawbacks, the IPF recommends intervention only in the cases we describe above and when shocks are large enough to threaten economic or financial stability, such as an unusually sharp fluctuation in the exchange rate or financial conditions. In these cases, intervention should not be used to avoid adjusting monetary and fiscal policies. And if reserves are scarce, it may be best to preserve them until bigger shocks loom.

When it is determined that intervention is appropriate, such intervention is most effective as part of a combined policy approach that integrates other macro and financial tools. Even before a shock, countries should want to deepen their FX markets, making them more resilient to strains. Appropriate macroprudential measures can reduce risky borrowing in foreign currencies. And countries can better anchor inflation expectations to reduce the need for intervention in the event of shocks.

Our framework updates our advice by considering more integrated use of a wider range of policy levers to address market frictions and large shocks. It is also intended to foster policy discussions with member countries as we regularly assess their vulnerabilities and potential responses. The IPF can help countries adapt to their unique circumstances as they prepare for enduring uncertainty and future shocks.

- For more, see our December policy paper, Integrated Policy Framework: Principles for the Use of Foreign Exchange Intervention. The principles recognize the practical challenges central banks face and build on prior modelling work by Basu and others from 2020 and 2023, Adrian and others from 2021, and other empirical work.