By PYMNTS

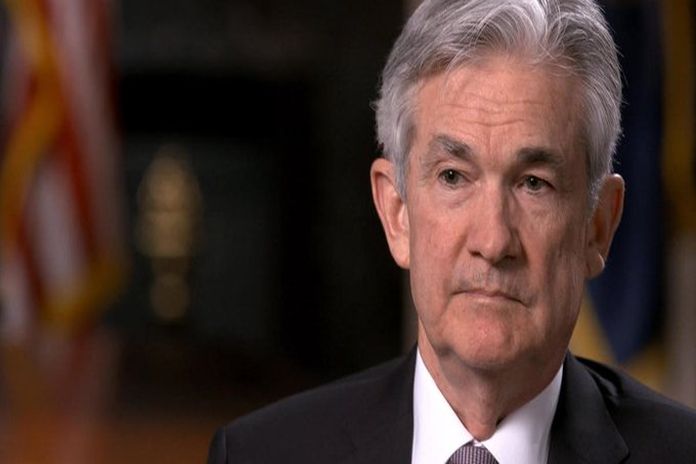

Federal Reserve chairman Jerome Powell, speaking on “60 Minutes,” said an economic recovery could take as long as another year and a half, but he said he believes the economy could begin recovering as early as the second half of this year.

Powell, speaking with correspondent Scott Pelley, considered the possibilities that could occur as the year continues to unfold.

“Assuming there’s not a second wave of the coronavirus, I think you’ll see the economy recover steadily through the second half of this year,” he said. “So, for the economy to fully recover, people will have to be fully confident, and that may have to await the arrival of a vaccine.”

Powell said he knew the country is in a dark place and that everything has changed so rapidly that it is hard to ascertain where the economy is going next.

“In the long run, and even in the medium run, you wouldn’t want to bet against the American economy,” he said. “This economy will recover. It may take a while. It may take a period of time. It could stretch through the end of next year. We really don’t know.”

Powell’s words add to the chorus of Fed officials ruminating on the possible futures. There have been a range of opinions from Minneapolis Federal Reserve Bank President Neel Kashkari saying he doesn’t believe a quick recovery is likely to St Louis Federal Reserve Bank President James Bullard’s opinion that the economy was doing well before the virus and so it could recover more quickly than expected.

Other economic experts have predicted the future via letter shapes, from an optimistic V-shape, predicting a steep recovery, to the L-shape predicting a long, slow trudge through recession.

There are a number of factors that will have to be met in order for the economy to recover, including the fear of consumers to go out while they could get sick, and the apprehension of business owners to open shops up if they might not get customers.