FRANCE / USA – After a rapid recovery from the pandemic, the US economy faces significant challenges from surging inflation and slowing economic activity, according to a new OECD report.

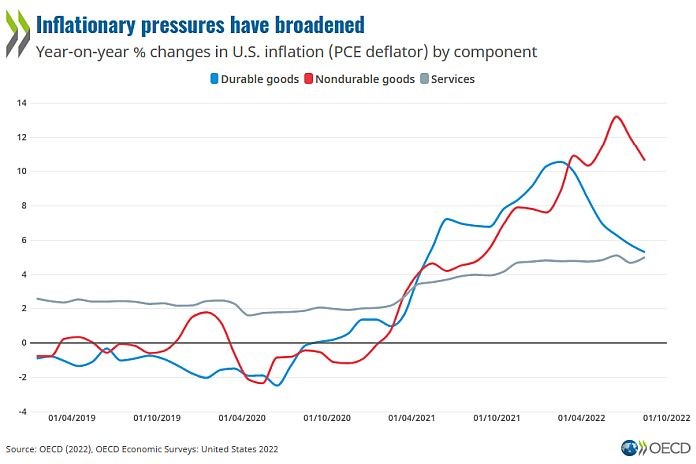

Growth is projected to slow to 1.5 percent in 2022 and 0.5 percent in 2023 with inflation and tight financial conditions weighing on spending. Inflationary pressures – driven by strong demand, supply constraints and rising commodity prices following Russia’s war of aggression against Ukraine – have broadened, with services inflation now accelerating. Inflationary pressures may prove persistent, prompting additional monetary tightening.

Beyond managing immediate economic developments, the latest OECD Economic Survey of the United States says that preparing for the fiscal costs of an ageing population and easing financial pressures on middle-class households should be key priorities. The Survey draws attention to a polarisation in income and wealth distributions in recent years as the growth of disposable incomes of the US middle class has been weak relative to that of higher and lower-income households, and a shrinking middle class has faced higher costs of living.

“Like many countries, the United States is dealing with the negative impact of lower global growth and higher inflation caused by Russia’s unprovoked, unjustifiable and illegal war of aggression against Ukraine, while also still working through some of the economic implications of the pandemic,” OECD secretary-general Mathias Cormann said, presenting the Survey in Washington. “The US administration is rightly focusing on reducing income disparities and investing in infrastructure and the green transition. The flexible and innovative nature of the US economy makes it well placed to tackle challenges and priorities, leveraging the structural transformations taking place.”

Middle-class households, which are key drivers of economic growth and social stability, had already been feeling the effects of rising housing, education, healthcare and childcare costs for some years. These rising costs, coupled with weak growth of incomes, have resulted in higher levels of household indebtedness. To ease some of these pressures, the Survey recommends raising public funding for childcare, widening the income eligibility for public programmes, fixing minimum federal childcare standards and establishing a consistent quality rating system across states.

Middle and low-income households should also be supported with measures to ensure they can benefit from investment in energy efficiency and are shielded from energy price hikes. As part of broader efforts to advance the transition to net zero emissions, financial support and preferential lending for weather-proofing and retro-fitting housing should be expanded to cover middle-income households while states are incentivised to update building energy standards.

Over the longer term, the United States will need to address fiscal challenges from ageing-related costs, which are set to increase by over 8 percent of GDP by 2060 without policy reforms, and foster efforts to strengthen the social safety net and achieve the climate transition. Stabilising the debt-to-GDP ratio will require additional tax revenue and more efficient spending in areas like health and infrastructure, where costs are high relative to other OECD countries.

In broadening the tax base, a priority should be to reduce tax distortions that erode revenues and have unwanted economic consequences. Reforms should include eliminating the mortgage interest tax deduction and phasing out the deduction of state and local taxes from federal income tax liabilities. Efforts to combat tax evasion could be strengthened by raising staffing in the U.S. tax administration closer to average OECD levels, and the additional funding announced in the recent Inflation Reduction Act is a step in the right direction.

United States Economic Snapshot – Economic Survey of the United States (October 2022)