– Reforms could bolster productive potential and ensure the country remains a global innovation leader

By the UK team, IMF European Department

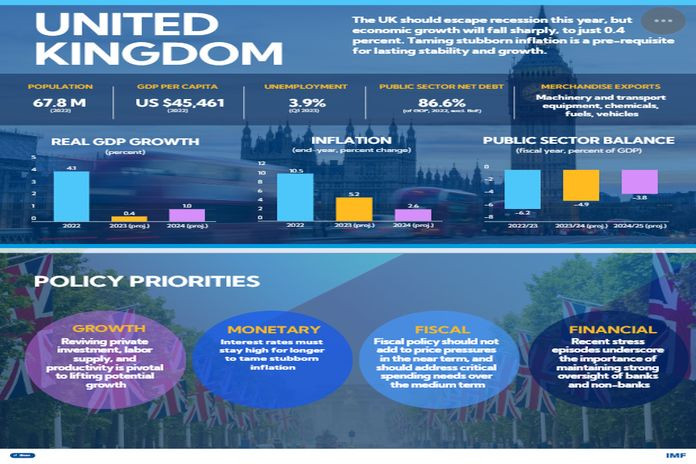

Although the United Kingdom is expected to avoid a recession this year, the country faces a challenging economic outlook. The energy price shock due to Russia’s war in Ukraine has disrupted the recovery, with growth projected at a modest 0.4 percent in 2023 and 1 percent in 2024. The terms of trade shock, amid historically tight labor markets, has also pushed inflation to record levels.

Bringing down inflation is a prerequisite for lasting stability and growth. The authorities have rightly tightened monetary policy, most recently with a 50-basis-point rise in interest rates in June, and fiscal policy in the fight against inflation. But, as we discuss in our regular review of the UK economy, the country also faces structural challenges, notably weak potential growth, currently estimated at about 1.5 percent. Ambitious reforms are needed to bolster the UK’s productive potential.

Prior to the 2008 global financial crisis, the UK had been a strong performer among the Group of Seven countries. But this momentum was lost in the middle of the last decade. By 2022, real business investment was still slightly lower than in 2016, in contrast to the 14 percent increase among other G7 economies. Labor supply, which has just reached its pre-pandemic level, has also been weaker than peers. As in other advanced economies, productivity growth has been sluggish, reflecting a slower pace of innovation and technological diffusion.

The authorities are taking steps to boost the UK’s growth potential. The “Windsor Framework” and a more measured approach to reviewing retained EU laws will help reduce Brexit-related uncertainty. Enhanced childcare support and tax relief on investment in plant and machinery introduced in the Spring budget should support labor participation and business investment, respectively. The Chancellor’s “4Es” strategy (enterprise, education, employment, everywhere) targets high-productivity growth areas, such as advanced manufacturing, life sciences, and clean energy.

In our report, we spotlight further policies that could add momentum to these efforts.

- A stable, long-term strategy to promote business investment, including a permanent set of tax incentives that could potentially apply to investments other than plant and machinery would strengthen investor confidence. Public infrastructure investment, notably in transport, health, networks, and the green transition, could “crowd-in” private investment. Liberalizing the planning system would reduce barriers to investment in new industries and facilitate the mobility of both firms and workers. The authorities could also consider unlocking pension and insurance savings for investment in higher-return projects, while being mindful of any implications for financial stability.

- Long-term sickness and, to a lesser extent, early retirement, are the main drivers of the post-pandemic spike in inactivity. Hence, improving health outcomes is critical. The authorities should consider additional targeted mental-health interventions alongside an expansion of good quality apprenticeships and career counseling in schools to tackle high unemployment among young people. Flexible working and coaching services could enhance female labor participation and complement the recently announced expansion in childcare support. Insofar as these measures enhance the labor supply in the near term, they can also ameliorate inflationary pressures stemming from a tight labor market.

- The above reforms will also enhance productivity. In addition, upskilling and knowledge development, and higher investment in the education and training of young adults, can strengthen human capital and raise labor productivity. There is also potential to increase R&D support for businesses to ensure the UK remains a global leader in innovation.

To support these reforms, future budgets should accommodate critical public investments as well as the level of recurrent spending needed to maintain high-quality public services (especially health, social care, and education). Meeting these needs while ensuring that debt stabilizes in relation to gross domestic product will require savings from additional tax and spending measures.

In this context, our report highlights options to strengthen carbon, property, and wealth taxation; to close loopholes in the income and social security tax systems, and to reform pensions.