– Low Pay Commission recommendations take the minimum wage to its long-term target in April 2024

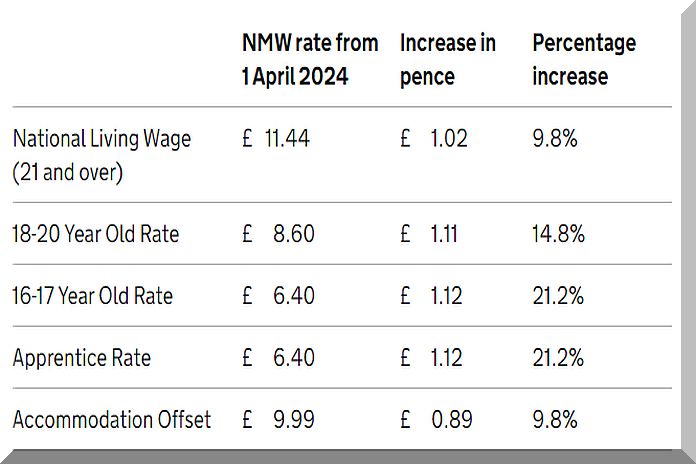

LONDON, England – The government has today announced its acceptance of the Low Pay Commission’s recommendations on minimum wage rates to apply from April 2024. The rates recommended by the LPC are set out below.

We judge that this recommendation for the NLW will achieve the target first set by the Government in 2019 – the NLW will be equal to two-thirds of median hourly pay for those aged 21 and over. In addition, from April 2024 the NLW will be extended to 21 and 22 year olds, fulfilling a recommendation we first made in 2019.

This will be the largest-ever increase in the minimum wage in cash terms and the first time it has increased by more than £1. The size of this increase is driven by the strength of pay growth across the economy, which is forecast to continue into next year.

Bryan Sanderson, LPC chair, said:

“The National Living Wage has delivered an improved standard of living to thousands of people who care for our children and elderly, work in farms and shops and at many other essential jobs. These efforts over the lifetime of the NLW mean over £9,000 p.a. more to a full time worker without any increase in unemployment.

“This hasn’t been easy for employers, with the economy facing a range of unprecedented challenges in recent years. The high degree of political and economic uncertainty has made assessing and forecasting the performance of the economy, and therefore our task, very difficult. It is a tribute to my fellow Commissioners that we have continued to achieve consensus.

“Our new recommendation of a National Living Wage of £11.44 attempts to steer a path through this uncertainty and achieve the government target of two-thirds of the median wage, an outcome which if accepted would position the UK at the forefront of comparable economies.”

The Low Pay Commission in a press release, said:

“As every year, we heard evidence from employers across the UK about the pressures they faced. Costs in most sectors have continued to rise, and uncertainty has made it difficult to plan for and invest in the future. Small and medium-sized businesses report the greatest concerns, and firms in low-paying sectors are more worried about reduced consumer demand, costs of energy and the cost of labour than firms in other sectors.

“At the same time, the low-paid workers we spoke to this year painted a picture of growing hardship. Those on the lowest incomes have felt the rising cost of living most sharply. We heard accounts of foodbank usage and indebtedness as targeted support introduced last year began to fall away.

“We believe our recommendation will restore the real value of the NLW, which has been eroded through the recent cost of living crisis. Our judgement is that this increase will not cause significant risk to employment prospects,” said the Low Pay Commission. “Alongside the NLW, we have recommended large increases to NMW rates for young workers and apprentices. These increases reflect the strength of the youth labour market and aim to prevent the wage floor for young people being cut adrift from prevailing wage rates in the wider labour market.”