By Oliver Reynolds, Economist

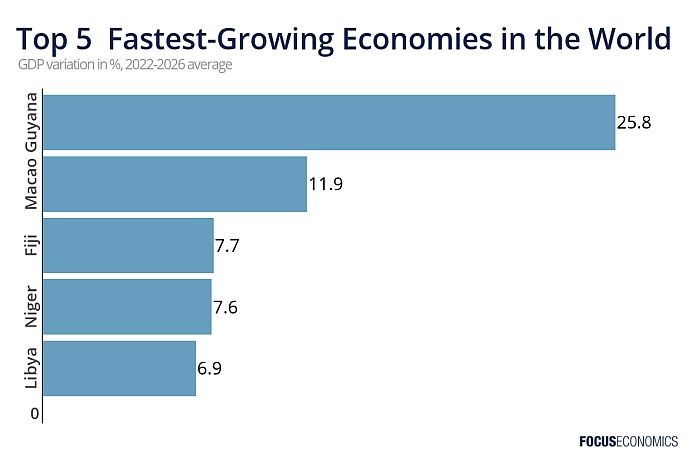

BARCELONA, Spain, (FocusEconomics) – This article looks at which among the nearly 200 countries covered by FocusEconomics are expected to grow the fastest over the 2022–2026 period.

- Guyana

Average growth 2022-2026: 25.8 percent

Guyana will be by far the fastest-growing economy over the next few years. An oil bonanza is behind the favorable projections: Oil production rose from virtually zero in 2019 to over 100,000 barrels per day (bpd) in 2021, and the World Bank sees output rising to more than 400,000 bpd by 2024 as new projects come online. Dozens of oil discoveries have been made in recent years, with the latest as recent as October 2022. The ensuing boom in fiscal revenue should fuel public spending. This, together with the government’s local content policy to favor Guyanese individuals and firms in the energy sector, should support the non-oil economy. That said, there are numerous risks to the outlook. The burgeoning energy sector could lead to cronyism and weaken institutions, as well as divert resources away from manufacturing and services. Ethnic tensions and protests are further clouds on the horizon.

“Guyana’s increasing reliance on the extractive sector raises its vulnerability to oil-related shocks. It also faces well-known risks associated with resource-dependent economies, increasing reliance on the state which can affect private sector competitiveness, and an erosion of institutions. Maintenance of an operational sovereign wealth fund is central to mitigating the imbalance between the resource inflow and the economy’s absorptive capacity while also limiting waste. Moreover, oil production has environmental consequences that must be carefully considered.” – World Bank.

- Macao

Average growth 2022-2026: 11.9 percet

Macao, a special administrative region of China, is forecast to grow at the world’s second-fastest rate over our forecast horizon. However, this will largely reflect a base effect following one of the world’s steepest pandemic-related downturns, rather than strong underlying growth prospects. Macao relies heavily on tourism and gambling, and its economy has thus been ravaged by China’s zero-tolerance Covid-19 policy and border restrictions. The strong growth projections for the coming years hinge on an eventual loosening of China’s Covid-19 stance and a subsequent rebound in foreign visitor arrivals. Risks include the country’s reliance on a single industry – gambling – and on visitor arrivals from the mainland.

“Macau’s recovery remains contingent on a recovery in Chinese visitors, which EIU does not expect to significantly materialise until after mid-2023. Recurring outbreaks will still keep gambling and tourism activity below pre-crisis levels until beyond 2024. Worsening US-China ties are unlikely to affect the renewal of casino licences scheduled for end‑2022, including for the three US-owned casinos in the territory. This risk will nevertheless persist as US-China frictions intensify over the next decade.” – Economist Intelligence Unit.

- Fiji

Average growth 2022-2026: 7.7 percent

As with Macao, Fiji is extremely dependent on foreign visitors -particularly those from Australia and New Zealand. As such, the economy suffered an over 15 percent GDP contraction in 2020 at the height of the pandemic as both Australia and New Zealand introduced strict quarantine requirements. Fiji then recorded a further, smaller contraction in 2021. This steep downturn has created a favorable base of comparison which will flatter growth over our forecast period as tourism picks up. In H1 2022, visitor arrivals were over half their pre-pandemic levels. The country’s narrow economic base, vulnerability to natural disasters, high public debt and large current account shortfall are all risk factors.

“Visitor arrivals in July 2022 were almost 82 percent of those before the COVID-19 pandemic, with the number of tourists from Australia at 101 percent of the July 2019 count, Canada 76 percent, New Zealand 90 percent, and United States 94 percent. […] The strong tourism rebound will be sustained throughout the year in the absence of more severe variants of COVID-19. With the benefit of being the first mover, Fiji is likely to attract more business meetings, travel promotions and incentives, international conferences, and exhibitions in the coming months.” – Asian Development Bank.

- Niger

Average growth 2022-2026: 7.6 percent

Niger’s economy will benefit in the coming years from rising oil production and exports. In particular, the near-2000-kilometer oil pipeline to the Beninese port of Seme is expected to be operational next year. Construction work on and the eventual completion of the Kandadji Dam will also provide support. That said, the country will remain one of the poorest in the world at the end of our forecast horizon. Moreover, given population growth of over 3 percent per annum, GDP per capita growth will be notably less impressive than headline GDP growth. Risks are manifold, and include climate change, attacks by jihadi groups, political instability, elevated prices for agricultural inputs and social discontent.

“Comprehensive institutional and economic reforms, to increase overall productivity especially in agriculture, are needed to support a more resilient and inclusive development trajectory. Reforms should strengthen economic governance, including ensuring that the rents from the petroleum sector are invested to support inclusive growth.” – World Bank.

- Libya

Average growth 2022-2026: 6.9 percent

The economy of oil-dependent Libya should expand at a brisk pace in the coming years thanks to expected higher energy output and still-elevated crude prices. However, this is likely contingent on an improvement in the political situation. Following the failure to hold promised general elections last December, the country is currently split between rival governments, one based in Tripoli and the other in Sirte and clashes between the supporters of the two governments disrupted oil production earlier this year. Prompt elections are an upside risk, as this could allow the country to be reunited under a single government, boosting oil output and investment. On the flip side, a prolongation of the current standoff between rival governments is a downside risk, as it could lead to increased violent conflict and economic disruption.

“The main driver of economic growth will be the oil sector, which has strong, economy-wide multiplier effects. This will filter through to strong government consumption and investment and in turn support a recovery in private consumption. […] Growth in the non-oil sector will remain subdued in the first half of the forecast period, impeded by sporadic conflict and the poor provision of services, including power. However, on the assumption that fighting ceases and a more unified and effective elected government takes power from mid-2024 we expect security to improve gradually, and the government will look to promote non-oil growth.” – Economist Intelligence Unit.