By FocusEconomics

BARCELONA, Spain – The global economy is currently undergoing a shift in gravity from the West to emerging markets. To illustrate this, in 2011, the G7 economies collectively had GDP around two and a half times that of the BRIC economies (Brazil, Russia, India and China). Only a decade later, that figure was just 1.7 times.

Our Consensus Forecasts are for this trend to continue to play out in the coming years, given strong potential for catch-up growth, mineral wealth – particularly in those minerals that are powering the green energy transition -and healthy demographics in emerging markets. That said, developed markets will continue to dominate the podium of the world’s largest economies in the coming years, despite losing relative economic clout.

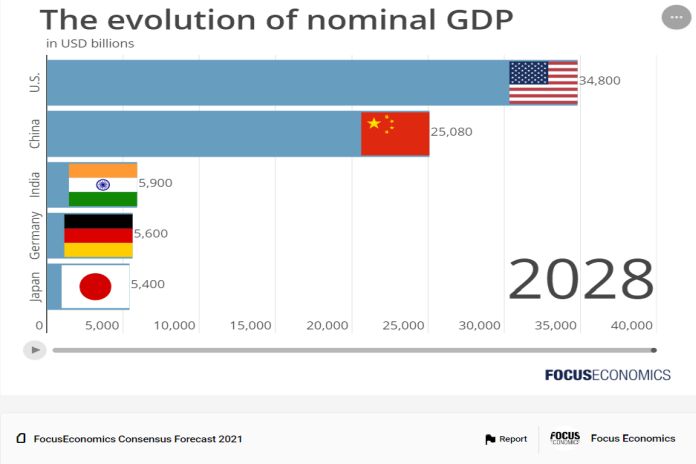

Which will be the world’s top five largest economies in 2028?

- United States: USD 34.8 trillion in 2028

FocusEconomics panelists see the US retaining its title as the world’s largest economy over the next several years, forecasting nominal GDP of USD 34.8 trillion in 2028. Healthy private consumption and fixed investment, growing energy output, a flexible labor market, still-favorable demographics and a supportive fiscal policy will all aid activity. Plus, the country boasts the world’s most dynamic private-sector companies and cutting-edge research institutions, which will drive innovation in emerging technological sectors.

However, rising public debt- which is already well over 100 percent of GDP- and debt interest payments crowding out other areas of spending are a downside risk. Moreover, the political gulf between Republicans and Democrats is hampering structural reforms and endangering social stability. On the external front, growing frictions with China-over technology and Taiwan in particular-will hamper bilateral trade between the two countries and could spark a full-blown conflict.

Moreover, the US will shed its relative economic clout: While in 2000, the U.S. economy was around four times the combined size of the BRIC economies (Brazil, Russia, India and China), the BRICs will be slightly larger than the US by 2028.

“Non-consumption-related drivers of US GDP growth in 2025-28 will primarily include investment and exports. The Biden administration’s industrial policies will gradually filter through the economy, including more than US$2trn in funding and incentives in green technologies, energy, infrastructure and semiconductor manufacturing. Exports will also benefit from strong demand from Europe for US energy commodities, notably liquefied natural gas (LNG), as the region cuts its dependence on Russian energy exports.” – The EIU

- China: USD 25.1 trillion in 2028

Our panelists forecast Chinese GDP at USD 25.1 trillion, or roughly 72 percent of US GDP, in 2028, compared to 76 percent in 2021 and 66 percent in 2023. Convergence with the US has gone into reverse in the last two years due to a weaker Chinese yuan, rapid economic growth in the US and the fact that China’s economy has been hampered by Covid-19 restrictions, a crumbling property market, political frictions with the West and regulatory uncertainty at home.

Looking ahead, China’s economy will remain held back by political tensions, population decline, regulatory uncertainty and overbearing state intervention in many areas. However, the economy still has strong potential for catch-up growth, given that per-capita income and urbanization rates are still lower than in developed economies. Plus, heavy government investment in high-tech and renewable sectors should yields results. As such, China should resume its converge with US GDP levels over the coming five years, albeit at a much slower rate than in the 2010s.

“There are bright spots in the economy, including investment in electrical machinery in the manufacturing sector and an increase in making precession instruments and cars. Policymakers’ will have to manage the outlook for GDP growth as the world’s second-largest economy transitions from one of its important economic engines – property and infrastructure investment – to a new one based on upgraded manufacturing and self-reliance.” – Goldman Sachs analysts

- India: USD 5.9 trillion in 2028

India is set to become the world’s third largest economy by 2028, with nominal GDP of USD 5.0 trillion, overtaking both Germany and Japan. Growth will be spurred in the coming years by surging consumption, investment-from both domestic and foreign firms-and exports. Prime Minister Modi’s Make in India agenda, together with increasing interest with firms looking to diversify output away from China, is set to galvanize the manufacturing sector. Moreover, brisk population growth will spur services activity. GDP growth will average over 6 percent a year out to 2028, among the highest rates in Asia.

That said, the government’s increasing attempts to pick winners could result in an inefficient use of resources, such as the USD 10 billion of public money earmarked to build an indigenous semiconductor industry. Moreover, the country’s protectionist bent-India bowed out of the Asia-wide RCEP trade deal in 2019 for instance, and is not part of the CPTPP or ASEAN, the other key trading blocs in the region-will dampen potential growth, as will shoddy infrastructure and still-significant red tape.

- Germany: USD 5.6 trillion in 2028

Germany is projected to overtake Japan as the world’s fourth largest economy from 2023, due largely to the recent weakness of the Japanese yen relative to the euro. By 2028, our Consensus Forecast is for Germany to boast nominal GDP of USD 5.6 trillion.

While a stable policy environment and stronger government investment will support activity in the coming years, the economy will be hindered in the near term by tight monetary policy. Plus, a deteriorating demographic profile will weigh on growth in the longer term; the population is projected to begin declining in 2025. Moreover, the shift to electric vehicles could spell trouble for the country’s crucial car industry, given the need for substantial retraining, retooling and restructuring of workforces to take advantage of job opportunities opening up in the electric vehicle supply chain.

- Related Link: Top 5 Largest Economies in 2028

- Japan: USD 5.6 trillion in 2028

Japan will slip to become the world’s fifth-largest economy over the next few years, with nominal GDP of 5.6 trillion in 2028-only marginally below that of Germany-according to our panelists’ forecasts. Despite extensive fiscal support and the loosest monetary stance of any major developed economy, Japan will continue to lose relative economic clout compared to both high-income and emerging-market rivals. A shrinking population will feed through to anaemic growth of just 1 percent on average in 2023–2028, by far the lowest in the G7.

At the beginning of the 21st century, Japan was the world’s second-largest economy and had nominal GDP roughly half that of the US; by 2028, it will be less than a sixth. Fiscal sustainability concerns amid an aging, shrinking population, low uptake of digital services, an ingrained low-inflation mindset and a rigid labor market cloud the horizon.a

Key takeaways

While developed economies will continue to dominate the list of the world’s largest in the coming years, emerging markets particularly move up the rankings. The days of a world economy dominated by the US and the West will increasingly give way to a multipolar world, with the US, the EU, China and India as its four key lodestars.

This will have a profound impact on a host of areas, such as international trade flows, geopolitics and the makeup of global financial institutions such as the IMF and the World Bank. Here at FocusEconomics, we will continue to provide succinct analysis and reliable forecasts to help clients navigate this shift in the tectonic plates of the global economy in the coming years.

- Originally published in December 2017, updated in December 2023