By BDC

MONTREAL, Canada – This year, like the last one, has begun with much uncertainty for the Canadian economy, and it remains to be seen if it will show the same resilience, it did in 2025. Faced with trade and geopolitical tensions last year, the Canadian economy still managed a respectable performance, with real GDP growth coming in at 1.5 percent between January and October.

However, the economy showed weakness late in the year. GDP declined in October (-0.3%) compared to September. The service sector, which accounts for about 70 percent of the economy was down by 0.2 percent, while the goods sector reversed course, after a strong September, to decline by 0.7percent. The manufacturing and oil and gas extraction sectors accounted for much of the drop.

GDP is projected to have also declined by 0.1percent in November, according to preliminary estimates from Statistics Canada. That would mean the country posted growth of no more than 1.4 percent for the first 11 months of 2025, compared with the same period last year.

Trade continues to show no clear trend

Trade remains the wild card for Canada’s economic outlook. Following high volatility earlier in the year, October data brought no clarity about the future direction of trade. Exports rose 2.1% to $65.6 billion, while imports jumped 3.4% to $66.2 billion, tipping the trade balance from a slight surplus in September to a deficit in October.

Significant movements during the year artificially inflated GDP without reflecting a sustainable improvement in the real economy.

Domestic demand remains moderate, and trade tensions with our main partner, the United States, exacerbated by tariffs on steel, aluminum and automobiles, continue to weigh on the outlook. Initial estimates suggest that exports declined for 2025 as a whole, while imports remained flat. This dynamic widens the country’s trade deficit and reduces the contribution of international trade to GDP growth. This phenomenon is likely to continue in 2026.

The job market was spared last year

Although job creation slowed, Canada had 226,300 more people working in 2025 than in 2024. Despite the economic uncertainty, the private sector contributed more than 200,000 of the new jobs, while the number of self-employed workers declined by just under 30,000.

Employment has nevertheless shown significant monthly variations over the past 12 months and there have also been significant regional disparities. It’s important to note that the unemployment rate remains high, while job vacancies have declined significantly.

In December, the labour market showed signs of slowing down, with Statistics Canada reporting just 8,200 more jobs than in November. The national unemployment rate rose 0.3 percentage points to 6.8 percent.

Households remain cautious despite rate cuts

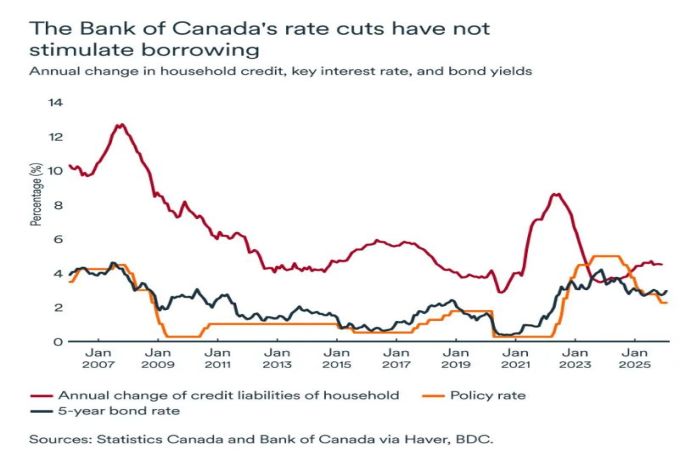

The Bank of Canada cut its key interest rate by 100 basis points in 2025, from 3.25 percent in January to 2.25 percent. However, this failed to encourage households to boost their borrowing significantly.

It appears the central bank’s actions have had less of an impact than in the past in lowering prevailing market interest rates and encouraging borrowing. Five-year bond rates, for example, have remained virtually unchanged over the past 12 months.

Usually, it takes several months for central bank rate cuts to have their full effect on the economy. There is, therefore, still hope that the 2025 rate decisions will support the real economy in 2026.

However, we will probably have to hope that fixed rates in credit markets come down since Canadian households seem to be continuing to exercise caution in their borrowing, despite lower variable rates.

The impact on businesses

- Prolonged uncertainty, particularly regarding international trade conditions, and modest GDP growth are making financial and strategic forecasting more complex for businesses in 2026. Take a scenario-based approach, make sure you have up-to-date and complete financial statements in order to optimize your costs and secure your margins.

- Rate cuts have not yet stimulated borrowing, which is delaying business expansion and modernisation projects. It would be surprising to see further cuts by the Bank of Canada anytime soon. If you have projects or maintenance that require financing, now is a good time to seek it out.

- Despite the economy’s resilience, domestic demand remains moderate. Labour market volatility is prompting households to be cautious, which is limiting consumption. Businesses that are more domestically oriented should expect volatility in demand. A scenario-based approach and an assessment of business optimisation will be beneficial in 2026, whether you export or not.