By Caribbean News Global ![]()

TORONTO, Canada – The significance of the state banquet held on Wednesday, August 3 in Taipei to welcome US House Speaker Nancy Pelosi, where Mark Liu (劉德音), chairman of Taiwan Semiconductor Manufacturing Co., (TSMC), the world’s largest contract chipmaker, reportedly on the guest list, serves the economic and trade purposes following ‘The Chips and Science Act’ passed by the US Congress and signed into law by president Joe Biden, stands out in technical competition to rival China.

The bipartisan bill to invest billions of dollars in domestic semiconductor manufacturing and science research, with the aim of boosting US competitiveness with China and other foreign rivals’, includes more than $52 billion for US companies producing computer chips, as well as billions more in tax credits to encourage investment in chip manufacturing, fund scientific research and development, and to spur the innovation and development of other US technologies.

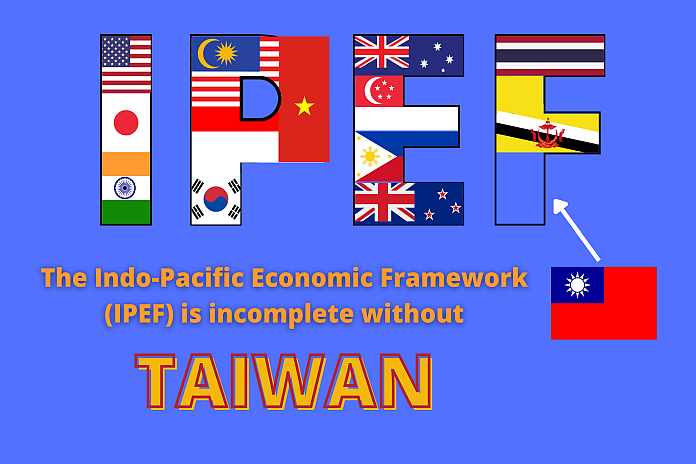

Moreover, the focus vindicates the important role Taiwanese companies such as TSMC integration into the US economy and the global supply chain. It also reinstates that signing a US-Taiwan Bilateral Trade Agreement further bolsters the role of IPEF as a whole. And thus, the Indo-Pacific Economic Framework (IPEF) is incomplete without Taiwan.

COVID-19 demonstrated affirmatively, Taiwan’s strategic positioning in the global marketplace to manufacture and distribute the most advanced types of semiconductors. These critical components are found in consumer electronics, automobiles, health care equipment and weapons systems, to name a few.

And while Speaker Pelosi said the trip aimed at reaffirming US ties to its regional allies, it is understandable why the US seeks to increase its share of global chip production, while China and other nations invest extensively in the industry.

US Treasury Secretary Janet Yellen in the article ‘A first-hand view of the work and innovation’ observed:

“Countries across the Indo-Pacific, and throughout the global economy, remain vulnerable to countries using their market positions in raw materials, technology, or products to exercise geopolitical leverage or disrupt markets and trading activities for unrelated reasons.

“One such example is China, which has directed significant resources to seek a dominant position in the manufacturing of certain advanced technologies, including semiconductors while employing a range of unfair trade practices to achieve this position.

“One of the ways we can address this is by modernizing our approach to trade integration by properly taking into account externalities arising from concentration of supply chains, geopolitical concerns, and value – rather than overly focusing on cost.

“To be clear, China has benefited enormously from being part of a global system, a rules-based multilateral system.

“We ought to try to preserve the best features of that system – one that has been beneficial to the United States and our allies – while working to address the real problems that have emerged, including the unfair Chinese practices that damage our national-security interests.

“In modernizing the multilateral trading system, our objective is to achieve free and secure trade that benefits our workers, businesses, and consumers.

“We cannot allow countries like China to use their market position in key raw materials, technologies, or products to disrupt our economy or exercise unwanted geopolitical leverage.”

Lora Ho, senior vice president and ESG committee chairperson advised, recently:

“As a world-leading dedicated IC foundry service provider, TSMC is committed to delivering an innovative technology platform to help customers achieve various chip innovations and to provide products that are more advanced, powerful, energy-efficient, and safe. Our goal at TSMC is to drive positive change and progress in society through technology.

“As TSMC strives to achieve sustainable management, we have become deeply aware that corporate growth cannot be independent of social development. TSMC has built a mutually dependent and mutually influential relationship with employees, shareholders/ investors, customers, suppliers/ contractors, government/associations, and community residents. In the face of complex issues and our many stakeholders, TSMC must spotlight these issues, communicate our objectives, and determine priority sustainability issues to exert our influence.”

“Taiwan’s TSMC, the world’s biggest chipmaker, is building a $12 billion factory in the United States, while GlobalWafers, another Taiwan chip giant, plans a $5 billion plant, as reported by Asia Financial. “Our interactions with the United States have been rather more, communication is closer,” said Taiwan deputy economy minister Chen Chern-chyi. “We also hope to develop the same close relationship with the EU. If it’s like this, it would be very helpful for our companies for their attention towards and knowledge of Europe.”

TSMC is building a new chip plant with Sony Group and Denso. (TSMC) says the new chip plant it is building in Japan alongside Sony Group will now be expanded, to an extra $1.6 billion in spending, while auto supplier Denso Corp will also take a 10 percent stake.

The chip giant has also been looking at building a factory in Germany, although it said last year it would focus on other clients first.

TSMC, which is the world’s largest contract chip maker, announced the $7 billion factory in southern Japan in November and construction is scheduled to start this year, with production beginning by the end of 2024.

This global concentration is purportedly described as a balancing act with Western allies, and a mitigating worse-case strategy to global supply chain interruptions, that rival China. This business expansion draws TSMC the manufacturing of advanced chips under 10 nanometers it controls, about 84 percent of the global market, according to the European Institute for Asian Studies in Brussels.

Further, TSMC is moving closer to customers and alternative supply chains in the world’s largest centres, with the main consideration on client demand. This provides leverage, and another competing advantage should China attempt to cut off TSMC’s supply chain, and cause a major crisis in the world economy.

Nevertheless, TSMC is expecting revenue to increase by 30 percent, compared to 24.9 percent in 2021.

The background on the US Advanced Manufacturing Investment Tax Credit, cites:

“While American companies still dominate the global semiconductor industry, accounting for nearly half of all revenues, the share of global production in the US has dropped from 37 percent in 1990 to just 12 percent today.

“This is a national and economic security threat. Semiconductor production is increasingly concentrated overseas, with 75 percent of global production now occurring in East Asia. Foreign government subsidies drive as much as 70 percent of the cost difference for producing semiconductors overseas. Combined with other factors, the result is a 25 to 40 percent cost advantage for overseas semiconductor production, as compared to the United States.

“These dynamics must change if the United States is to remain at the forefront of technological development in this vital industry and retain these high-skill, high-wage jobs.”

Taiwan sophisticated semiconductor industry dominates global supply

Taiwan has proven that it is an important and reliable partner, a strong and prosperous democratic country. And that, Taiwan’s economic and national security interest is reciprocal to the United States.

US leadership and an established framework is important as a market for US-made goods and innovation. The partnership of US – Taiwan businesses brings strengths that could help both countries achieve their goals – developing leading-edge semiconductor technologies and building advanced semiconductor production facilities, that rival the People’s Republic of China.