By Caribbean News Global ![]()

RODNEY BAY, St Lucia – A recent report attributed to Impact of Subsidized Goods to Manufacturers and Consumers published on the government of Saint Lucia news portal meets the methodology for shady politics and false economics.

The report attributed to the ministry of commerce, manufacturing, business development, cooperatives and consumer affairs, Sophia Alfay-Henry, contends that:

“A longstanding measure of support to homegrown Micro-Small and Medium-sized Enterprises (MSMEs) and the consuming public to imported container-loads of flour, rice and sugar, and sold at the government supply warehouse to local retailers and manufacturers at severely discounted prices.”

The pivot to this conveys with very little sway that: ”These items are imported annually through a transparent tendering process, which carefully considers several factors including service reliability, product quality and price.”

However, frequent shortages, product quality and operational efficiency tell a better-forgotten story of the need for privatization of the government supply warehouse. This is practical because the current model is detrimental to the supply of public goods and renders a classic methodology for shady politics and false economics.

Government subsidies are supposed to help stimulate or supplement economic activity and help influence market prices and economic growth.

Export subsidies help compete with foreign exporters, increase export trade and harness foreign exchange. Agriculture subsidies should help to protect domestic food prices, help to stabilize food prices and safeguard food production. Oil subsidies lower the price of oil, the cost of fuel and its by-products for consumers. Housing subsidies provide the opportunity to own homes via mortgage assistance, interest rate subsidies, and property tax amnesty. Healthcare subsidies via Universal Health Care (UHC), procurement of modern medical equipment, prescription drugs and preventative healthcare programs focused on schools and rural communities that are distant from health facilities.

The distribution methods include voucher distribution, procurement policies, food and agriculture policies. Thus, while understanding economics and business strategy is paramount in Saint Lucia, the creole bread increased from $0.35 to $0.45. The small pan loaf increased from $3.60 to $4.35 and the large, from $5.40 to $6.50.

Saint Lucia’s fuel price adjustment is said to help cushion the disproportionate impact on households with limited resources. “That is why the government continues to provide subsidies to prevent exorbitant retail price increases to keep the cost of cooking gas as low as possible for consumers.”

Saint Lucia’s retail costs for gasoline and diesel have remained unchanged for three years at $16.50 per gallon, respectively.

The impact of the increase in prices on subsidised products and services is significant on per capita income. The attributes reduce the effects that are supposed to supplement expansion and reduce poverty reduction.

However, learning to think and understand concepts that shape politics and change people’s lives are principles that do not provide excuses.

“Throughout 2023, the government heavily subsidised the price of flour, sugar and rice, amounting to $11.5 million. In 2022, the subsidy on flour alone was $8.9 million; of which $5.6 million went to bakers and $3.3 million went to the public. We removed the 6 percent service charge on price-controlled products.”

Conferring to the impact of subsidized goods to manufacturers and consumers, permanent secretary Sophia Alfay-Henry declaration is not a satisfactory approach, as referenced:

“Despite global fluctuations in the purchase prices of these basic commodities, local prices have remained stable as a result of this government intervention. Government subsidies have a significant impact on pricing dynamics and strategies. They are designed to support domestic industries by lowering the cost of raw materials sourced from abroad. If utilized as intended, subsidies can make imported goods more affordable for manufacturers; resulting in lower production costs. This, in turn, can lead to more competitive pricing of finished local products.”

With this ostensible fiction, we can undertake that the total fiscal resources and the subsidies efficiency losses have arisen. Increased subsidies may have reduced productivity, and interfere with private capital investment over the long run. And that, increased subsidies have not added value to domestic consumption and export production of significance.

“The prices of [these] commodities are very volatile -especially flour, given the unstable price of wheat. To ensure affordability, to ensure that the prices of these commodities don’t increase, the government has been selling these commodities below the purchase price or the cost in most cases.” [ ] …

The permanent secretary noted the cumulative impact on exporters who relied almost exclusively on the government supply of these commodities to continue producing their goods cost-effectively.

With this celebrated fiction, abstract to unemployment and inflation, the increased emphasis on subsidies worsens social equity and poverty. This hurts to improve employment, stimulate growth and economic advancement.

Agriculture and food security: Save St Lucia’s farmland and help curb food inflation

CNG Insights

Income, in most parts of the island, is dependent on human capital, thus, a government scarcity of capital to widen growth in manufacturing highlights the gross disparity – the benefit to consumers, the hypothesis of production – and under-investment in Research and Development (R&D).

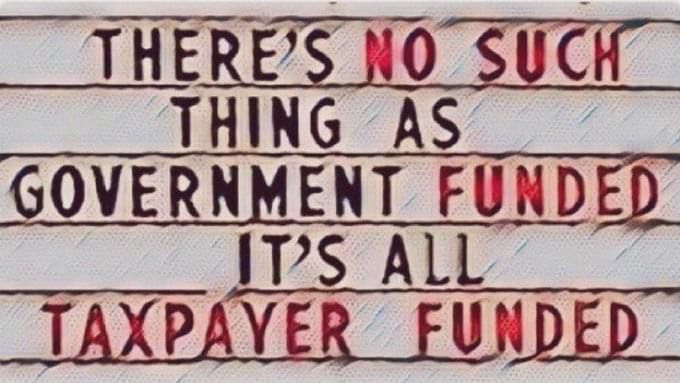

The heavy transfer of government resources to subsidies means specific public expenditures are, in part, overlooked, including a decrease in public deliverables and services. This has to be made up elsewhere. And that, the expectant mechanisms are likely in personal and private sector tax increases and/or increases in borrowing.

The quantitative significance is to strengthen food and agriculture production, import/export policy and make imported staples justifiable on added value from subsidised commodities.

Moreover, increasing per capita income and agricultural expansion and implementing land rationalization to halt poverty and the dependence syndrome.

Social and economic policies can intensify a realistic model, as these factors are important prerequisites to strengthen economic development and not a fool’s errand, based on increased subsidies.