By Caribbean News Global ![]()

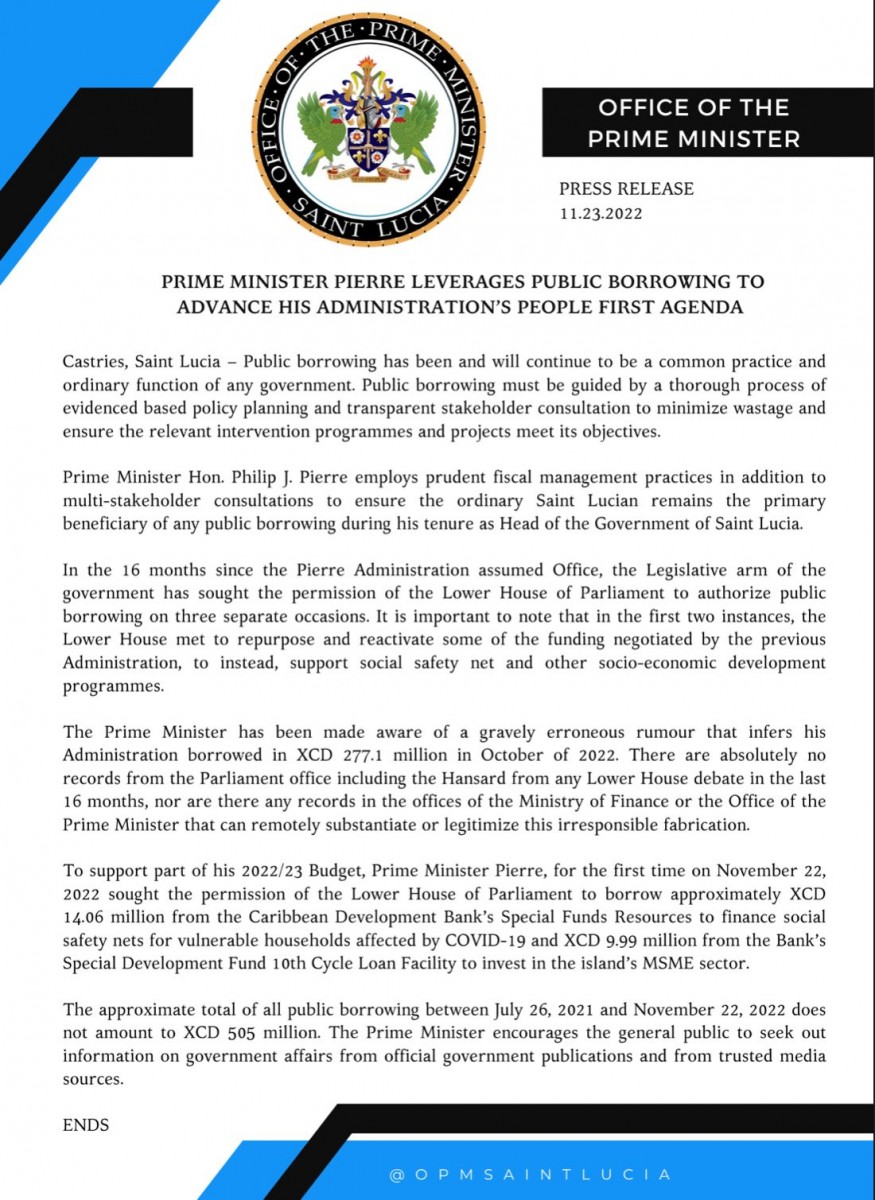

TORONTO, Canada, (CNG Business) – The Office of the Prime Minister (OPM), of Saint Lucia, November 24, advised that the prime minister and minister for finance Philip Pierre, “leverages public borrowing to advance his administration’s people-first agenda.” The communiqué also selected to “dispel erroneous rumour”, and to substantiate or legitimize irresponsible fabrication of borrowing.

According to the OPM press release:

“Public borrowing has been and will continue to be a common practice and ordinary function of any government. Public borrowing must be guided by a thorough process of evidenced-based policy planning and transparent stakeholder consultation to minimize wastage and ensure the relevant intervention programmes and projects meet its objectives,” OPM communication, added. “Prime minister Pierre employs prudent fiscal management practices in addition to multi-stakeholder consultations to ensure the ordinary Saint Lucian remains the primary beneficiary of any public borrowing during his tenure as head of the government of Saint Lucia.”

On Tuesday, parliament borrowed USD$8.921M from CDB:

- USD$5.217M from the Special Funds Resources of the Caribbean Development Bank (the bank) to finance safety nets for vulnerable populations affected by COVID-19.

- USD$3.704M from the Caribbean Development Bank’s (the bank) Special Development Fund 10th Cycle Loan Facility to support the Micro, Small and Medium Enterprises Sector post-COVID-19.

St Lucia parliament to amend the constitution and borrow USD$8.921M from CDB

The OPM communication further advised:

“In the 16 months since the Pierre administration assumed office, the legislative arm of the government has sought the permission of the lower house of parliament to authorize public borrowing on three separate occasions. It is important to note that in the first two instances, the lower house met to repurpose and reactivate some of the funding negotiated by the previous administration, to instead, support social safety net and other socio-economic development programmes.”

The parliament of Saint Lucia press release, July 8, 2022, outlined four borrowing instruments, illustrated in CNG’s article: St Lucia’s parliament borrowing habits return in confidence:

“(a) To authorize the minister of finance to borrow USD10M from the Export-Import Bank of the Republic of China to finance the implementation of national development projects and initiatives; (b) borrow from the European Investment Bank the sum of EUR 13.5M to finance emergency operating expenses in the health sector related to the COVID-19 Virus Pandemic; (c) borrow USD8M from the International Development Association to finance the Organization of Eastern Caribbean States Data for Decision Making Project, and (d) borrow USD18M from the International Development Association for the implementation of the Unleashing of the Blue Economy of the Caribbean Project.”

The OPM press release, November 23, 2022, reads:

“To support part of his 2022/23 budget, prime minister Pierre, for the first time on November 22, 2022, sought the permission … to borrow approximately XCD$ 14.06 million from CDB … to finance social safety nets for vulnerable households affected by COVID-19 and XCD$ 9.99 million from the … to invest in the island’s MSME sector.”

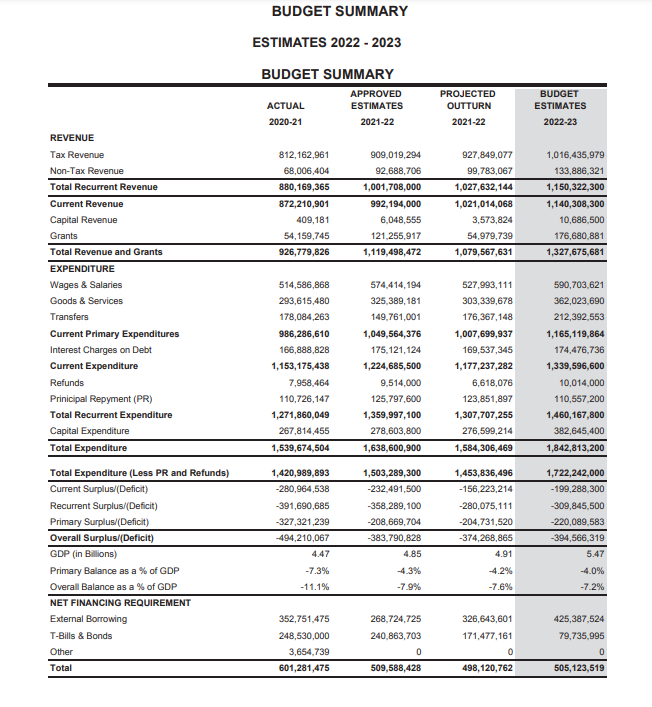

St Lucia’s 2022/23 budget of $1.842B styled ‘the peoples budget’, reads:

Financing – $505.12M

“The government anticipates moderate improvement in the revenue administration and grant receipt from friendly donors, a significant financing gap remains. … based on the projected level for revenue and grants, the budget targets an overall deficit of $394.57 million for the fiscal year 2022-2023.

When added to the principal repayment for the year a financing gap of $505.1 is anticipated which will be financed by a blend of foreign and domestic financing resources.

In addition to total revenue and grants of $1.327 million, it is anticipated that [my] government will have to borrow a total of $505.12 million comprising $425.4 million, equivalent to 84.2 percent of the total financing requirement for the year from external sources.

Domestic financing is expected to be moderate given that much lower amounts are programmed from primarily bonds.

This is entirely in keeping with [my] government’s strategy of relying on external borrowing on concessional terms rather than the market debt which bears higher interest rates.

Domestic financing requirement amounts to $79.7 million which is expected to be sourced through various means including treasury bills, treasury notes and bonds.

The total amount to be raised from external sources will be as follows:

- Caribbean Development Bank – $57.3 million

- International Development Association (IDA) – $82.3 million Republic of China on Taiwan EXIM Bank – $191.8 million CARICOM Development Fund (CDF) – $3.06 million

- CDB-Inter-American Development Bank – $8.6 million

- Canadian Clean Energy & Forest Climate Facility Fund – $1.4 million

- World Bank (Development Policy Credit) – $81 million

In defense of the government of St Lucia borrowing record, the OPM press release said:

“Gravely erroneous rumour that infers his administration borrowed in XCD$ 277.1 million in October of 2022. There are absolutely no records from the parliament office including the Hansard from any lower house debate in the last 16 months, nor are there any records in the offices of the ministry of finance or the office of the prime minister that can remotely substantiate or legitimize this irresponsible fabrication.”

CNG article, The ‘Forward’ to St Lucia’s estimates 2022-2023, subtitle: The structure to the estimates 2022-2023, says:

“The 2022-23 estimates of revenue and expenditure lays out the annual spending plans, projected revenue collections and programme performance information of all government departments.

“The budget estimates is structured by organizational segments namely, department, division, cost centre, programme and sub-programme. These segments are reflected in the schedules for revenue (recurrent and capital), operating, non-project capital and project expenditure.”

Confused, here and now?

The consequence of the understanding of neotypes to numbers, language, understanding governments instruments, their intent, and what happens in parliament is the political playfull mismatch and tapestry of idiosyncratic.

However, relative to the understanding of budget projections, one should not be instantly pigeon-holed to the fiscal year – public borrowing of XCD$ 505 million, vs the actual application, implementation and distribution, which in most cases, governments hardly expend the budget [75%] except in extraordinary circumstances.

“I’m confused,” said a commentor, who should not be!

The OPM has advised: “Seek out information on government affairs from official government publications and from trusted media sources.”