- My first priority is the promoting and protecting of the national interest of Saint Lucia,” ~ Prime Minister Philip J. Pierre.

- “It’s the first time that estimates have been given to the opposition, eight days before the debate,” said a confidential source.

- The budget summary for 2024/2025 looks parallel in numerical terms to previous, albeit moderate increases and a new detailed layout.

- Social and political observers, financers, and investors will be watching and listening attentively, to understand if the claims of the Leader of the Opposition (LOO) are true; and have become a reality …

TORONTO, Canada, (CNG Business) – The Parliament of Saint Lucia is scheduled to be prorogued, on Tuesday, March 26, 2024, followed by tabling of the 2024/ 2025 estimates of revenue and expenditure by Prime Minister, Minister for Finance, Economic Development and the Youth Economy, and Minister for Justice and National Security, Philip J Pierre.

The ensuing speech from the throne by the acting Governor-General Cyril Errol Melchiades, and the policy statement by Prime Minister Pierre scheduled for April 23, 2024, collectively, chart the way forward in the social and economic development of Saint Lucia.

The new session of the parliament and the fiscal year of the government of Saint Lucia shall commence on April 1, 2024. With a new government agenda, areas of consideration adapt to recent developments, outlook and risk, foreign policy, economic and social policies, health, security, education, housing, public-private investment and social investments.

Prime Minister Pierre is expected to address his administration’s performance from 26 July 2021, and where necessary address ‘bottlenecks to growth,’ and manoeuvre key risk factors that hinder policy and budget out-turn.

Social and political observers, financiers, and investors will be watching and listening attentively to understand if the claims of the Leader of the Opposition (LOO) are true; and have become a reality, subject to the 2024/2025 estimates of revenue and expenditure.

Related Links:

- St Lucia faces challenges to economic recovery and development

- St Lucia’s 2022/23 budget of $1.842B styled ‘the peoples budget’

- St Lucia’s acting governor-general prorogues parliament

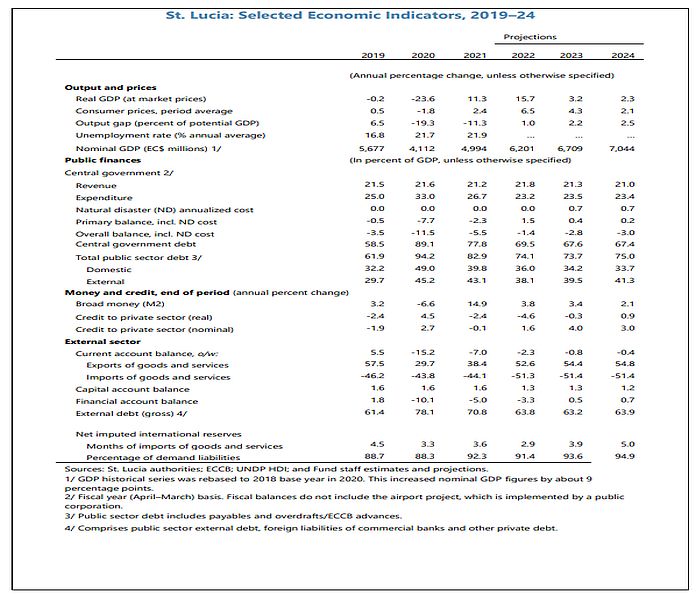

Economic growth

A press release from the Office of the Prime Minister (OPM) Friday, October 27, 2023, noted: “When businesses grow, so does the economy,” further advised that the “department of finance forecasts a real GDP growth rate of 3.2 percent for 2023 and projects 5.2 percent real GDP growth for 2024.

The strategic choice for the 2023/2024 budget focused primarily on three areas: health, national security, and economic sustainability. This was supplemented with investments in strengthening the social safety net and efforts to restore fiscal and financial buffers for financial stability and inclusion.

A $40 million investment from the World Bank will help Saint Lucia’s sustainable development by generating extra revenue, secure additional financial resources that can be directed towards poverty reduction efforts, as well as help the country build up its resiliency against future shocks.

To help Saint Lucia tackle these challenges, the project will have two main pillars:

“The first pillar supports Saint Lucia’s reforms toward fiscal sustainability, increasing revenue and transparency, and managing resources more efficiently. The second pillar will support efforts in climate change mitigation and adaptation by helping the government implement the National Energy Policy and Climate Change Bill, which aims to speed up the shift to an economy with lower carbon emissions by promoting the use of renewable energy sources, reducing reliance on imported energy, and cutting costs.”

The objective moving forward is sustainability and growth, buttressed by fiscal responsibility, efficiency, cost containment and increased revenue. There is also the ethos that baby steps are not practical, butress against the need for increased public-private investment, resource allocation, efficiency and fiscal sustainability.

The Pierre administration also secured a USD42.7M Policy-Based Loan (PBL) from the Caribbean Development Bank (CDB).

The Policy-Based Loan (PBL) supports a framework of reforms/institutional changes – specifically targeted and triggers one policy after another in sequence formation. The requirements of eligibility from external institutions mandate a borrowing country to have a sound macroeconomic policy framework. The PBL depends on the country’s financing needs and compliance with policy conditions. Inclusive of this PBL, additional inclination could have encompassed an investment component and further enhanced a Hybrid Loan.

Budget Summary

Estimates 2024-2025 – (Subject to embargo obligations)

It’s a noteworthy commendation that “It’s the first time that estimates have been given to the opposition, eight days before the debate,” said a confidential source. “The budget summary for 2024/2025 looks parallel in numerical terms to previous, albeit moderate increases and a new detailed layout.”

Prime Minister Pierre’s fiscal year 2024/2025 budget requests a moderate increase from the 2023/2024 budget is discretionary, based on taxpayers’ resource criteria and measures that do not undermine the country’s domestic and regional economic strength.

The discretionary increase allows for unprecedented improvements in service delivery, investments and funding by taxpayers, grants and diplomatic friends, and to help reduce the deficit for economic prosperity.

Wages and salaries continue to absorb above 47 percent of government tax revenue – the public service will have to improve efficiency and productivity – and deliver the expected results.

Pundits, the LOO, parliamentarians and financiers are expected to observe if there are factors of good and bad ratios that signal a failing or thriving economy:

Inclusive of unemployment, debt, or inflation – societal breakdown – shocks to aggregate supply or aggregate demand, market trends and structural policy, economic (in) equality, the impact of debt on the economy, ideal debt to GDP ratio, and the pros and cons of doing business in Saint Lucia, potential growth estimates and economic stability, within a regional and global perspective.

Investors that have indicated expressions of interest to explore business endeavours in Saint Lucia will get a further opportunity to examine linkages between economic and social development, and security. Reportedly, the government intends to embark on a strategic mission to attract foreign direct investment from multinational dimensions.

Attention will also be paid to revenue, grants, expenditure, the current account, capital expenditures, debt-to-GDP ratio, and government net financing requirements – External borrowing and T-Bills and bonds.

Saint Lucia needs sustained investment flows to grow the economy, support underserved and low-income communities. This is key to increasing and maintaining sustained momentum for economic growth.

The enabling environment

Prime Minister, Minister for Finance, Pierre, has previously advised, that “ the government of Saint Lucia continues to create the enabling environment for a financial sector that is globally competitive, well-regulated, diversified, market-driven, and responsive to our local realities.”

Saint Lucia is the largest member country and has the largest economy in the Eastern Caribbean Currency Union (ECCU).

“Over the last three years, Saint Lucia’s economy according to data from the World Bank and other independent sources, experienced double-digit growth rates over the last two years. For 2023, it is expected that growth will be between 3-5 percent.

“Our fiscal situation continues to improve [last year 2022] we moved from persistent deficits to a primary surplus which demonstrates the robustness of our economy. Our debt-to-GDP ratio increased due to the COVID-19 pandemic but with prudent borrowing, we have halted the rapid plunge that would have led us to unsurmountable or unsustainable debt levels. Our financial paper continues to do well on the Regional Securities Market albeit at competitive rates. Revenue collection is performing steadily. The Health & Security Levy was implemented fully in October 2023, with an annual projection of XCD 33 million.”

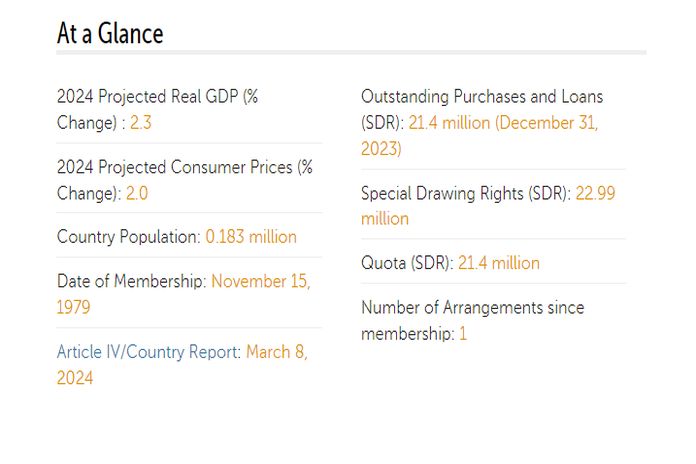

On August 25, 2023, the executive board of the International Monetary Fund (IMF) concluded the 2023 Article IV consultation with Saint Lucia.

- Saint Lucia’s tourist-dependent economy has rebounded strongly after the COVID-19 pandemic…higher government revenue has narrowed the fiscal deficit – strong tax revenue collection and CIP revenue, however, debt keeps financing needs elevated, and large rollover needs. implying refinancing risk;

- Though declining, public debt remains much higher than before the pandemic. The banking sector has adequate liquidity and is profitable, but NPLs are elevated;

- Annual inflation is projected to remain high in 2023 at 4.3 percent and then to decline to around 2 percent in the medium term;

- The current account deficit is expected at 0.8 percent of GDP in 2023 and is projected to close over the medium term driven by the continued recovery in tourism;

- On current policies, public debt is projected to stabilize around 75 percent of GDP in the medium term, significantly above the regional ceiling of 60 percent of GDP by 2035;

- Bank credit to the private sector is projected to remain anaemic in the absence of improved loan loss provisioning, fiscal adjustment, and additional legislative reform. Natural disasters are a recurrent threat.

Fiscal consolidation strategy

A credible fiscal consolidation strategy is needed for a downward path of public debt, to create fiscal space to support infrastructure and social investment and to ease ongoing inflationary pressures.

Lifting productivity growth will mean developing skills the economy needs, with adequate upskilling and reskilling opportunities and hindrances to domestic and diaspora investment, sustained employment and growth are disincentives to increase government revenue and decrease debt.

This includes investment in innovation, research and development and improving the business environment to strengthen Saint Lucia’s fiscal position and economic strategies. Investment in digitalisation, the green transition and a trade pact, can substantially improve capital inflows and strengthen public finances.

To help alleviate housing deficiencies and supply constraints, accelerated construction, administrative procedures, mortgage and finance – are not suitable for and – at the direction and control of the political class.

The current characteristics are caught in a vicious circle, that impedes domestic and external formalisation and, in turn, diminishes development.

Boost economic resilience and living standards

To help Saint Lucia boost economic resilience and living standards, rebuild fiscal buffers and sustain productivity, tackling housing challenges and infrastructure insufficiencies is paramount.

In much the same as the cabinet of ministers requires urgent reshuffling and shedding dead-weight, the Minister for Equity, Social Justice and Empowerment, and the Saint Lucia Social Development Fund (SSDF), needs to live up to – Uplifting People, Transforming Communities.

Government tax revenue is affected mainly by the level and efficiency of its tax system; and by [the level of its] economic activity.

Saint Lucia’s tax consolidation and collection methods require further streamlining, in the light of the need for extended amnesty and leniency. Alongside projected increased business activity combined with the health and security levy, there seems a projected outcome to generate XCD$70 Million. (Health and Security)!

Pension reform is required amidst prolonged working lives (beyond mandatory retirement at 55) and reducing options for early retirement. Inclusive of this requires fiscal strategies to mitigate commodity price volatility, the cost of living and easing inflationary pressures. Minimum wage policy and enactment is long overdue, alongside an enhanced social safety net to alleviate social deprivation and lawless orientations.

Economic priorities and national security

Securing domestic and external funding for the fiscal year 2024/2025 is crucial to achieving priorities. Economic recovery requires the implementation of sustainable plans, comprising a medium- and long-term economic agenda alongside dynamic partners.

The Pierre administration will need to energize and advance the implementation of key investment plans, broaden the revenue base, and strategically justify expenditures.

Supporting the economy will also require promoting access to capital, uplifting disadvantaged communities, combating financial crimes, the ‘alarming rise’ in fraudulent driver’s licences and the underground economy, fuelling lawlessness and crime.

The administration must also focus on taking necessary action to advance national security priorities, border security, immigration and migration, including Citizenship by Investment, to reflect as stated: “Saint Lucia CIP works for the islands’ benefit.”

Related Links:

- St Lucia – France to strengthen cooperation in security, health, and education

- ‘RSS must evolve to address complexities of crime’, minister Benn urges

- Symbolic of our enduring partnership and shared values

The 2024/2025 budget must continue addressing emerging threats and supporting investment security to enhance cybersecurity, systems and information. Innovation and new technologies are likewise toggles, for the stability of commerce, financial, infrastructure and technology systems.

The 2024/2025 budget alongside appropriate policy, implementation tools and resources to advance significant milestones ought to deliver key priorities that set the path for security, health care, infrastructure development and support for SMEs to access capital for growth and prosperity.

Moreover, efforts to focus on the diaspora investment options, beneficial ownership and protection of natural resources on behalf of the people of Saint Lucia, resonate:

“ My first priority is the promoting and protecting of the national interest of Saint Lucia,” ~ Prime Minister Philip J. Pierre.