- St Lucia Parliament to borrow from the Saudi Fund for Development the sum of SAR281,250,000 to finance the Reconstruction and Rehabilitation of St Jude Hospital Project – SJHRP

- Short and tall priorities …

- Volatile GDP: Sharp contraction of 24.4 percent in 2020; “A correction” of 12.2 percent in 2021; and 18 percent in 2022.

- ECLAC GDP growth projection for 2023 – 2024: St Lucia 4.0 – 4.5 percent.

By Caribbean News Global ![]()

TORONTO, Canada, (CNG Business) – The competence of the governments of Saint Lucia continues with the habitual sitting of parliament on Tuesday, to borrow and burden future generations, “in the war on poverty”; and despite the pretence of accountability and transparency, political distrust is foremost on display, to the lesser values of visual degradation.

A sitting of the House of Assembly is scheduled for Tuesday, September 12, 2023, (announced Friday, with little time for public scrutiny, as usual). Motions and Bills down for consideration, from 10:00 a.m., according to the government media note include:

- Health and Citizen Security Levy (Amendment) – Second Reading;

- Public Debt Management – First Reading;

- Co-operative Societies – First Reading.

The sitting of the Senate is scheduled for Thursday, September 14, 2023, at 10:00 a.m.

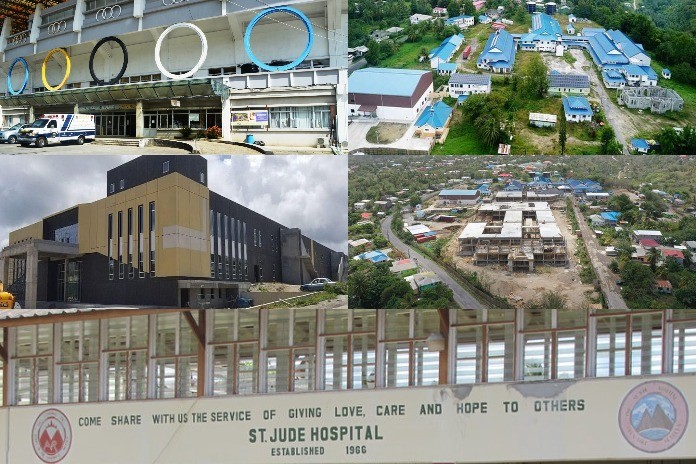

St Jude Hospital Reconstruction Project moves closer to completion

On September 6, 2023, Prime Minister Philip J. Pierre led a delegation of government stakeholders to receive a firsthand progress report on the ongoing St Jude Hospital Reconstruction Project (SJHRP), at the original (Phase I) construction site.

A report from the Office of the Prime Minister narrated:

“Prime Minister Pierre is nearing its goal to relocate St Jude Hospital operations from the George Odlum National Stadium to the original construction site to restore dignity to the delivery of essential medical care and secondary health services in the island’s south.”

If it is Tuesday, it’s borrowing … ‘the war on poverty’

The Public Finance Management Act Resolution of Parliament on Tuesday, September 12, 2023:

“Will borrow for capital or current expenditure, reconstruction and rehabilitation of St Jude Hospital Project from the Saudi Fund for development the sum of SAR281,250,000.”

– Notable, the official document of the Parliament of Saint Lucia deviates from recording the official currency (XCD) of Saint Lucia and the OECS, that it is a part of. Is there an unexplained reason not suitable for public knowledge?

“The loan is repayable in 20 years after the grace period of five years from the date of the Loan Agreement commencing on the 15th day of May and the 15th day of November in each year after the grace period.

“The interest rate of two percent per annum is payable semi-annually on the principal amount of the loan withdrawn and outstanding,” the government document said.

Resumption of St Jude reconstruction in S.T.E.P methodology

Last November, the government said it was considering parties of interest in ‘the box’ St Jude Hospital.

Minister for Health, Moses Jn Baptiste, said: “… I can tell you there are a number of parties who are interested in that building.” … the previous administration spent untold millions, is incomplete.

Saudi Fund for Development to the rescue

The Saudi Fund for Development (SFD) chief executive officer, H.E. Sultan Al-Marshad, on August 3, 2023, signed SFD’s first development loan agreement worth US$75 million with the prime minister of Saint Lucia, Philip Joseph Pierre, to fund the “Reconstruction and Rehabilitation of St Jude Hospital Project” in Saint Lucia, through SFD.

“This agreement is part of SFD’s efforts to support sustainable development in developing countries and Small Island Developing States (SIDS),” said the Saudi Fund for Development (SFD).

2.5 percent health and citizen security levy (amendment) act

The government of Saint Lucia recently implemented a 2.5 percent levy that will be collected separately from the VAT currently at 12.5 percent. The levy is expected to annually generate at least XCD 33 million for the government of Saint Lucia.

Implementing the 2.5 percent levy on products and services contrary to the government and its agencies has expectantly cascaded at a minimum – to a 5 percent increase in cost to consumers.

Telecommunication, technology, professional service and food service suppliers have already begun transferring the additional operational cost to customers. The ripple effect is further inflationary concentrations.

Moreover, the accountability and transparency of the governance of Saint Lucia have failed to communicate the basic intricacy of the SFD “secret and/or plausible non-disclosure agreement” with the people (taxpayers’ funded loan) contrary to annoyance and displeasures of similar while in opposition.

Health and security levy not a VAT, says St Lucia government officials

In continuance of the 2.5 health and security levy:

“Under clause 3 of the Bill, section 2 of the Act is amended to change the definition of the word “consideration” to exclude stamp duty payable under the Stamp Duty Act, Cap. 15.11 and other duties and levies under any other enactment. New definitions are inserted in the Act with respect to the words “registered person” and “registered recipient”.

“By virtue of clause 4 of the Bill, section 4 (Rate of levy on goods) is substituted to apply the 2.5 percent ad valorem on the customs value as determined under the Customs (Control and Management) Act, Cap. 15.05.

“Section 10 of the Act is amended under clause 5 of the Bill to make the payment of the levy on services by a registered person to be also applicable to a registered recipient.” ~ Health and Citizen Security Levy (Amendment) Act.

- Related Link: Latin American and Caribbean economies will maintain low growth levels in 2023 and 2024

Short and tall … I can, you can’t …

In short order, the shortfall (deficit) of things in Saint Lucia is widespread crime, lawlessness, insecurity, weak governance and leadership, a dysfunctional judiciary, the economy, inflation and unemployment.

Furthermore, a resurgence of innovation and knowledge is absent on pressing local challenges, including security, climate change adaptation, trade and investment, supply chain, and economic partnerships to attract and create good-paying jobs. (Unemployment reported at 19% and youth unemployment at 25.9%).

The tall task is the degree of conversion required, primarily a cultural transformation, work ethics, political maturity from the misadventure of MPs and quality representation.

In the 2022/23 budget, the finance minister advised that “we recognize that to become globally competitive we need to address the following areas: (1) speeding up the process of technological transformation, (2) strengthening entrepreneurial capacities, (3) continuing promotion of innovation, and (4) strengthening our human capital through skills training.”

But rather than allocating resources to the global challenges facing Saint Lucia, a diversion (strategic) argument of ‘short and tall’ permeates.

Saint Lucia needs inclusive ‘short and tall’ shared priorities … (internal and external), focused on making life better for its people. #Putting People First

Co-operative societies bill

At Tuesday’s sitting of parliament, the Co-operative Societies Bill (the Bill) makes new provisions with respect to the registration, supervision, regulation, governance, operation and management of a co-operative society.

“The purpose of the Bill is to consolidate and modernize the laws relating to debt management by providing for the administration of public debt management; a medium-term debt management strategy; public debt sustainability analysis; government borrowings, guarantees, on-lending; and to reduce multiple issuers of debt and ensure sound financial policies in relation to the management of public debt.”

Advancing trade ties, investment and innovation

In the article ‘manufacturing and construction sectors out-performed 2022 so far, says Export St Lucia’ subtitle ‘Food inflation in St Lucia is too high’ referenced:

“Prolonged food insecurity, inflation, and the practice of deceptive political science are elements of a disruptive economy and a crises-laden country.”

The ‘short and tall’ in Saint Lucia’s dimension should look towards a new chapter of strategic partnership, coupled with trade, investment, and business development, which serves as a gateway to attract and establish reliable business leaders and investments.

Strong partnership helps to build resiliency, innovation, and growth in weak and struggling economies. The tenets to expand partnerships, knowledge transfer, building innovative businesses and creating highly skilled jobs, help deliver ambitious science, technology and infrastructure plans.

The powers that be ought to focus on highlighting the competitive advantages of doing business in Saint Lucia. A targeted approach is critical to support people and businesses, laying a strong foundation for investments and the creation of good-paying jobs across Saint Lucia.

Nothin’ from nothin’ leaves nothin’

*** In the norm of parliamentary misadventure, “It is the intention of the minister to seek leave of the House to enable the Bill to go through all the stages at this sitting.”

In retrospect: What has changed in opposition to poverty, development and progress in the “short and tall … I can, you can’t” to whoosh legislation; if not more of the same?

- Parliamentary Papers are available here.