– This fiscal year is dubbed the “Year of Infrastructure”. Therefore, the policies and programs will focus on social, economic and physical infrastructures.

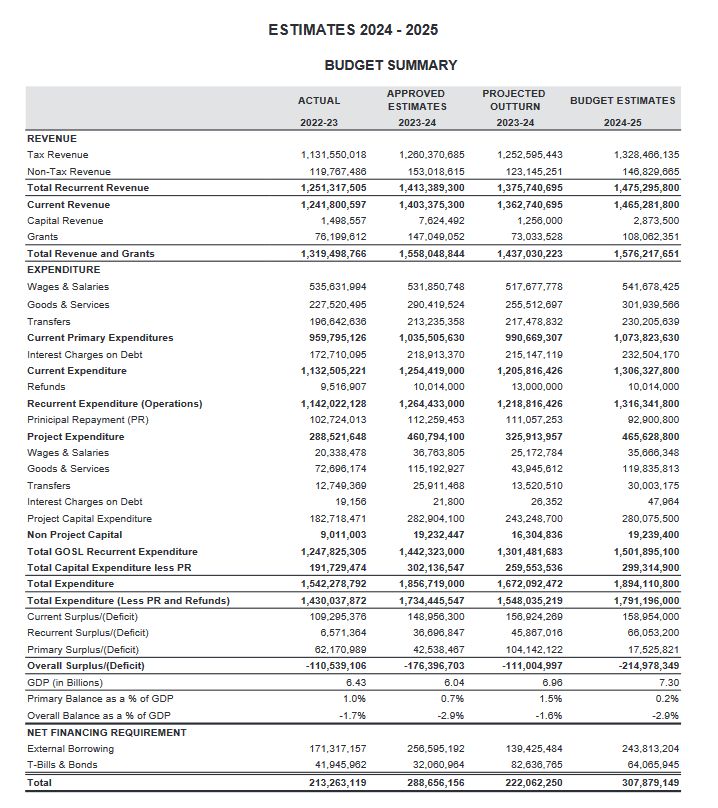

– The overall budget is projected at $1.894 billion comprising recurrent expenditure of $1.502 billion and capital expenditure of $298.9 million.

– Total recurrent revenue is projected at $1.475 billion comprising tax revenue of $1.328 billion and non-tax revenue of $146.8 million. Grants are projected at $108.0 million.

– The country’s finances have improved significantly since July 26, 2021. We have experienced three years (11.5%, 20%, and 2.2% in GDP) of sustained economic growth.~ Prime Minister Philip J Pierre,

By Caribbean News Global contributor

CASTRIES, St Lucia (CNG Business) – The estimates of revenue and expenditure represents the financial plans of the government for the fiscal year – 2024-2025, as laid out by the contents of the said document, “outlines the revenues to be collected and sets the limits for expenditure. The estimates of revenue and expenditure conforms to the Public Finance Management (PFM) Act, number 14 of 2020 which is the authority governing the preparation and submission to parliament.”

The financial plans include projected revenues, planned expenditures and performance information, arranged according to the classification of government by functions of department, division, cost centre, programme and sub-programme. These segments are reflected in the schedules for revenue (recurrent & capital), operating, non-project capital and project expenditure, the forward explains. POLICY estimates 2024-2025

“The budget summary highlights the fiscal position of the country including current surplus/deficit, primary balance, overall surplus/deficit, total revenue and expenditures. For this fiscal year, the office of the budget has made some improvements to the summary by pulling out project operations as well as non-project capital expenditure to provide a complete picture of the government expenditure. Non-project capital (or minor capital) expenditure refers to critical spending on assets such as furniture and equipment not associated with capital projects.”

In keeping with the recommendations emanating from the Public Expenditure & Financial Accountability Framework (PEFA) and the government’s own policies for transparency and accountability, the estimates of revenue and expenditure will be made available to the public and all stakeholders subsequent to parliament’s approval.

St Lucia’s 2024/25 budget proposal: The Year of Infrastructure

Budget overview

“Expansion in economic activity continues for the period 2023-2024 as economic and social conditions normalize in the country and externally. Additionally, growth is expected in 2024 driven mainly by activities in tourism and construction as well as other sectors of the economy. Budget outcome and growth will continue to be influenced by the ongoing geopolitical unrest (Ukraine/Middle East), supply and trade logistics and higher prices,” the estimates 2024- 2024 forward continued.

Budget outturn 2023-2024

“Recurrent revenue is projected to decline by 2.7 percent below the approved estimates for the fiscal year 2023-2024, however, an increase of 10.7 percent is recorded over the period 2022-2023, amounting to $1.376 billion. Total grants receipts are estimated at $73.0 million from the approved amount of $147.0 million.

Expenditure outturn for 2023-2024 is estimated at $1.683 billion compared to $1.856 billion approved estimates due to delays in project implementation as a result of administrative and technical bottlenecks. Total recurrent expenditure is estimated at $1.313 billion compared to

$1.442 billion previously approved. Capital expenditure for the period 2023-2024 is estimated at $259.6 million compared to approved estimates of $302.1 million.

“A primary surplus is expected in the amount of $92.7 million compared to a surplus of $42.5 million initially projected in 2023-2024. An overall deficit of $122.4 million representing 1.8 percent of GDP is expected compared to $176.4 million or 2.9 percent of GDP projected in 2023-2024.”

Budget overview 2024-2025

“The 2024-2025 estimates of revenue and expenditure is based on the strategic objectives of the government and encapsulates the guiding parameters emanating from the Medium Term Fiscal Framework. This fiscal year is dubbed the “Year of Infrastructure”. Therefore, the policies and programs will focus on social, economic and physical infrastructures.

The overall budget is projected at $1.894 billion comprising recurrent expenditure of $1.502 billion and capital expenditure of $298.9 million.

“Total recurrent revenue is projected at $1.475 billion comprising tax revenue of $1.328 billion and non-tax revenue of $146.8 million. Grants are projected at $108.0 million.”

Declared 2024/25 “Year of Infrastructure,” Prime Minister Philip J. Pierre, said:

“This year, significant emphasis will be placed on improving our digital and physical infrastructure to boost productivity and improve the lives and livelihoods of our citizens … assigned $484.9 million to the government’s investment portfolio from the 2024/25 budget. Out of that allocation, $299.3 million will be used to fund capital projects to enhance [our] public infrastructure like roads, bridges, public administration buildings, schools, police stations and hospitals.”

Delivering the budget address April 23, 2024, “Building our infrastructure for a resilient economy,” Prime Minister Pierre, stated, “The country’s finances have improved significantly since July 26, 2021.”

“Fiscal prudence and financial responsibility have returned to the management of our finances. Our economy has emerged from the downward spiral that once threatened to destroy our economic prosperity. The economic indicators have returned to, and in some cases have surpassed pre-COVID-19 levels. Investor confidence and trust in the Saint Lucian economy have returned with new investments in tourism, ports infrastructure, manufacturing, and the blue economy.”

“ … you can feel the positive change in the economy despite the challenges of inflationary pressures and the troubling crime situation. The positive changing economic landscape permeates the atmosphere as citizens go about their daily lives. Our social and economic policies have shielded the population from the full impact of inflation while providing new job opportunities for those seeking work, especially the youth and women. In addition to facilitating new job opportunities, we have purposefully supported the less fortunate and marginalised.”

Remaining “focused on the development of our country,” said Prime Minister Pierre, “We have experienced three years of sustained economic growth. We have reduced unemployment by 8 percent and youth unemployment by 12 percent. We have reversed the lack of investment in our country and ensured that the benefits of tourism are being felt by the many and not the few.”

“In 2021 we aimed at transforming our economy to empower our people. We returned hope, good governance, integrity and economic growth to our country – our people are more confident and hopeful with a renewed faith in government as an instrument for good.

“In 2022, we tackled the neglect in health care and alleviated the social conditions of the poor and underprivileged, while improving citizens’ security.

“The 2024/25 budget aims to establish a strong foundation for sustainable economic growth. The investments and employment opportunities that will be provided across all major sectors of the economy will bring real hope to the people. We will continue to build upon our previous successes, which have resulted in impressive economic growth rates of 11.5%, 20%, and 2.2% in GDP, after a contraction of over 24.5% in 2020.” ~ Prime Minister Philip J Pierre, 2024/2025 budget address.