Dear Sir

In a recent release of data, the ministry of finance indicated that the country’s debt to GDP ratio may be in the region of about 90 percent by March 2021. This would represent a sharp increase from a ratio of around 64 percent which attained at the end of December 2019.

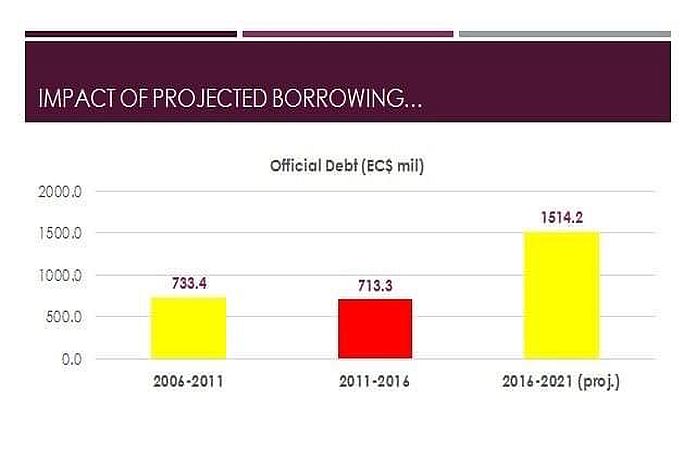

Given the COVID-19 crisis, we should expect the government to increase its level of borrowing. However, the binge borrowing which the government has engaged in is unconscionable.

The prime minister seems oblivious to the dangers of excessive borrowing. He seems dismissive to warnings about the risks of excessive borrowing to Saint Lucia’s long term economic prospects as spelt out in the report on the International Monetary Fund (IMF) 2019 Article IV consultation on Saint Lucia.

Good economic management requires that countries place limits on their public debt. In this regard, the concept of debt sustainability has received a lot of attention.

It is, for this reason, the member countries of the Eastern Caribbean Currency Union (ECCU) made a commitment to reduce their debt to GDP ratio to the prudential limit of 60 percent by the year 2030. Debt to GDP ratio in excess of 60 percent is regarded as being unsustainable in the sense that there is an increased likelihood of default, rescheduling and renegotiating of the debt.

Countries that are faced with an unsustainable debt situation are forced more often than not to turn to the IMF.

The Caribbean is replete with examples of countries that engaged in excessive borrowing: Antigua and Barbuda, The Bahamas, Barbados, Dominica, Grenada, Guyana, Jamaica, St Kitts and Nevis and Trinidad and Tobago. The countries listed entered in IMF structural adjustment programme. In all of these countries proximate cause of the unsustainable debt was was high fiscal deficits.

Saint Lucia is seemingly following the blueprint of countries that found themselves in the hands of the IMF – paying the price for poor fiscal management and binge borrowing.

Saint Lucia’s government debt was recently downgraded. It is conceivable that the government debt may be downgraded another notch. The government will be faced with an increased cost of borrowing, and the possibility exists that it may not be able to raise money in the Regional Governments Securities Market. Further, the government may find itself in a situation where debt servicing places a tremendous strain on the government finances making it increasingly difficult for the government to provide basic services.

Given COVID-19 crisis, debt to GDP ratio of about 90 percent raises the spectre of default, a scenario which would have a devastating impact on the Eastern Caribbean Central Bank (ECCB) area, and raise fears about a contagion.

Saint Lucia is sitting on a ticking time bomb of debt.

Carlton Augustine