By Caribbean News Global ![]()

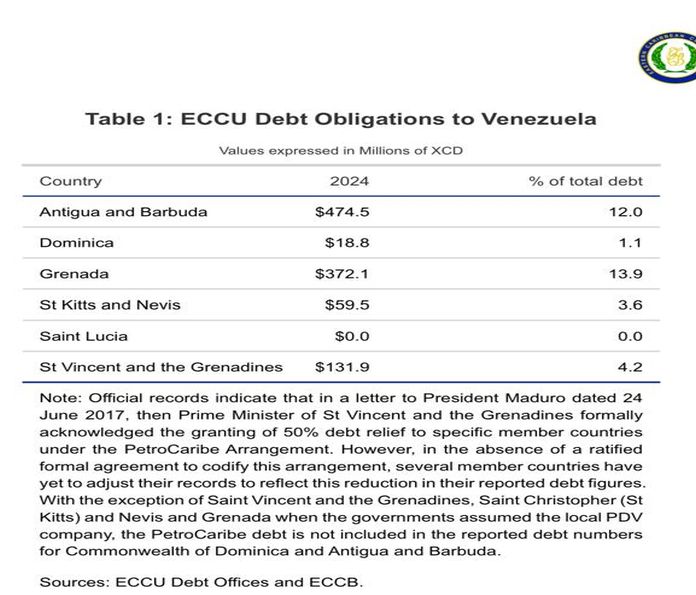

CASTRIES, St Lucia, (CNG Business) – Following US action in Venezuela and the repercussions to oil markets, pending social and economic impacts on the Caribbean, in particular OECS and CARICOM, the ECCU Regional Economic Aftershocks in Venezuela, table 1: ECCU debt obligation to Venezuela shows Saint Lucia at zero percent exposure – research, statistics and data analytics department report for January 2026.

A recent CNG publication, “The Venezuelan crisis has sanctioned a reset in the Caribbean and Latin America,” said:

“CARICOM must rethink affordable energy solutions. Member states that are most exposed to the Venezuelan oil market, with debt of up to USD 1 billion, must recalibrate energy dependence, energy charity, and financial obligations. CARICOM must rethink its economic and geopolitical spheres with coordinated action as an integrated bloc.”

The Venezuelan crisis has sanctioned a reset in the Caribbean and Latin America

The ECCU executive summary of the policy note, reads:

“Following months of escalating naval blockades and targeted strikes on maritime assets, US forces successfully executed a strike in Venezuela on 3 January 2026, resulting in the capture and extradition of Venezuelan president, Nicolas Maduro, to the United States. This Policy Note explores the short and medium-term economic impact for the Eastern Caribbean Currency Union (ECCU) from these recent events.

“Short–term disruptions to trade and transport, coupled with uncertainty regarding the status of the region’s legacy PetroCaribe agreements, may present some headwinds for member countries. On the upside, the potential for normalcy in the Venezuelan energy sector and the restructuring of regional debt obligations may offer an avenue for enhanced regional long-term growth. This report evaluates these possible pressures, focusing on the transmission mechanisms through which these events may spill over into the broader regional macroeconomic environment.

“We must emphasise that the analysis in this report is preliminary, as measuring the exact economic fallout from this recent US intervention remains difficult, due to its fluid and unpredictable nature. As such, this analysis should be viewed as a baseline assessment of potential risks rather than a fixed projection of economic outcomes. It broadly identifies a few of the mechanisms through which recent developments may affect the fiscal stability and long–term growth trajectories of the region, recognising that any eventual outcomes will depend on evolving US policy and the emerging geopolitical order.”

ECCU key messages advised:

- Fiscal Vulnerability: The region’s benefit from the PetroCaribe Arrangement is at further risk, as existing debt, including the 50 per cent relief previously acknowledged, may be recalled or subject to new conditions under the current geopolitical climate. The uncertainty of US policy makes it difficult to quantify the long-term economic impact on the region at this time.

- Contained Macroeconomic Volatility: While the US intervention is not expected to significantly alter global forecasts, inflation may be volatile due to unrest in Venezuela, and more recently, Iran.

- Humanitarian and Social Pressures: Heightened civil unrest and economic challenges may drive mass migration from Venezuela towards the southern islands of the region, while new US diplomatic agendas regarding the repatriation of refugees and deportees to countries like Antigua and Barbuda, Dominica, and Saint Christopher (St Kitts) and Nevis may strain public service delivery.

- Geopolitical Realignment: Increased US focus on Cuba threatens essential bilateral initiatives, such as the Cuban Medical Brigade and scholarship programmes, creating a climate of uncertainty that complicates the quantification of long-term regional impact.

Section 2.3 ECCU’s debt obligations to Venezuela reads:

“The most significant fiscal threat to Caribbean stability is the outstanding Venezuelan debt through the PetroCaribe/ ALBA frameworks. Contingent on the new administrative arrangements, which are still unclear, this debt could be subject to US-led restructuring or reform-related “swaps.” It is difficult to predict whether the new US-backed administration would demand immediate repayment, or whether the US may facilitate debt forgiveness in exchange for regional alignment.

“For instance, the United States may leverage outstanding PetroCaribe liabilities to necessitate specific reforms from ECCU member countries as a prerequisite for debt relief. Such arrangements could compel the nations to align their domestic policies and regional diplomatic stances with US security standards in exchange for rescheduling their debt obligations.”

Prime Minister Philip J. Pierre and Minister for Finance, Justice, National Security, Constituency Development and People Empowerment, on Sunday, reaffirmed Saint Lucia’s ‘resolve to move forward together …”

“Over the past four years, we have worked deliberately to stabilise the economy, protect the most vulnerable, and rebuild opportunity. Our economy has recovered, jobs have returned, unemployment has dropped to its lowest level, and confidence has been restored. But more importantly, we have remained guided by a single principle: government must work for people.”

Moving Forward Together: A New Year’s Call to Unity, Progress, and Responsibility

The growing concerns in Venezuela have far-reaching regional and global implications that threaten global estrangements. Saint Lucia’s path forward in the absence of Venezuela and with Cuba on the horizon is strategically positioned economically to continue its ‘focus on policy delivery, stable and sustainable growth.’

PM Pierre’s new cabinet to focus on policy delivery, stable and sustainable growth

The balancing act – (IMF): Saint Lucia’s fiscal economic policies and sustainable growth currently characterise macroeconomic indicators, resulting in optimism for stability, business investment and significantly reduced unemployment.