-

-

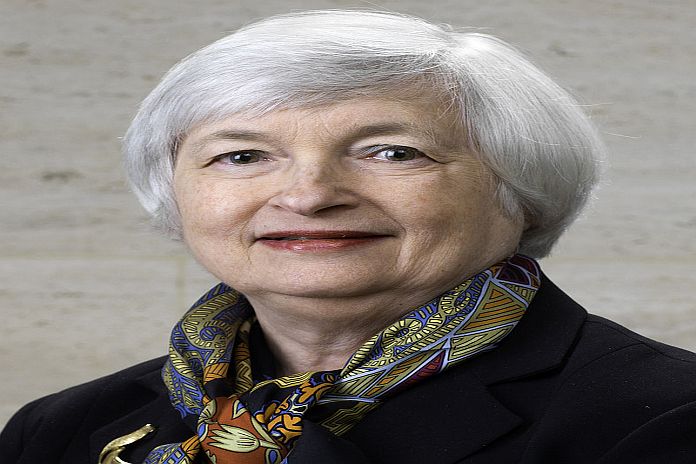

- Secretary of the Treasury Janet L. Yellen at the Center for Global Development

-

By Janet L. Yellen

Today, I will focus my remarks on our vision for development: the promise and challenges in developing countries, and how we can evolve the development finance system to better address the needs of the 21st century. But first, I will speak about the global context: both our short-term and longer-term challenges.

Immediate macroeconomic priorities

As we meet [today], in the wake of two large, back-to-back shocks, the global economy faces significant uncertainty. The pandemic caused a staggering loss of life and unprecedented fluctuations in economic activity and global commerce.

And earlier this year, Vladimir Putin launched a brutal war against Ukraine. The human toll has been devastating. Putin’s fraudulent attempt to annex sovereign Ukrainian territory is the latest example of his blatant contempt for the United Nations Charter and peaceful nations everywhere. The war’s economic impacts are reverberating far beyond the borders of Ukraine and Europe, causing volatile energy, food, and fertilizer prices, which impose substantial harm on many countries across the globe.

At the beginning of the Global Financial Crisis, the world’s major economies faced a similar suite of problems and responded with a similar suite of remedies. The same was true at the start of the pandemic. In contrast, the last year has seen divergent economic pressures. Many advanced economies, but not all, face inflation that is too high. Some major economies face more acute stress due to uncertain energy supplies than others. These different challenges require different policy approaches.

For major economies facing high inflation, the immediate task is to return to an environment of stable prices. Central banks bear the prime responsibility. But it is important to recognize that macroeconomic tightening in advanced countries can have international spillovers. Differences in countries’ circumstances and in their respective policies are bound to result in some currency realignments. The G7 has committed to market-determined exchange rates. But we are attentive to the potential consequences of exchange rate movements.

Emerging markets and developing countries are often most acutely affected both by global shocks and by spillovers from the policies of advanced countries. Swings in capital flows and financial pressures resulting from higher interest rates can add additional stress on top of significant and strained debt vulnerabilities. Some countries face acute food insecurity, exacerbated by climate change. Many are struggling with energy supply. Others, especially in sub-Saharan Africa, suffer from insufficient deployment of vaccines and boosters. Many developing countries – with the most limited resources and policy space, and high debt burdens – are facing all these challenges simultaneously.

During next week’s IMF and World Bank annual meetings, I will work with a broad group of partners to advance our response to the current macroeconomic challenges. Policymakers in the major economies must continue implementing policies to rein in high inflation while remaining attentive to global repercussions. Clear and open communications, coupled with cooperation among the major economies to address spillovers, remain essential.

From energy to food security, the United States and our partners have coordinated to stem the fallout from Russia’s war against Ukraine felt by people around the world. Since spring, the United States has released 160 million barrels of crude oil to shore up supply, and our coalition has committed to finalize and implement a cap on the price of Russian oil. This cap aims to keep Russian oil flowing onto global markets at lower prices – particularly benefitting low- and middle-income countries – while also cutting into the revenue Putin is using to fund his illegal war. The United States has also pledged almost $10 billion to tackle the growing food security crisis. The international financial institutions are redoubling their efforts by implementing a food security action plan announced in May. These efforts must continue.

We must also be prepared to help countries that fall into debt or other crises. Broadly speaking, we have well-developed tools to support countries in need. For example, the IMF and the multilateral development banks have resources to support and advise countries as they calibrate their macroeconomic policies.

Some countries will need considerable debt relief. Even before Russia’s invasion of Ukraine, more than half of all low-income countries were at high risk of or already in debt distress. It will be crucial for all the world’s major bilateral creditors to meaningfully participate in debt relief so that lower- and middle-income countries can regain their footing after these years of extreme stress. This is particularly true for China. To date, China has delayed providing debt treatments to borrowers in debt distress or has provided treatments that fall short of restoring the borrower’s debt sustainability. We need to redouble our efforts to resolve ongoing cases – like Zambia and Sri Lanka – and be prepared to work together on future cases.

Long-Term challenges for developing countries

The immediate issues I’ve highlighted call for urgent action. At the same time, we must not lose sight of big picture, longer-run challenges, particularly in developing countries. The remainder of my remarks will focus on these challenges: what they mean for developing countries and how to address them.

Longstanding trends and challenges in developing countries

The last several decades have seen substantial alleviation of world poverty. But recent crises are eroding those gains. At least 75 million additional people are facing extreme poverty this year. Without urgent and concerted action, the world is unlikely to meet Sustainable Development Goals by 2030.

Longstanding problems are the cause of persistent poverty and inequality. Those problems include lack of access to education and healthcare and basic infrastructure like clean water, electricity, roads, and broadband. Ineffective, nontransparent institutions foster corruption and political oppression. They also limit the rights of women and minorities. And developing countries – along with the rest of the world – are experiencing increasing incidents of extreme weather, driven by climate change, with agriculture especially vulnerable.

Addressing these contributors to poverty has always been central to development policy. But this agenda is particularly important in unlocking key trends that are shaping the future of the developing world. Let me touch on two examples.

The first is demographics. Most of the world’s net population growth over the next century will be in Sub-Saharan Africa and certain regions of Asia. In Africa, an estimated 1.7 million individuals are now entering the job market each month. These future generations will expand the labor force and could drive new innovations and productivity gains. But capitalizing on the promise of a growing population necessitates investments today in both human capital and sustainable infrastructure.

The second trend pertains to technology and digitalization. Greater connectivity can bring significant efficiencies. It can also spur innovation and democratize access to finance, education, and health. But realization of these benefits requires investment in digital infrastructure. At the same time, countries need to strengthen their regulatory frameworks and enforcement against illicit activity and threats to cybersecurity and privacy. The growth of the digital economy must expand opportunity; it must not exacerbate inequality.

Rise of global and borderless challenges

In the past, most anti-poverty strategies have been country-focused. But today, some of the most powerful threats to the world’s poorest and most vulnerable require a different approach. Why so? Because the challenges are global rather than “country-specific.”

A prime example of such a challenge is climate change. Indeed, it is an existential threat to our planet. No country can tackle it alone. Success requires all countries to work together to achieve the goals of the Paris Agreement. Understanding the economic and human risks of climate change to Americans and to the world, the United States has just enacted our most aggressive domestic action on climate yet. We are committed to a net-zero economy by 2050. We must also help developing countries transition their economies away from carbon-intensive energy sources and expand access to clean energy. To advance this objective, Treasury is announcing a new nearly $1 billion contribution to the Clean Technology Fund and the Biden administration remains committed to boosting international climate financing to over $11 billion by 2024.

In addition to abating emissions, countries must also build greater resilience to climate change’s impacts. Recently, devastating floods in Pakistan dislocated more than 33 million people and destroyed hundreds of thousands of hectares of farmland. Global climate change has stark consequences at every level – local, national, and regional. The world must mitigate climate change and the resultant consequences of forced migration, regional conflicts, and supply disruptions.

Pandemics are another key global challenge. As the COVID pandemic has demonstrated, pathogens do not respect borders. If unchecked, pandemics can bring the global economy to a standstill. Uneven access to vaccines and medicines – along with underinvestment in public awareness and public health infrastructure – can cause outbreaks of new variants that disrupt the entire world. We must build on the work we have already done, which includes the new Financial Intermediary Fund for pandemic prevention, preparedness, and response housed at the World Bank. nd we must accelerate our work to help countries build robust public health infrastructure.

And of course, local fragility, conflicts, and violence can spill over to neighboring regions. As of June, the UN estimates that there are more than 100 million people worldwide displaced by conflict, violence, and fear of persecution. That is almost 60 million more than just a decade ago. Displacement of people and broken supply chains can ripple through regions and the world. To contend with these effects, governments will have to increase their budgets for security, refugees, or disaster recovery. That will likely be at the expense of investments such as education and health.

Some people have said that limited resources and capacity constraints pose a tension between progress on development and addressing these global challenges. But that is a false choice. We must do both: especially since these priorities are mutually reinforcing. Unmitigated global challenges can be destructive to our development aspirations by putting at risk investment, financial stability, and human health and welfare. Conversely, lack of development can magnify global challenges and increase vulnerabilities, with negative spillovers onto the rest of the world.

Rethinking development finance

Rethinking our overall strategy

So, how to make sustained progress on this array of challenges?

We need to come together to develop new strategies, policies, and approaches to mobilize financing more effectively: across domestic resources, the official sector, and the private sector. There is a huge pool of global savings. But the flow to developing countries is limited. Why? The obstacles include information asymmetry, a scarcity of bankable projects, and political and regulatory uncertainty. There is also a shortage of tools to diversify risks beyond individual projects with uncertain returns. Now there is broader macroeconomic uncertainty. And private investors remain risk-averse.

These impediments make it crucial for us to examine our strategies for bringing together different sources of financing, for deepening capital markets, and for expanding lending in local currencies. The private sector has a key role to play, especially now, with countries struggling to recover from COVID and with constrained fiscal space. Investors must recognize the tremendous promise and need for investments in developing countries, with their huge potential upside in both financial and human development terms.

On their own, the multilateral development banks cannot provide financing on the scale that is needed. But they are a critical part of the solution. In concert with developing countries, the multilateral development banks have worked effectively for more than 75 years in designing holistic economy-wide development strategies. They have provided direct financing for roads, basic education and health, water and sanitation, and energy. They have done so on financial terms that countries cannot access from the market.

Beyond direct financing, the multilateral development banks have served as pioneers in development finance. Development banks step in to fund activities that may never be profitable for private investors. They provide essential funding for countries recovering from disasters and conflict – as, for example, in Bosnia and Liberia, and as we expect them to do in Ukraine. They help scale development solutions that work. And they help chart the course for private investors by diffusing risk and providing policy advice to strengthen countries’ institutional frameworks for investment. All in all, these banks have a broad set of tools to address many of the challenges I have outlined.

Evolving our multilateral development bank system

But the multilateral development banks need to evolve as well. They have a strong record of financing national projects like infrastructure, where the costs and the benefits both largely accrue to the same country. But to address the complex global challenges I described, we also need to invest in programs where the costs and benefits are more diffuse. We do not yet have a sufficiently robust toolkit to address, with scale and urgency, our global and cross-border challenges.

The shareholders of these banks must ask them to devise new approaches to address global challenges without diminution of their traditional focus on poverty reduction and other Sustainable Development Goals. I strongly believe that tackling these global challenges will bolster the banks’ existing work on poverty alleviation. After all, climate change, threats to global health, and fragility have a disproportionate impact on the poor.

The evolution of these banks will require changes to incentives, operating models, and uses of the banks’ financial resources.

First, we need to take a different view of how to incentivize investments to tackle global challenges.

It is appropriate to consider greater use of concessional resources, including grants, to fund investments where the benefits are shared more broadly by the world. For example, I see a case for concessional financing to help middle-income countries transition away from coal in the context of accelerating the clean energy transition. If the global community benefits from investments in climate, then the global community should help bear the cost.

The development banks should also use their research and analytical capacity to provide improved diagnostics related to global challenges. They can use policy advice and conditionality to encourage countries, especially those with access to other financing, to direct funding towards investments with broader benefits.

Second, the development banks should consider changes to their operational models.

In addition to the traditional country-based lending model, it is time to consider expanded options. The development banks may need to support both global and regional entities. Tackling global challenges requires global coordination and funding pools that go beyond national governments. During the pandemic, for example, global organizations like COVAX have been vital to expediting the rollout of COVID-19 vaccines to a broad range of developing countries.

The development banks should also consider targeting additional resources toward sub-sovereign levels where local expertise and reform energy could result in faster, more tangible benefits. Green city and smart city initiatives are examples of sub-sovereign development that multilateral development banks could support in a more direct and integrated fashion.

I also believe that development banks should adopt stronger targets for mobilizing private finance, and deploy a broader range of instruments, including guarantees and insurance products, to mobilize more private capital into their projects. This is especially true for development banks that are focused on private sector development.

Third, given the scale of the challenges, the development banks must continue to explore financial innovations to responsibly stretch their existing balance sheets.

The resources available to these banks are scarce and must be used most effectively. The goal is to deliver extra financing without substituting resources away from other priorities or compromising development impact. The G20’s recent independent review of capital adequacy of the development banks offers a number of interesting ideas. One possibility involves freeing up capital for new lending through increased securitization of private sector projects or portfolios. Other potential ideas include expanding sources of equity and adjustments to financial management.

We must, however, be clear-eyed about how much more lending can be leveraged from current balance sheets. Prudent financial management and financial sustainability are important for these institutions to deliver – not only today, but into the long term. We need to preserve the ability of the institutions to borrow from markets on attractive terms and to play a countercyclical role when needed.

Since the establishment of the World Bank in the aftermath of World War II, the multilateral development bank system has continuously evolved in line with the new challenges we have faced over time. We have seen the development of new, specialized institutions – like the International Development Association – to provide concessional finance to the poorest countries. The European Bank for Reconstruction and Development was created to nurture a nascent private sector in transition economies in Eastern Europe. The development banks have also incorporated work on new sectors and issues – such as on human capital, post-conflict reconstruction, good governance and anti-corruption, and climate change mitigation and adaptation.

Some of the ideas I mentioned today will be easier to implement. Some will be harder. All of them will require political leadership. Progress may be incremental and non-linear, and results may take years to become fully evident. But we must start now.

Of course, global challenges like climate change will not be solved by the development banks alone, no matter how successful these reforms may be. The scale of the problem is too big. Individual countries will need to make changes, including important policy reforms. Advanced economies must provide quality financing, and crucially, the private sector will need to step in with investments and technology. The Just Energy Transition Partnership being developed for a number of countries with active participation from the United States, the G7, and other partners, provides a promising new model for aligning domestic, public, private, and philanthropic resources in support of the fight against climate change.

The world cannot afford to delay or lower our ambitions. The current challenges are urgent. That is why I, along with leaders from a broad group of countries, will be calling on World Bank management at the annual meetings next week to work with shareholders to develop a World Bank evolution roadmap by December. Deeper work should begin by the spring. Shareholders will then need to drive parallel, holistic reform efforts across other development banks as well.

To accelerate this work, my team will step up our engagement with World Bank shareholders and management. And we look forward to discussing more details on this project in the coming weeks.

Conclusion

Let me conclude where I started. To confront the evolving challenges facing the global economy today, we all have jobs to do at home. In the United States and many other advanced economies, this means reining in inflation, while providing targeted support to those most impacted by rising prices. At the same time, in addressing our global challenges, we must cooperate. And we must listen to one another. Shocks from the pandemic and Russia’s terrible war have rattled the world economy.

But this is no time for us to retreat. The world needs ambitious responses to all our problems: from policymakers, business leaders, and development officials alike. We need ambition in how we work together to guide the global economy in the near term. We need ambition in updating our vision for development financing and delivery. And we need ambition in meeting our global challenges.