PARIS, France – Global growth is set to remain modest, with the impact of the necessary monetary policy tightening, weak trade and lower business and consumer confidence being increasingly felt, according to the OECD’s latest Economic Outlook.

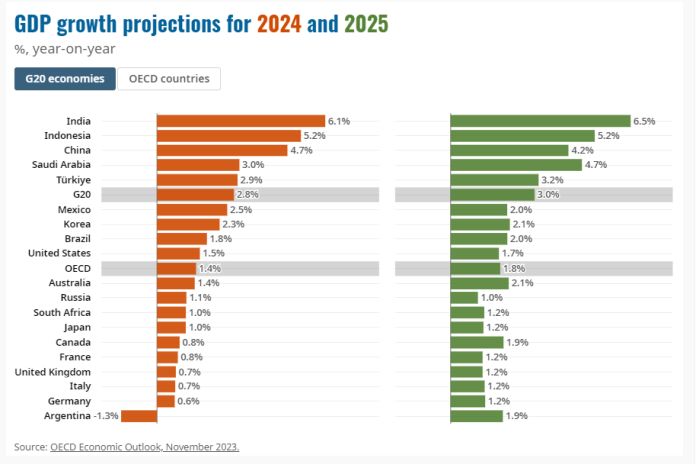

The Outlook projects global GDP growth of 2.9 percent in 2023, followed by a mild slowdown to 2.7 percent in 2024 and a slight improvement to 3.0 percent in 2025. Asia is expected to continue to account for the bulk of global growth in 2024-25, as it has in 2023.

Consumer price inflation is expected to continue to ease gradually back towards central bank targets in most economies by 2025, as cost pressures moderate. Consumer price inflation in OECD countries is expected to decline from 7.0 percent in 2023 to 5.2 percent in 2024 and 3.8 percent in 2025.

GDP growth in the United States is projected at 2.4 percent in 2023, before slowing to 1.5 percent in 2024, and then picking up slightly to 1.7 percent in 2025 as monetary policy is expected to ease. In the euro area, which had been relatively hard hit by Russia’s war of aggression against Ukraine and the energy price shock, GDP growth is projected at 0.6 percent in 2023, before rising to 0.9 percent in 2024 and 1.5 percent in 2025. China is expected to grow at a 5.2 percent rate this year, before growth drops to 4.7 percent in 2024 and 4.2 percent in 2025 on the back of ongoing stresses in the real estate sector and continued high household saving rates.

“The global economy continues to confront the challenges of both low growth and elevated inflation, with a mild slowdown next year, mainly as a result of the necessary monetary policy tightening over the past two years. Inflation has declined from last year’s peaks. We expect that inflation will be back at central bank targets by 2025 in most economies,” OECD secretary-general Mathias Cormann said. “Over the longer term, our projections show a significant rise in government debt, in part as a result of a further slowdown in growth. Stronger efforts are needed to rebuild fiscal space, also by boosting growth. To secure stronger growth, we need to boost competition, investment and skills and improve multilateral co-operation to tackle common challenges, like reinvigorating global trade flows and delivering transformative action on climate change.”

The Outlook highlights a range of risks. Geopolitical tensions remain a key source of uncertainty and have risen further as a result of the evolving conflict following Hamas’ terrorist attacks on Israel. Amid heightened geopolitical tensions and a longer-term decline in the trade intensity of growth, the anticipated cyclical pick-up in trade growth could fail to materialise. On the upside, stronger consumer spending could push up growth if households make greater use of the savings accumulated since the COVID-19 pandemic, though this could also increase the persistence of inflation.

The Outlook lays out a series of policy recommendations, underlining the need to continue policies aimed at bringing down inflation, reviving global trade and adapting fiscal policy to meet long-term challenges.

The effects of the tightening of monetary policy since early 2022 are increasingly visible. Policy interest rates appear to be at or close to their peak in most economies. Monetary policy should remain restrictive until there are clear signs that inflationary pressures are durably reduced. No rate reductions are expected in the major advanced economies until well into 2024, and in some economies not before 2025. There is scope for rate reductions in many emerging market economies, but global financial conditions will limit the pace at which these can occur. Greater efforts should be made to ensure that markets remain open to help lead the way to the digital and green transitions. Fiscal policy should prepare for long-term spending challenges.

“Governments really need to start confronting the mounting challenges that public finances face, particularly from ageing populations and climate change,” OECD chief economist Clare Lombardelli said. “Governments need to spend smarter, and policymakers need to contain current and future fiscal pressures while preserving investment and rebuilding buffers to respond to future shocks.”

For the full report and more information, visit the Economic Outlook.