- Last year’s turmoil showed that further progress is required in a number of areas to ensure banks aren’t too big to fail

By Tobias Adrian and Marc Dobler

Almost a year ago, Credit Suisse, a globally systemic bank with $540 billion in assets and the second-largest Swiss lender, founded in 1856, failed and was sold to UBS. In the United States, Silicon Valley Bank, Signature Bank and First Republic Bank failed at around the same time amid Federal Reserve interest rate hikes to contain inflation. With a combined $440 billion of assets, these were the second, third, and fourth biggest bank resolutions since the Federal Deposit Insurance Corporation was created during the Great Depression.

This banking turmoil represented the most significant test since the global financial crisis of ending too-big-to-fail whereby a systemic bank can be resolved while preserving financial stability and protecting taxpayers.

So, what’s the verdict? In short, while significant progress has been made, further work is required.

On the one hand, as we note in a recent report, the actions of authorities last year successfully avoided deeper financial turmoil, and the financial soundness indicators for most institutions signal continued resilience. In addition, unlike many of the failures during the global financial crisis, this time significant losses were shared with the shareholders and some creditors of the failed banks.

However, taxpayers were once again on the hook as extensive public support was used to protect more than just the insured depositors of failed banks. Amid a massive creditor run, the Credit Suisse acquisition was backed by a government guarantee and liquidity nearly equal to a quarter of Swiss economic output. While the public support was ultimately recovered, it entailed very significant contingent fiscal risk, and created a larger, more systemic bank. Use of standing resolution powers to transfer ownership of Credit Suisse, after bailing in shareholders and creditors, rather than relying on emergency legislation to effect a merger would have seen Credit Suisse shareholders fully wiped out and potentially less public support extended. We expect to learn more in the coming days when a Swiss report on the too-big-to-fail regime is issued.

In the United States, in addition to easing collateral requirements for liquidity support, the authorities cited systemic concerns to invoke an exception allowing protection of all deposits in two of the failed banks. This significantly increased costs for the deposit insurer which will need to be recouped from the industry over time. Even very large and sophisticated depositors were protected -not just the insured.

What we’ve learned

Intrusive supervision and early intervention are critical. Credit Suisse depositors lost confidence after prolonged governance and risk management failures. In the US, the failed banks pursued risky business strategies with inadequate risk management. Supervisors in both cases should have acted faster and been more assertive and conclusive. Our recent review of supervisory approaches found that the ability and will to act remain critical and can suffer from unclear mandates or inadequate legal powers, resources, and independence as well as powerful financial sector lobbies. Policymakers need to better empower banking supervisors to act early and with authority if needed.

Even smaller banks can be systemic. Supervisory and resolution authorities should ensure sufficient recovery and resolution planning for the sector. This should include banks that may not be systemic in all circumstances but could be in some. This was a key recommendation of our latest Financial Sector Assessment Program for the US.

Resolution regimes and planning need sufficient flexibility. Policymakers should ensure resolution rules and plans are flexible enough to balance financial stability risks and taxpayer interests. Government support may still be required in some circumstances – or example, to avoid a systemic financial crisis. IMF staff recommended the equivalent of a systemic risk exception for the euro area, for example. While authorities should continue pursuing plan A, they need the flexibility to depart and from, and for example combine different resolution tools, as necessitated by the specific circumstances at the time of failure.

Liquidity in resolution is crucial. Banks typically fail because creditors lose confidence, even before the balance sheet reflects potential losses. Rebuilding capital buffers in resolution may not be sufficient on its own to restore confidence. Authorities must make further progress on how quickly banks heading into resolution could receive liquidity support – including prepositioning of collateral and testing preparedness – while still protecting central bank balance sheets.

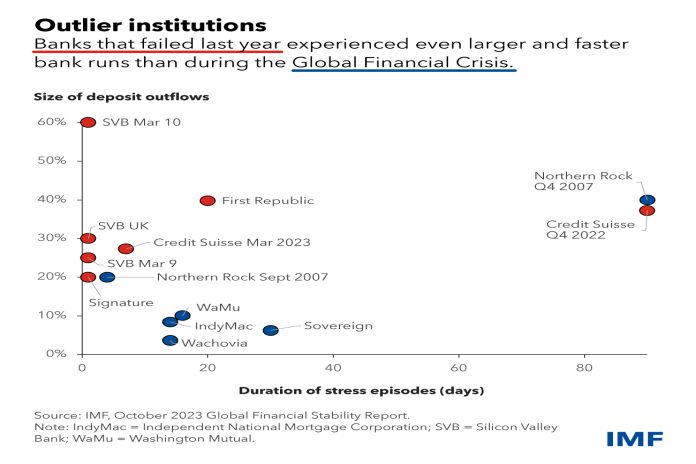

Authorities in many countries need to strengthen deposit insurance regimes as we recommended to Switzerland. New technology like 24/7 payments, mobile banking, and social media have accelerated deposit runs.

Last year’s failures followed rapid deposit withdrawals, and deposit insurers and other authorities should be ready and able to act more quickly than many currently can. The US banks that failed were outliers with balance sheets that had grown very rapidly, funded by a high degree of uninsured deposits. Where wider coverage is being considered, it would need to be adequately funded. Particularly in countries with deposit insurance that is not backed by a sovereign with deep pockets, policymakers should be careful not to overextend deposit insurance coverage. If not backed by a commensurate rise in deposit insurance funding, depositors could quickly lose confidence.

The bottom line is that progress has been made, but there is still further to go in putting an end to too-big-to-fail. Last year’s bank failures provided a valuable check on the progress that policymakers are making on the reform agenda and to set course for the remaining ground to be covered.

IMF staff are working actively to support efforts in member countries to strengthen their supervision, resolution, liquidity assistance and deposit insurance frameworks including through FSAPs, technical assistance. We are also contributing to policy formulation at the international level, including a recently announced review of the international deposit insurance standard, and by earlier this year hosting with the financial stability board a workshop for policymakers on the use of transfer powers in resolution.

- See the recent Global Financial Stability Note, The US Banking Sector since the March 2023 Turmoil: Navigating the Aftermath, for more analysis of affected banks and a deeper discussion of remaining vulnerabilities.

![]()