By Oliver Reynolds, Economist

BARCELONA, Spain, (FocusEconomics) – On 15 September 2020, top officials from Bahrain, Israel, the UAE and the US met in the White House to sign the Abraham Accords. This marked the establishment of full diplomatic ties between Israel and the two Arab nations; until then, only two Arab states – Egypt and Jordan, had formally recognized Israel. The Abraham Accords were swiftly followed by a similar deal with Morocco. Ties with regional juggernaut Saudi Arabia, while still informal have also warmed, with Israeli businessmen recently addressing an important Saudi investment conference.

The economic implications of this rapprochement are important, as the synergies between Israel and the Arab states are clear. Israel offers the region’s most advanced technology, with particular strengths in defense, cybersecurity, healthcare and agriculture, accessing this tech would help diversify the economies of the oil-dependent Gulf states. On the flipside, Israel stands to benefit from greater capital investment, access to new export markets and more tourist arrivals.

Early signs are encouraging. Israel and the UAE clinched a free trade agreement (FTA) in May, which aims to raise bilateral trade to USD$10 billion annually -up from less than USD 200 million in 2020. The UAE-Israel Business Council predicts there will be nearly 1,000 Israeli companies working in the UAE by the end of this year. Moreover, Israeli exports to Morocco roughly tripled in annual terms in 2021, while those to Bahrain rose many times over. An FTA with Bahrain could be concluded by end-2022.

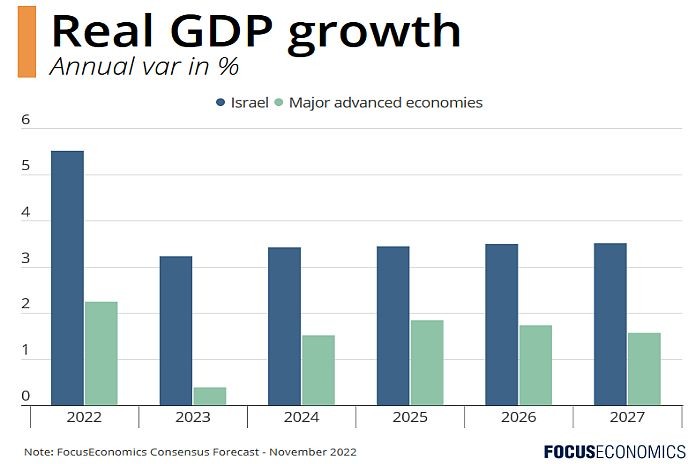

These improving relations are likely partly behind our analysts’ rosy GDP growth projections for Israel for the coming years, which are far above the average for major advanced economies. However, diplomatic progress is fragile and could be set back by a renewed outbreak of Israeli-Palestinian violence.

The likely presence of the ultra-conservative Religious Zionist movement in the next Israeli government is also a risk, as it could increase tensions with Arabs at home and abroad, one of the movement’s key figures has proposed deporting Arab citizens who show ‘disloyalty’ to the Israeli state, for instance. Moreover, Israel has an image problem among Arabs abroad; opinion polls suggest most are against normalization, and tourist arrivals to Israel from Bahrain, Morocco and the UAE reportedly remain minimal. There is thus still much to be done to maximize the economic potential of Israel’s regional integration.

- Insights from our analyst network:

Regarding an Israel-Bahrain FTA, analysts at the EIU said:

“The Gulf state’s small economy, which is undergoing a renewed diversification and development drive, has far more to gain from the increase in direct trade that an FTA could herald: there have been signs recently of collaboration in fintech (a Bahraini strength and priority), with a cooperation agreement signed in August between Israel Advanced Technology Industries and Bahrain’s “Fintech Bay”, a government-backed industry hub and incubator. The primary interest for Israeli companies is ease of procedural and physical access to Saudi Arabia (which is already quietly extending political and economic cooperation with Israel but unlikely to normalise ties under the current king).”