By FocusEconomics

ASIA – In the West’s latest attempt to destabilize the Russian economy, officials looked to end an over three-year standoff between the US and Iran to bring both parties back into the 2015 nuclear accord, which would lift restrictions on Iranian oil sales and therefore support Western economies’ shifts away from dependence on Russian oil. The nuclear deal was spoiled under the Trump administration in May 2018, for reasons not clearly understood by the UN nuclear watchdog at the time.

After 11 months of negotiations, Iran and other major world powers were almost certain to sign off on an agreement that would have removed economic sanctions on Iran in the near future. However, Russia, a key signatory required to revive the 2015 agreement, vetoed the deal in its final stages, due to its demand that US economic sanctions on Russia over its invasion of Ukraine not impede Russian-Iranian trade.

The US attempted to ease tensions with both Iran and Venezuela in recent weeks, hoping both to undermine Russia’s political relationships with the countries, as well as to identify alternative oil and gas reserves for export. Iran is home to the second-largest proven gas reserves and is one of the top OPEC+ crude oil producers. Consequently, bringing the nuclear deal back into play would significantly support the Iranian economy, which has been battered by US sanctions since late 2018. Russia’s decision to veto the deal sent global crude oil prices rising even further, as most analysts had priced in a deal being reached sometime in the coming months.

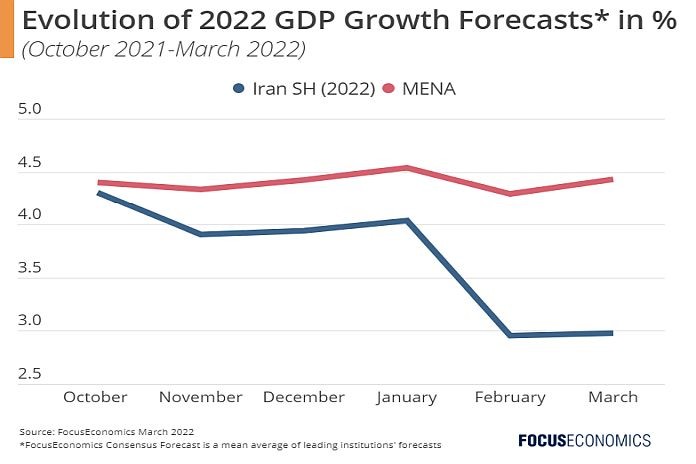

Looking ahead, Iran’s economy is still expected to grow at a solid pace next Solar Hirji (SH) year (April 2022 to March 2023), but the latest decision from Russia has likely weighed heavily on prospects for stronger growth. Meanwhile, the Middle Eastern and North African (MENA) region as a whole is set to benefit from the current geopolitical turmoil, as global crude oil and gas prices continue to edge higher, which should support the public coffers of governments in the region, broaden diversification efforts and see the implementation of key economic reforms. Our panel of analysts expect the Iranian economy to grow 3.0 percent in SH 2022. Moreover, our panel of experts see the MENA region expanding 4.4 percent in 2022.

Insights from our analyst network

Commenting on the potential lifting of US sanctions on Iran, economists at Goldman Sachs noted:

“A deal to return to the JCPOA agreement with Iran could help bring additional barrels to the global market, which we now conservatively base-case. Despite headlines that Russia could derail an agreement, the issuance of export waivers remains a unilateral US decision. We reiterate our view, however, that the associated ramp-up in Iran oil flows would neither be large nor immediate, with implementation and certification leaving for a Q3 2022 ramp-up in exports, even if a deal were to be signed now.”

On Iran’s economic outlook given a return to the 2015 accord, Daniel Richards, MENA economist at Emirates NBD, noted:

“Iran boosted oil production in 2021 as it produced an average 2.43 (mbpd), compared with 2020s 1.97 (mbpd)—growth of 23.4 percent. […] Should a deal be reached, however, then there is substantial upside potential for the Iranian economy. Current production is far off the 2018 levels of 3.8 (mbpd), and a renewed inflow of FX receipts and foreign investment would provide a substantial boost to economic activity.”