By Amina Lahreche and Niko Alfred Hobdari

IMF African Department

On November 11, 2020, the International Monetary Fund granted the Republic of South Sudan a $52 million emergency disbursement under the Rapid Credit Facility to help its economy weather the shock of the COVID-19 pandemic. This is the first time this new and still fragile country has received financial support from the IMF.

- Fragility has many shapes and forms. South Sudan is emerging from a prolonged civil conflict with a very high human cost. More than half of the South Sudanese population requires urgent food assistance, about 40 percent of the population is internally displaced or live as refugees in neighboring countries. More than 80 percent live below the poverty line. Recently, floods and locusts have further worsened living conditions for millions of South Sudanese. The country has massive development needs, from building basic infrastructure, to developing education and health services, to building institutions. These are difficult challenges for a country that has very limited access to affordable financing.

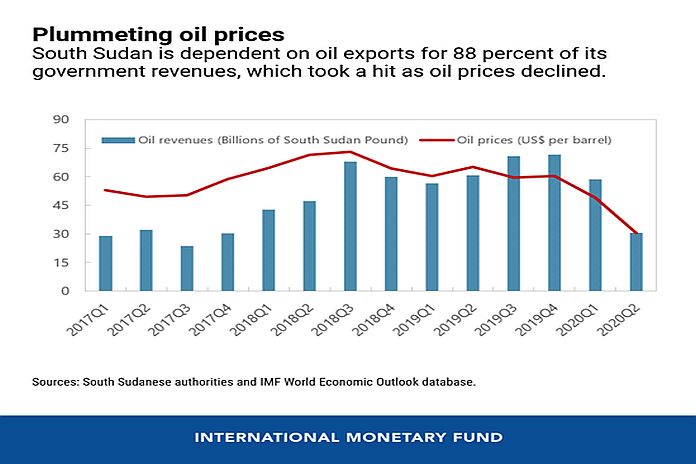

- The COVID-19 crisis is more than a health crisis. People in South Sudan have suffered illness and death from the pandemic, although the toll is difficult to fully assess, given limited testing capacity. Beyond the impact on health, South Sudan has also been hit hard by the sharp decline in oil prices during the pandemic. Proceeds from oil exports account for 97 percent of exports and a large share of budget revenue, further compressing the already limited space for fiscal policy action. The exchange rate is depreciating, contributing to higher inflation. Financial support from the IMF is providing much needed breathing room and reducing the economic and social cost of adjusting the economy toward a sustainable path.

- A recent push for economic reforms. South Sudan would benefit from diversifying its economy away from oil. Accomplishing this will require large investments in infrastructure, human development, and stronger institutions. Donor support is largely focused on humanitarian operations. Attracting more financing for development requires additional reforms. More effective institutions for public financial management are a high priority, and the authorities have embarked on this reform in line with their commitments under the 2018 peace agreement. The authorities are also charting a fiscal course that maintains debt sustainability, fosters economic growth, and provides for peace-building and social spending. These steps, together with commitments to ensure transparency and accountability in the use of IMF resources, helped unlock the first IMF funding for the country.

- IMF help has multiple components: funding from the newly approved Rapid Credit Facility, capacity development, and policy advice. The Rapid Credit Facility provides emergency financing to deal with the most acute challenges of the crisis. At the same time, the IMF is providing technical assistance to help with modernizing the institutions necessary for public financial management, focusing first on budget planning, cash management, and the establishment of a treasury single account. In South Sudan as in other countries, to avoid overwhelming stretched capacities, reforms need to be incremental, prioritized, and focused.