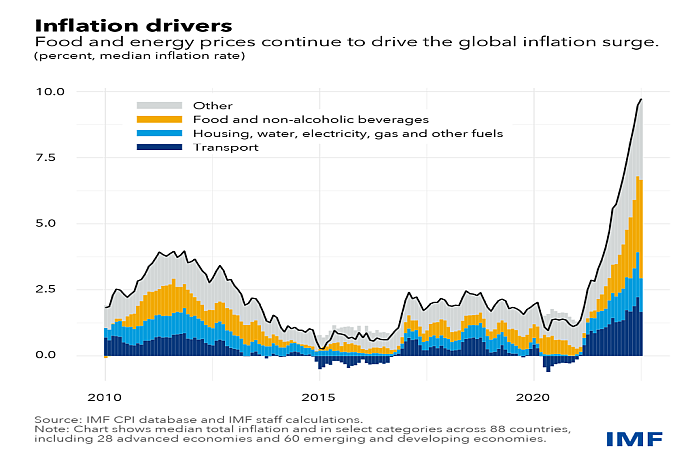

Global inflation was generally moderating when the pandemic began, and the downward trend continued into the early months of the crisis. But surging prices since late 2020 have pushed inflation steadily higher. The average global cost of living has risen more in the 18 months since the start of 2021 than it did during the preceding five years combined.

Food and energy are the main drivers of this inflation, as our Chart of the Week shows. Indeed, since the start of last year, the average contributions just from food exceed the overall average rate of inflation during 2016-2020. In other words, food inflation alone has eroded global living standards at the same rate as inflation of all consumption did in the five years immediately before the pandemic. A similar story holds for energy costs, which show up both directly and indirectly, through higher transportation costs. This is not to say that prices of other items are not rising too. For example, services inflation has increased in the United States and the Euro Area. And the relative impact of food, energy, and other items in driving inflation varies considerably across countries.

Inflation continued to climb through July, albeit a little more slowly. Though circumstances vary by country, the latest observations show a slight change in the composition of inflation, with food’s share increasing further while energy-related categories eased slightly. This is consistent with the possibility that global energy prices have been passed on to consumers more quickly than higher wholesale food prices.

Our latest World Economic Outlook in July projected inflation to reach 6.6 percent this year in advanced economies and 9.5 percent in emerging market and developing economies – upward revisions of 0.9 and 0.8 percentage points respectively from three months earlier. Next year, interest-rate hikes are likely to bite, with the global economy growing by just 2.9 percent and in turn slowing price increases worldwide.

With rising prices continuing to squeeze living standards worldwide, taming inflation should be the priority for policymakers. Tighter monetary policy will inevitably have real economic costs, but these will only be exacerbated by delaying corrective action. As a recent Chart of the Week shows, central banks have dramatically pivoted this year toward tighter policy globally.

Targeted fiscal support can help cushion the impact on the most vulnerable. Policies to address specific impacts on energy and food prices should focus on those most affected without distorting prices. And with government budgets stretched by the pandemic such policies will need to be offset by increased taxes or lower government spending.