By FocusEconomics

There are multiple risks and unknowns on the horizon for next year, but our Consensus Forecasts help cut through that uncertainty. In this article, we look at our panelists’ key forecasts for 2025 for a range of countries, indicators and commodities.

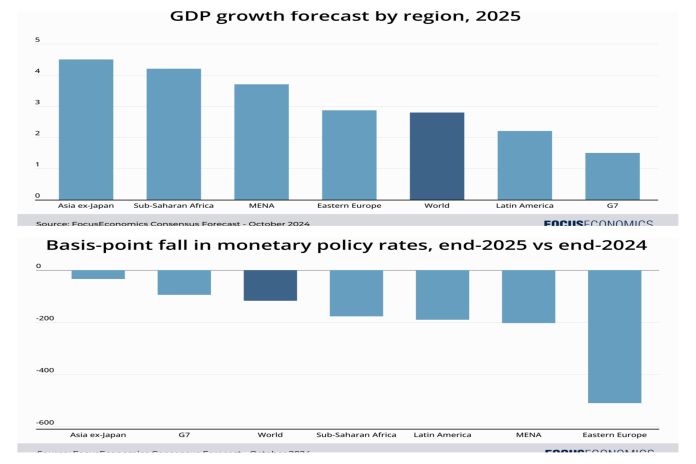

GDP predictions for 2025

Our Consensus is for the global growth to slow slightly to 2.8 percent in 2025 from 2.9 percent in 2024. This would be the worst reading since 2020, at the height of the global pandemic.

The slowdown in the world economy will chiefly be due to softer expansions in the US and China, which together account for around half of global output at current USD prices. China’s economy will be hampered by an ongoing property downturn, a shrinking population and workforce, rising Western trade and tech restrictions, a lack of substantive reforms to boost the private sector and consumer spending, and strained public finances.

Meanwhile, the US will likely see a slowdown from this year’s above-trend growth due to a slowing labor market and the lagged impact of past rate hikes, but should remain the G7’s joint-strongest performer with a 1.7 percent expansion.

Looking at key developing economies, our panelists expect the growth rates of Brazil, Russia, and India to decelerate next year. In Brazil, both domestic demand and exports are forecast to ebb, while the war-related boost to Russian government spending and investment is likely to fade somewhat next year. Moreover, though India will slow, it is set to remain one of Asia’s fastest-growing economies (with 6.6% GDP growth projected), benefitting from favorable demographics, government capital spending, and foreign investment in the manufacturing sector.

In contrast, most other parts of the global economy should pick up speed. The Consensus is for Africa, ASEAN, the euro area, Latin America and the Middle East to all gain steam in 2025 from 2024 thanks to declining inflation and interest rates. In the case of the Middle East, the boost will also come from the rollback of OPEC+ oil output restrictions that hampered the region’s oil sector this year.

On China, Nomura analysts, said:

“New headwinds include plummeting equity financing, the PBoC’s efforts to raise bond yields, strengthening tax collection, a surge in penalties, the hiking of utility prices, and a crackdown on pay in the financial sector. The ongoing headwinds include the contracting property sector, the tapering of post-Covid pent-up consumption demand, and the cooling of investment frenzy in lithium-ion batteries, solar and EVs.”

On the US, EIU analysts, said:

“Consumer spending will weaken against recent levels, but remain supported by an overall robust jobs market, real wage gains and a moderate level of household debt, most of which is secured by collateral such as houses. We expect that economic growth will be sedate in the remainder of 2024 and in 2025, but that the economy will avoid a technical recession.”

Inflation forecasts for 2025

Our Consensus is for global inflation to decline to 3.5 percent on average next year from 5.3 percent in 2024, less than half the 2022 peak. However, inflation will still be above the level that prevailed during the 2010s, propped up by countries’ generally reduced openness to free trade and preference for establishing secure supply chains over those of lowest cost.

By region, sub-Saharan Africa, Latin America and Eastern Europe will have by far the highest inflation rates, due to currency weakening and socio-political instability. In contrast, Asia and the G7 will see the joint lowest rates. In the case of Asia, this will be largely due to the region’s huge manufacturing capacity plus depressed demand in China; in G7, by soft economic growth.

Trends in monetary policies next year

Panelists expect Asia ex-Japan to see the mildest drop in the policy rate by the end of next year. This is largely as monetary policy was tightened less dramatically in 2022–23, meaning there is less leeway for monetary easing by central banks. Interest rates in G7 economies are forecast to fall by around 100 basis points next year, but to still end 2025 close to 3 percent – triple pre-pandemic levels. At the other end of the spectrum are Eastern Europe and the Middle East and North Africa (MENA); the falls projected for these regions will largely be due to sharply declining interest rates in Egypt, Russia and Turkey.

On the Fed’s monetary stance, Goldman Sachs analysts, said:

“The greater urgency suggested by [September]’s 50bp cut and the acceleration in the pace of cuts that most [Fed] participants projected for 2025 makes a longer series of consecutive cuts the most likely path, in our view. We have therefore revised our Fed forecast to accelerate the pace of cuts next year and now expect a longer string of consecutive 25bp cuts from November 2024 through June 2025, when the funds rate would reach our terminal rate forecast of 3.25-3.5 percent.”

Our main commodities predictions for 2025

Precious metals: Our Consensus is for precious metal prices to see the largest price rise out of the four commodity groups in 2025 on average vs 2024. Ongoing elevated safe-haven demand, lower interest rates and rising jewelry demand in emerging markets will benefit precious metals generally. Moreover, silver’s increasing usage in the solar and electric vehicle sectors should drive higher silver prices, while platinum will benefit from a larger supply deficit. That said, precious metal prices are seen pulling back slightly from their late-September spot price by the end of next year, as global concerns over inflation and recession subside.

Base metals: Base metal prices should see a small improvement next year versus this year on average, likely due to the green energy transition. Most base metals are critical elements in renewable energy technologies, including solar panels, wind turbines, hydroelectric and geothermal plants, and batteries – especially in the automotive sector. That said, expected slowdowns in the US and China – key consumers of base metals will cap the improvement.

Energy: Panelists see energy prices averaging lower next year compared to this year. Fossil fuel demand growth will likely ebb as the shift to green energy continues. Moreover, OPEC+ is currently expected to start ramping up oil output from December, which will keep a lid on prices of crude oil and its derivatives. That said, prices are seen picking up by end-2025 from their late-September lows.

Agricultural: Agricultural prices are forecast to see the sharpest average fall in prices in 2025 vs 2024. The end of the El Niño weather phenomenon will likely have a part to play, as this should support improved crop growing conditions in emerging markets. Prices for coffee and cocoa are seen falling particularly sharply; prices for both commodities surged this year on weather-related disruptions.

On oil prices, ING analysts, said:

“Weaker Chinese demand has led us to revise our Brent forecast lower for the remainder of the year. We now expect ICE Brent to average US$80/bbl in the fourth quarter of this year, down from our previous forecast of US$84/bbl. In addition, our balance is showing a slightly larger surplus in 2025, which has led us to cut our 2025 Brent forecast from an average of US$79/bbl to US$77/bbl. Our balance sheet assumes that OPEC+ will stick to its plan to unwind additional voluntary supply cuts.”

On gold prices, Goldman Sachs analysts, said:

“Goldman Sachs Research forecasts the price will reach $2,700 by early next year, buoyed by interest rate cuts by the Federal Reserve and gold purchases by emerging market central banks. The metal could get an additional boost if the US imposes new financial sanctions or if concerns mount about the US debt burden.”

Risks and challenges

US politics: Both Donald Trump and Kamala Harris have a good chance of clinching the US presidency in the November elections.

A victory for Harris would likely maintain the status-quo; domestic economic policy would be redistributive, and foreign policy would be cautious, albeit with a likely continued ratcheting-up of restrictions on Chinese firms. There is an outside risk of civil unrest in the US if Harris wins the elections but Trump refuses to accept defeat. This unrest could be violent, given high levels of gun ownership and an extremely divided society; such an outcome could weigh on private spending, investment and the dollar.

In contrast, Trump could impose large import tariffs and clamp down on migration while simultaneously cutting taxes. The outcome would be higher inflation in the US and abroad, with interest rates staying higher for longer. The net effect on US GDP would depend on whether the positive impact of lower taxes outweighs the negative impact of higher tariffs and less migration. The net impact on world GDP would be unambiguously negative due to reduced global trade.

Evolution of global conflicts: There are three particular areas to keep an eye on for next year: The Middle East, Ukraine, and Taiwan. Regarding the Middle East, if the current war waged by Israel widens–such as through all-out war between Iran and Israel–the impact would be primarily felt in the immediate region. However, it would also boost global inflation: This is because the Middle East is a key oil producer, and because large quantities of oil and gas pass through the Strait of Hormuz, which could be blocked in the event of conflict. Finally, there is an outside chance of the US and China being dragged into the conflict – the former to defend Israel and the latter to back Iran. Such an outcome would make the economic impact of the conflict exponentially larger.

Regarding Ukraine, a victory for Kamala Harris would likely ensure a continued flow of US aid, which could in turn cause the Russia-Ukraine war to grind on. However, if Donald Trump gets into power, he could push for a quick resolution to the conflict by threatening to sever US financial support to Ukraine. Moreover, an expansion of the conflict beyond Russia and Ukraine is a low-probability, high-impact risk; such an escalation would become more likely if Trump draws away from the NATO military alliance.

Thirdly, a Chinese invasion of Taiwan is an outside possibility next year, with potentially catastrophic consequences for the global economy.

La Niña: The El Niño weather phenomenon ended earlier this year. In the coming months, the US National Weather Service estimates that there is an over-70 percent chance that the opposite weather pattern, La Niña, emerges. La Niña is characterized by unusually cold ocean temperatures in the Equatorial Pacific. The weather pattern is currently forecast to be weak, but a strong La Niña could lead to heavy rains in some areas of the Americas and Asia and drought in others, raising food prices.

China’s faltering economy: China’s economy is currently being buffeted by myriad headwinds, and is seen slowing next year according to our analysts. A deeper-than-expected property downturn and related financial-market spillovers could cause the expansion to come in even slower than expected, dragging on global GDP growth. On the flipside, if the economy deteriorates further, it could encourage the government to unleash large fiscal stimulus, on top of the monetary and financial measures announced in September, which would be growth-positive.

Final thoughts

In sum, the world economy will be girded next year by lower inflation and borrowing costs. But what could otherwise be a placid 2025 panorama is clouded by a host of geopolitical risks which could increase trade protectionism, disrupt supply chains, raise commodity prices and even spell global conflict. In uncertain times such as these, accessing a range of different analyst forecasts rather than relying on a single number becomes ever more relevant. In that regard, our Consensus Forecasts provide one solution. However, here’s to hoping that citizens and businesses the world over can benefit from looser global financial conditions, and that the worst of the risks enumerated above never come to pass.

Methodology and data sources

Our Consensus Forecasts are calculated by taking the mean average of our analysts’ projections. Analysts include international investment banks, rating agencies, leading national banks, forecasting firms and think tanks. Projections are first validated by our in-house team of economists and data analysts to ensure maximum quality and reliability.

More information on the Consensus Forecast is available here. Our historical data is sourced from the data provider Macrobond.