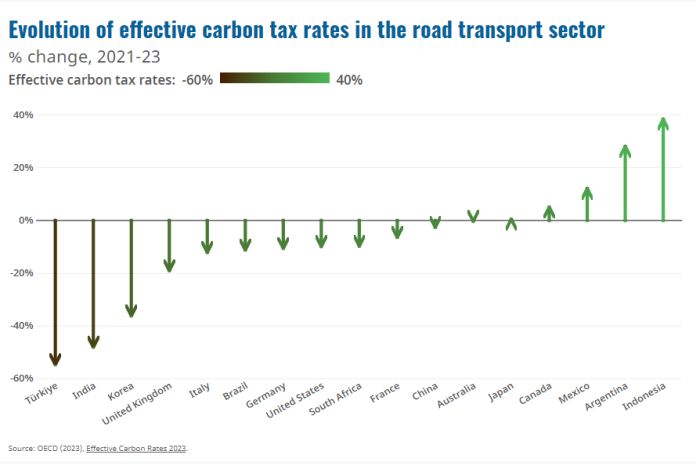

PARIS, France – Tax rates in the road transport sector decreased in a large majority of OECD and G20 countries between 2021 and 2023, due in part to government support and high inflation, eroding the carbon pricing signals designed to alter consumer behaviour and help countries meet climate change objectives, according to a new OECD report.

Emission trading permit prices showed more resilience, however, increasing or remaining stable in most countries.

Effective Carbon Rates 2023: Pricing Greenhouse Gas Emissions through Taxes and Emissions Trading, which presents data on taxes and tradeable permits for carbon emissions in 72 countries accounting for around 80 percent of global emissions, finds that road tax rates decreased in real terms over 2021-23. This was due in part to rate cuts carried out in response to pre-tax price hikes, as governments sought to support households and businesses in response to the energy crisis triggered by Russia’s war of aggression against Ukraine, but was also due to a lack of indexation to inflation. Rates decreased more between 2021 and 2022, at the height of the crisis, than between 2022 and 2023.

Despite the high-energy price environment, progress was seen in efforts to boost the use of carbon pricing. Emissions trading systems (ETSs) are progressively expanding in countries where they are already established and being introduced in new countries, with a range of new initiatives emerging in Latin America and Asia. According to the report, ETS permit prices have been resilient to energy price shocks, with prices increasing for most systems between 2021 and early 2023, mostly applying to carbon prices in the electricity and industry sectors.

The new report, presented today at the OECD’s COP28 Virtual Pavilion, measures carbon prices using the Effective Carbon Rate, which is the sum of three components: specific taxes on fossil fuels, carbon taxes and prices of tradeable emission permits. All three instruments increase the price of high-carbon fuels relative to low- and zero-carbon fuels, encouraging energy users to go for low-or zero-carbon options.

Nearly 60 percent of the approximately 40 billion tonnes of GHG emissions were unpriced in the 72 countries covered in this report in 2021, down from about 70 percent of unpriced GHG emissions in 2018, with significant variation of coverage, prices and pricing instruments across sectors and countries.

The report underlines that GHG emissions from non-energy use – methane, nitrous oxide, fluorinated gases and CO2 emissions from industrial processes – can represent a significant share of total emissions in certain countries, but are the least covered by carbon pricing measures.

Download the full report, data, and country notes.

Download a summary with key findings.