RapidRatings analysis of global public and private companies finds poor Financial Health to double by the end of 2020

NEW YORK–(BUSINESS WIRE)–RapidRatings conducted a multi-faceted stress test on portfolios of public and private third parties, suppliers, borrowers, and other counterparties to aid clients in modeling potential outcomes of the COVID-19 crisis.

“The combined effects of the COVID-19 medical crisis, economic and political disarray, and tightening credit cycles means there are more unknowns than knowns for supply chain actors,” said James H. Gellert, Chairman & Chief Executive Officer of RapidRatings. “The RapidRatings COVID-19 Stress Test provides a sobering look at the global business landscape, starkly reflected in lower FHR® scores and higher probabilities of default.”

In its scenario analysis, RapidRatings provides insights on the likely impacts of a 15 percent drop in revenues on the Financial Health Ratings of public and private companies globally. The scenario analysis looked at how companies would be affected on an industry-adjusted company basis, then overlaid macro factors to evaluate how companies would fare through 2027. The macroeconomic adjustments were selected to mirror the troughs of the global economic crisis of 2008.

Risk Distribution Changes

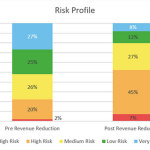

After applying the 15 percent revenue reduction to financial statements and generating ratings across RapidRatings’ Public and Private company coverage, virtually all companies either suffered a downgrade or stayed in their starting risk categories. The COVID-19 Stress Test revealed that the 15 percent decrease in revenue across Public and Private company coverage would result in more than half of all global companies (52%) being categorized as High-Risk or Very High-Risk, a 137 percent increase (see chart).

Macro Stress Testing

In order to determine the overall impact of a potential macroeconomic downturn of companies in its global database, RapidRatings applied an additional Transition Probability Matrix (TPM) model for economic stress testing on top of the original 15 percent revenue reduction. For this stress test, RapidRatings used the 2007-2008 financial crisis as the guide and selected the most adversely impacted levels for GDP (-8%), CPI (0%), industrial production (-14%), unemployment (an increase of 22% per quarter for the following four quarters % over pre-pandemic levels), and the S&P 500 Index (-45%). The results show a 50% increase in probabilities of default (i.e., the likelihood that a borrower will not be able to make its debt obligations over a specified time frame- see chart) in the stressed coverage compared to unstressed coverage by the end of 2027.

“It is clear from the stress test that even if a crisis scenario is modeled that is likely milder than the current pandemic, that risk managers still have their work cut out for them – understanding financial health and deepening collaboration across the supply chain has become more critical than ever,” said Gellert.

For additional information about RapidRatings COVID-19 Stress Test Analysis, and resources for risk managers looking to understand the probability of default of companies within their supply chain, please visit the RapidRatings COVID-19 Resource Center.

About RapidRatings

RapidRatings® sets the standard for financial health transparency between business partners, transforming the way the world’s leading companies manage enterprise and financial risk. RapidRatings provides the most sophisticated analysis of the financial health of public and private companies in over 140 countries worldwide. The company’s predicative analytics provide insights into how suppliers, vendors, and other third parties are likely to perform. For more information, visit rapidratings.com.

Contacts

JP Letourneau

Phone: +1.212.584.5483

Email: jpletourneau@blissintegrated.com