- SMBs say housing is the economy’s biggest risk with solutions requiring public-private partnerships and innovative tax relief measures, a recent KPMG in Canada survey shows

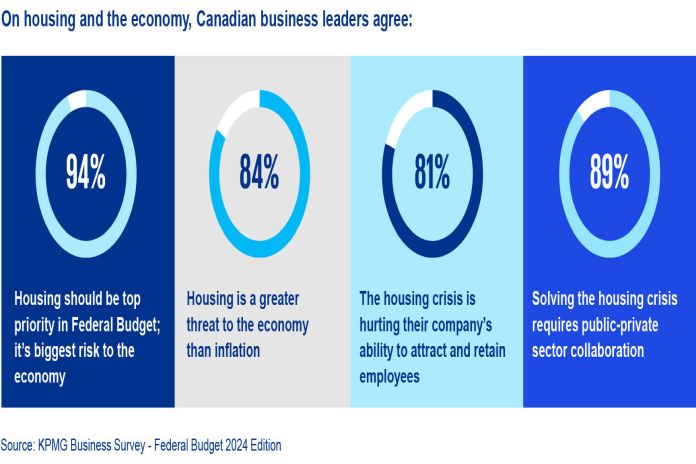

TORONTO, Canada – The overwhelming majority (94 percent) of Canadian business leaders believe that housing should be the top priority in the upcoming federal budget, calling it the biggest risk to the economy, finds a recent survey by KPMG in Canada.

They expect the housing crisis will dampen economic growth this year, with nearly nine in ten (87 percent) saying the rising cost of living, driven largely by housing costs, is forcing their organization to pay more for labour and affecting their ability to attract and retain already-scarce talent.

“The ripple effects from the high cost of housing and lack of supply are being felt throughout the economy,” says Caroline Charest, an economist and Montreal-based partner at KPMG in Canada. “New and young Canadians are being shut out from purchasing and are finding rentals scarce and costly. Those who were able to enter the market a few years back due to record-low interest rates now face the risk of default when their rates reset at upwards of three times what they pay now. All this is weighing heavily on business leaders struggling to attract and retain key personnel and talent, particularly in urban areas that have witnessed the highest increases in the cost of housing and in regions where housing is scarce.”

The survey finds that business leaders want to see more innovative public-private sector housing solutions, with nearly nine in ten (89 percent) saying public-private collaboration will be required.

However, the challenge for communities extends beyond housing to infrastructure and services that will be required to support population growth, says Chris Sainsbury, partner and National Leader for Smart Cities, KPMG in Canada, based in Vancouver.

“The central questions are, who are we building housing for, how will it be serviced, and how do we create cities and communities that we all want to live in?,” he says.

Beyond tax policy and funding, the federal government does not have many levers and provincial and local governments are relatively limited in influencing actual construction rates, adds Vivian Chan, a Vancouver-based KPMG partner in the Global Infrastructure Advisory Group.

“Just doing more and doing it faster is not good enough,” says Chan. “There needs to be a new model to deliver housing, one that brings all levels of government, not-for-profit associations, and the development community together. We have an opportunity to rethink and reshape how our cities and communities are built. But it requires governments to do something that’s fundamentally different.”

The primary concern from local governments is ensuring they have the resources today, and on an ongoing basis, to properly design and service a much-needed spike in new housing, she says.

“The reality is, most municipalities don’t have the bandwidth or technology to cut through the complex steps to access the much-needed federal grant programs,” Chan says. “It’s not only about the amount of money available to kickstart building but the reliability and sustainability of the source of funding around all of the infrastructure that will be needed to support housing development.”

Key survey findings

- 94 percent of business leaders at 534 small-and-medium-sized businesses (SMBs) say high housing costs and lack of supply are the biggest risks facing Canada’s economy and should be the top priority in the upcoming federal budget

- 87 percent say the rising cost of living (driven largely by housing costs) is forcing their organization to pay more to attract and retain talent

- 87 percent are budgeting for higher labour costs due to competition for talent, inflation, and the high cost of affordable housing

- 89 percent say that solving the housing crisis will require public-private sector collaboration

- 81 percent say the high cost/lack of affordable housing has hurt their ability to attract and retain employees

- 87 percent expect inflationary pressures in Canada to persist until the housing shortage and high rents are dealt with

- 84 percent say the high cost/lack of affordable housing is a greater threat/risk to the economy than inflation

Innovative tax relief for housing

More than eight in 10 (86 percent) believe the government should use the income tax system to make housing more affordable, including making mortgage interest tax deductible. Eighty-eight percent say the federal government should maintain the current capital gains inclusion rate (50 percent), as well as the Principal Residence Exemption and Lifetime Capital Gains Exemption.

Similarly, 85 percent agree the government needs to introduce innovative, repayable tax measures that provide relief to existing homeowners faced with mortgage renewals, as a buffer against mass mortgage defaults similar to the Tax-Free First Home Saving Account for Canadians saving for a home.

The federal government, in partnership with other levels of government, has made efforts to reduce red tape and incentivize construction, and has introduced a variety of federal housing-related tax measures in recent years, says Brian Ernewein, senior advisor, National Tax Centre, KPMG in Canada. These measures include beneficial changes such as a GST rebate on rental housing construction, as well as tightening measures like the Underused Housing Tax, the “anti-flipping” tax, the two-year extension of the ban on foreign buyers (to January 1, 2027) and the disallowance of deductible expenses on short-term rentals, he says.

“Our survey revealed strong support from the business community for innovative tax measures to increase housing supply and construction and provide relief to homeowners dealing with higher interest rates and mortgage renewals,” says Ernewein. “While we can debate whether the tax system is the most effective mechanism to help address Canada’s housing challenges, there is a clear view among business leaders that further fresh thinking is needed, and that government has a critical role to play.”

Learn more about how to streamline grant management processes. Click here to read about how con-tech can help address housing, infrastructure challenges.