MONTREAL, Canada, (BDC) – Real gross domestic product grew by 0.1 percent in November, similar to October’s growth. November’s gains came mostly from the service industry, where activity continues to hold up well. However, preliminary data from Statistics Canada points to sluggish growth in December (0.0%), even though retail sales benefitted from a more normal holiday season in 2022.

Policy rate peaks at 4.5 percent

After raising its key rate by an additional 25 basis points at the end of January, the Bank of Canada hinted this hike would be the last in this tightening cycle.

The policy rate would therefore peak at 4.5 percent. However, there are risks that could lead the Canadian central bank to revise its stance in the coming months. (See this month’s main article for a complete picture on inflation and monetary policy.) Regardless of what moves are made by the bank in the months ahead, the effects of hikes over the past year will continue to temper economic growth.

Households readjust their budgets

The sectors that slowed in the last quarter of 2022 are those that are typically most sensitive to interest rates -construction, manufacturing, retail trade, and accommodation and food services. Together, these four sectors lowered growth by 0.12 percent in November, limiting overall economic growth.

The slowdown in the more interest rate-sensitive sectors is consistent with consumers pulling back on their spending in the face of rising interest rates. Obviously, discretionary consumption is the most affected by this readjustment. Nearly 88 percent of households have cut back on travel, dining and entertainment, followed by 74 percent who have reduced clothing purchases, according to the Bank of Canada.

Canadians are also changing the contents of their grocery baskets in response to high food inflation. And they’ve further slowed their pace of borrowing in the consumer credit market (+0.3% in November).

A recovery in Canadian manufacturing in January?

The Canadian Manufacturing Purchasing Managers’ Index rebounded in January. After dipping below the 50 mark (which usually indicates a contraction in the sector) in December, the S&P index rose to 51 at the start of the year and the Ivey index to 54.7.

This modest improvement was supported by gains in production and stronger order books. The rebound is entirely attributable to demand in the domestic market since export orders fell for the eighth consecutive month.

Towards a more sustainable labour market

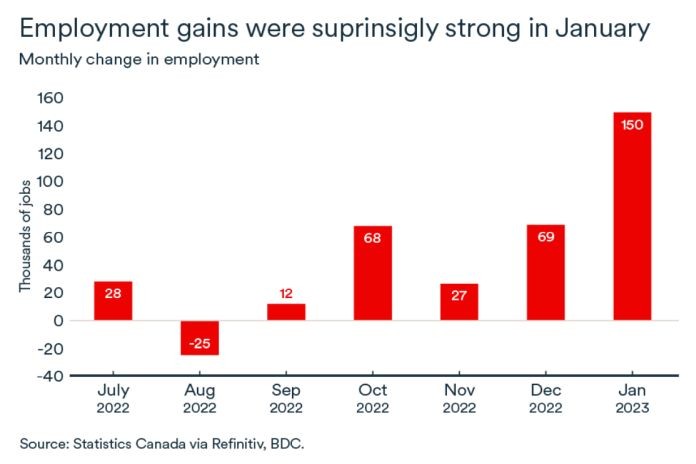

The Canadian economy added an impressive 150,000 jobs in January. While the unemployment rate remained at a low 5.0 percent, labour market pressures are showing signs of easing.

The number of job vacancies in the country has fallen rapidly. It dropped from 1 million to 850,000 positions over just two months in the fall of 2022. While the current level is still high, the speed at which job opportunities are disappearing points to an easing of competition for workers.

Amid high economic uncertainty, companies expect to hire fewer workers in 2023 and employees will be less likely to change jobs. The result appears to be somewhat of a rebalancing of the Canadian labour market, even though retirements remain high at more than 263,000 new departures in the last year.

These factors resulted in wage growth of 4.5 percent between January 2022 and January 2023, a slower pace than in recent months despite the impressive level of jobs added in January.

The impact on your business

- Despite an expected pause in Bank of Canada rate increases, Canadian household debt payments will continue to slow domestic demand. Consumers are still coming to grips with higher interest rates and more sectors will experience slower demand as households reallocate their budgets. Growth will be more challenging in the early part of the year and businesses should pay close attention to their inventories in the current environment.

- The Canadian labour market remains strong, which should temper recession fears. Household savings are still above their pre-pandemic trend and wage growth is strong. Households, therefore, still have a good cushion to absorb interest rate shocks and inflation, but they’re being more cautious in their spending.