By Indranie Deolall

A powerful hunter constantly on the prowl for prey of opportunity, the silvery sabre-toothed species is famous for its distinctive lengthy fangs protruding from the lower jaw.

Nicknamed the “vampire fish” by adventurous anglers, it swiftly impales smaller piranha, an aggressive relative, swallowing them whole in the swirling eddies and crashing currents of South America’s raging rivers.

The National Geographic channel’s host of the “Monster Fish” series, American Professor Zeb Hogan searched for the freshwater fish, a dog-toothed tetra with the indigenous musical moniker, inland south-west Guyana. “We found the Payara just below the Corona Falls on the Rewa River,” a tributary of the Rupununi River. “It’s on the small side for mega-fish, at 40 pounds and four feet long,” he said, as the popular show prepared to premiere in January 2016.

Reeled in riches

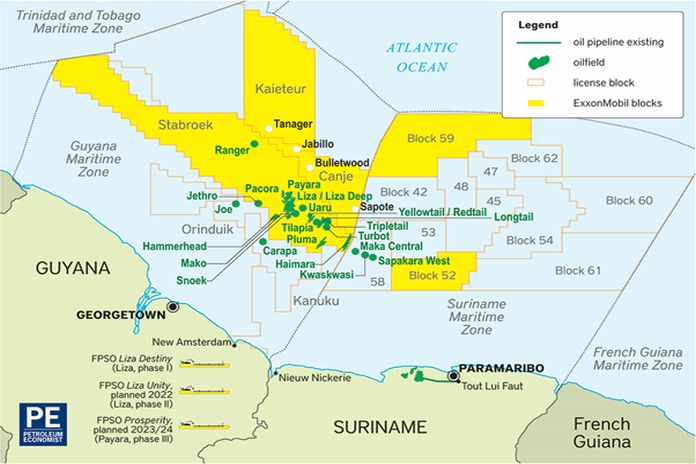

On its ongoing quest in the deep waters of the Atlantic Ocean, the United States multinational ExxonMobil (XOM) reeled in the country’s first significant oil riches, announcing the Liza-1 discovery in May 2015. Nearly two years later, Payara launched the series of local fish titles adopted by ExxonMobil to brand its long line of lucrative petroleum finds, in the ultra-rich Stabroek Block, under a secretive, lop-sided fishy deal of paltry royalty payments with the then coalition regime that hid the US$18 million signing bonus.

A fortnight after the historic visit of the US Secretary of State, Mike Pompeo, the two-month-old Guyana Government headed by President Irfaan Ali, quietly signed off on the US$9 billion Payara project with ExxonMobil, late Wednesday, away from the glare of the media, despite a chorus of calls for leveraging a comprehensive Stabroek Production Sharing Agreement (PSA) revision and far fairer terms.

Stance evaporated

It is certain now that president Ali’s seeming tougher earlier stance has evaporated faster than overly optimistic expectations and national goodwill, as his People’s Progressive Party/Civic (PPP/C) came to power in early August following an exhausting five-month-long election rigging impasse with the losing APNU+AFC.

Preceding the March general elections this year, Ali had reiterated keeping the “pioneering” ExxonMobil investment contract intact, but promised that “production contracts post-ExxonMobil must be and will be renegotiated as these contracts would have been signed when Guyana was already de-risked.” He argued then “The terms of some of these contracts are even more lopsided than that of the Exxon contract, e.g. the Tullow contract which has a 1% recoverable royalty rate.”

“In the case of Exxon…they are on a different footing as a pioneer in the sector and as such we will review that contract to ensure that the administration of the contract brings greater benefit to Guyana and Guyanese. This review must allow for better contract administration and greater local content,” he said.

Guyana US$55 billion loss

In August, the respected international non-governmental organisation (NGO) Global Witness urged the Ali government “to immediately investigate and renegotiate Exxon’s exploitative oil license, ensuring the country has the funds needed to rebuild after divisive elections and a debilitating pandemic.”

Back in February, Global Witness’ explosive exposé “Signed Away” revealed that Guyana could lose a shocking US$55 billion in value over 40 years, due to the poorly negotiated deal with ExxonMobil for the right to continue exploring the sprawling 6.6 million-acre Stabroek Block. It blamed the bad financial terms on Exxon’s aggressive negotiation tactics with inexperienced Guyanese officials. The investigation showed that Guyana’s lead official, the former-Natural Resources Minister, AFC front liner, Raphael Trotman had rushed to sign the deal despite experts calls for caution, and while knowing ExxonMobil was about to announce extensive fresh finds in the Stabroek Block.

Interests of all Guyanese

“With Exxon increasingly dependent upon an immense Guyanese oil find, president Irfaan Ali has a remarkable opportunity to make a new deal while showing the interests of all Guyanese – not Exxon – are at the heart of his administration,” observed Jonathan Gant, senior campaigner at Global Witness.

Yet, the much-anticipated review of XOM’s Field Development Plans for Payara, by a team headed by a controversial former Alberta premier and Queen’s Counsel, recommended by the Canadian government, appears to have fizzled into a tame look of environmental-related issues such as tighter fines for gas flaring and reinjection of wastewater.

A review of the project was carried out by the British Bayphase Oil and Gas Consultants contracted by the Department of Energy (DoE) under the previous Government of A Partnership for National Unity/Alliance For Change (APNU/AFC), but the election stand-off meant approval of XOM’s proposals was delayed.

ExxonMobil threat

Stressing contract sanctity, ExxonMobil’s country manager, Alistair Routledge bluntly threatened recently, that ExxonMobil can take its money elsewhere if the Payara plan, its third development project, was not approved in a timely manner.

“The Guyana portfolio is one of the better opportunities for us in the ExxonMobil portfolio, but it’s not the only one,” he declared to a group of local reporters via online conference, noting “Indeed, if we don’t get the agreement as we are looking for in Payara, the investment money will go elsewhere in ExxonMobil’s portfolio.”

“If the contract was more challenging to us then to be honest I don’t think in this environment that investment dollars would be coming to Guyana,” Routledge claimed, maintaining “It is a global business, and especially in these days when commodity prices have fallen, the investment dollar will flow to where it is competitive.”

Over eight billion barrels

Drilled to some 18,000 feet in 6,600 feet of water, the Payara-1 well encountered more than 95 feet of high-quality, oil-bearing sandstone reservoirs. The gross recoverable resources of Payara alone, are estimated to be 600 million barrels of oil equivalent (BOE), with the Stabroek block containing well over eight billion BOE from 18 world-class finds so far, according to existing seismic data.

The US Geological Survey estimates that the prized Guyana coastal area holds recoverable oil reserves of roughly 13.6 billion barrels and gas reserves of 32 trillion cubic feet. ExxonMobil, the majority partner in a consortium including the American Hess firm and the State-owned Chinese National Offshore Oil Company, began producing oil ahead of schedule last December.

Ramp-up Liza output

Despite the economic downturn from the COVID-19 pandemic and the loss of US$1.1 billion during the second quarter, XOM is preparing to ramp-up output at Liza with a second floating production, storage and offloading unit (FPSO). Startup is set for 2022, with another 220,000 barrels daily. It was producing below capacity at the first phase of the Liza project, but was expected to reach 120,000 barrels of oil per day in August. XOM holds 45 percent interest in the block. Hess and CNOOC, own 30 percent and 25 percent interest respectively.

News of the signing and the giant’s Final Investment Decision come as Bloomberg predicted XOM has likely made a third consecutive loss in the last quarter, heaping further pressure on the energy behemoth’s ability to pay its US$15 billion-a-year dividend, currently the third-highest in the S&P 500 Index.

A seismic shift

“Exxon’s dividend yield has risen to more than 10% over the past few days, indicating shareholders believe the dividend is unsustainable at current levels and maybe cut” Bloomberg reported, terming any such reduction “a seismic shift for Exxon, which has made a rising pay-out the keystone of its investment strategy for the last 37 years.” A third-quarter company discussion is set for month-end.

Weary and disillusioned Guyanese are learning that the more some things change, the more they remain the same, with governments in, and governments out. It is always business as usual, especially big business as usual, and particularly so to opportunistic political parties that behave very much alike, or as the piranha before the feared payara.

ID compares the symbolic payara and a cautionary fairy tale exchange. Red Riding Hood gasped, “Oh Granny, what big teeth you’ve got!” and the Big Bad Wolf answered, “All the better to eat you with, my dear.”