By FocusEconomics Insights

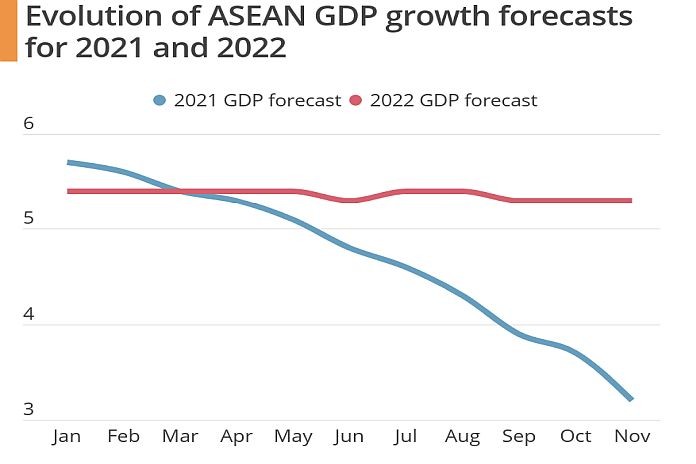

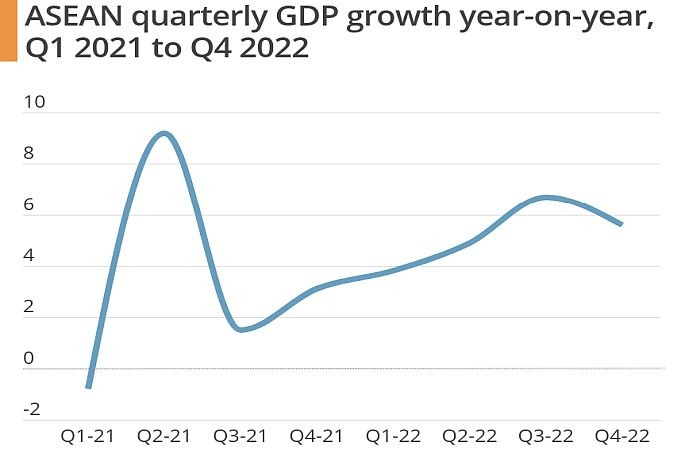

ASIA – At the beginning of 2021, our panel of analysts projected the ASEAN region would expand at the fastest pace in nearly a decade. Skip forward to our latest gauge of the ASEAN economy in late October, and expectations for growth this year are lagging behind 2019’s despite a massively low base effect due to the pandemic.

Since the start of the year, the spread of the Delta variant has undoubtedly had the largest impact on the ASEAN growth outlook, as a number of countries in the region were forced to implement strict measures to contain the virus. That being said, a number of other factors have also contributed to the deteriorating GDP projections across the region: Supply bottlenecks, the semiconductor shortage, elevated freight costs, a spike in energy prices and moderating demand from kingpin China. Deteriorating growth prospects in Indonesia, Malaysia, the Philippines and Thailand have been the main drivers of the downward revision to the regional outlook since the start of the year.

Looking ahead, our panel of analysts expect GDP growth in ASEAN to pick up notably next year, with the overall expansion penciled in for 5.3 percent. Further progress on the vaccination front should allow most countries to remove restrictions on travel and mobility, which should spark a strong acceleration in private consumption growth. Nevertheless, headwinds persist due to heightened uncertainty around the virus, a normalization in global demand, and regulatory clampdowns and factory shutdowns in China—which could potentially drag on exports to the Asian giant.

Insights from Our Analyst Network

Commenting on Chinese supply disruptions and their impact on ASEAN economies ahead, analysts at Nomura, noted:

“We believe the impact on other economies will likely materialise via two channels. First, China’s exports include intermediate inputs sourced from other countries, which are then used in the production and assembly of finished goods that are exported from China to rest of the world. […] Second, countries that depend on imported parts and components from China could be impacted due to insufficient inputs. […] On the first channel, our estimates suggest that the production disruptions in China will have the largest impact on Taiwan; its value-added in China’s gross exports stood at an elevated 7.1 percent of its GDP in 2020. The next most exposed economies are Malaysia (3.9% of GDP), South Korea (2.5%) and Singapore (2.4%). […] The second channel […] could constrain production and exports the most in Malaysia, Thailand and Taiwan.”

Reflecting on the health situation in regional heavyweight Indonesia, economists at HSBC, said:

“We forecast Indonesia’s GDP as likely to return to the pre-pandemic level by Q3 2021- the first in ASEAN to do so. As is always the case with Covid-19, however, uncertainty remains high. Despite the government’s impressive efforts to secure vaccines and distribute them across the sprawling archipelago, the full vaccination rate is only 15 percent and at the current pace, the country will reach the 70 percent level only in Q2 2022. A sustained rate of Covid-19 infections means that consumer activity is unlikely to fully normalize anytime soon. But we would argue that downside risks to growth for the rest of 2021 and for 2022 are still somewhat limited, barring a severe new wave: The government has consistently taken a less interventionist approach when it comes to lockdowns.”