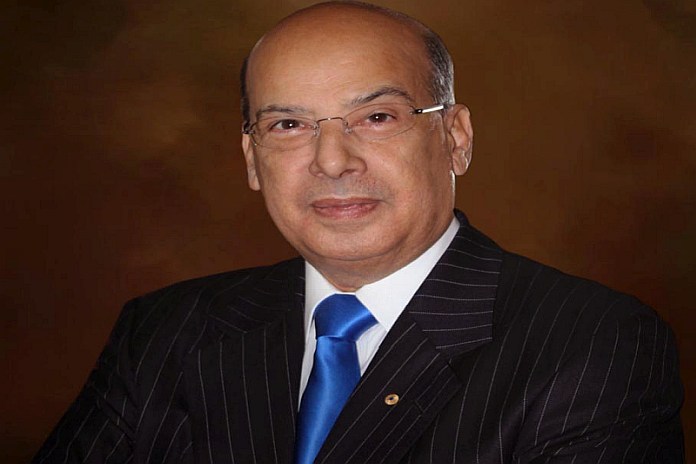

The following statement issued by Antigua and Barbuda’s ambassador to the United States, Sir Ronald Sanders – debt suspension to IDA countries, not enough.

WASHINGTON, USA – On March 25, the World Bank Group (WBG) and the International Monetary Fund (IMF) called on “all official bilateral creditors” to suspend debt payments by International Development Association (IDA) countries because the “coronavirus outbreak is likely to have severe economic and social consequences for them”.

The WBG and IMF should not stop there.

There are many other countries whose vulnerabilities, including dependence on one or two sectoral activities, such as tourism, render them urgently in need of the suspension of debt payments.

IDA countries in Latin America and the Caribbean are Dominica, St Vincent and the Grenadines, Grenada, Guyana, Haiti, Honduras, Nicaragua, and Saint Lucia. They are so rated because of their per capita income, which by itself, is a false criterion for judging countries’ level of development and their capacity to respond to severe economic shocks, driven by external factors.

Caribbean countries that should be included in the WBG and IMF list are countries that are highly dependent on tourism, such as Antigua and Barbuda, The Bahamas, Barbados, Belize, Jamaica and St Kitts-Nevis whose economies, earning capacity and ability to cope with external shocks to their economies are no greater than the IDA nations.

Already, the severe blow with which the global effects of COVID-19 have walloped the economies of these countries is patently obvious. Many of them lost more than ten percent of their gross domestic product in three weeks, and the situation is deteriorating as cruise ships and airlines curtail schedules, hotels close, workers are laid off and the countries are forced to close their borders.

Indeed, some of these countries need more than debt relief, they urgently require budgetary support – grants or very concessionary long-term, low-interest loans – to carry them for at least the next year or they will find it very difficult, not impossible, to recover from a severe economic downturn.

The WBG and the IMF have invited G20 leaders to task the WBG and the IMF to prepare a proposal for comprehensive action by official creditors “to address both the financing and debt relief needs of IDA countries”, saying that they will seek endorsement for the proposal during the Spring Meetings scheduled for April 16 and 17.

But, the WBG and the IMF must include other vulnerable economies that are already reeling. These are extraordinary times and extraordinary responses are required. All governments must raise their voices, and G20 countries must respond.