- Large fiscal deficits and elevated debt levels call for greater fiscal prudence, but political forces are pulling in the opposite way

By Era Dabla-Norris, Enrico Di Gregorio, Yongquan Cao

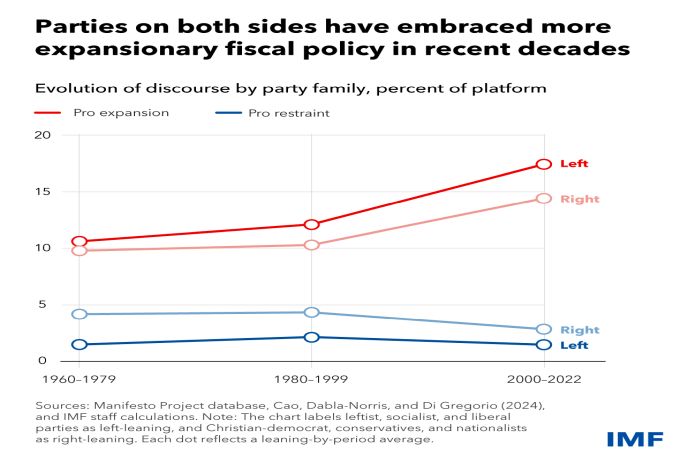

Conservative politics has traditionally been defined by its emphasis on fiscal prudence and the idea of a small state. While parties leaning left are usually associated with more spending and a larger presence of the state in the economy. The reality may be different though. As our new analysis shows, parties across the political spectrum sound increasingly similar when it comes to fiscal policy: they all campaign on ideas of a bigger government and promising more spending.

A comprehensive analysis of 65 advanced and emerging market countries over six decades shows that political discourse on fiscal issues has become increasingly favourable to higher government spending since the 1960s. From socialists to nationalists, support for more spending has steadily increased, while fiscal restraint rhetoric has lost favor across the board in the last three decades, after being most popular in the 1980s.

Our new paper uncovers this growing pro-spending pattern by looking at the fiscal content of over 4,500 political platforms from 720 national elections held between 1960 and 2022 in advanced and emerging countries, using data from the Manifesto Project.

We construct two separate measures of fiscal discourse, capturing a party’s implied or stated support for increasing public spending or for adopting a more prudent fiscal stance ahead of elections. “Expansion” discourse includes policy statements favouring public spending on welfare, social services, and demand-side policies such as fiscal stimulus during economic crises. While “restraint” captures the share of a manifesto’s content calling for an outright reduction of budget deficits or the limitation of public spending.

The analysis shows that fiscal discourse is responsive to the general state of the country’s economy. Fiscal discourse turns more conservative under more adverse economic conditions, including in the aftermath of public debt surges, and after the adoption of fiscal rules, but only to a limited extent. And more talk in favour of public spending across elections translates into higher fiscal deficits over the following 5-8 years.

When we look at different elections within the same country, we find that party platforms drafted when the budget deficit is 1 percentage point of gross domestic product higher feature on average 0.22 percentage point less expansion discourse and 0.1 percentage point more restraint talk. Higher levels of public debt are also associated with more restraint discourse in emerging market and developing economies, suggesting that fiscal sustainability concerns become more prominent as fiscal pressures build up. But this may not dent support for higher spending for too long.

Indeed, major fiscal events only partially serve as shifters of political discourse. For instance, elections held within three years of a “debt surge” – a large increase in public debt-to-GDP ratio – feature higher restraint discourse but reductions in expansion discourse are more uncertain. Similarly, the adoption of fiscal rules that impose operational constraints on the budget balance result in a higher share of pro-restraint discourse over subsequent election cycles. But the widespread adoption of fiscal rules did not result in curtailing pro-spending rhetoric, suggesting that their success is only partial.

Walking the talk

Expansionary fiscal policy seems to be one case in which politicians keep their election promises. We show that a 5 percent increase in the share of platforms suggesting future spending is followed by an increase in primary deficits of up to 0.5 percentage point of GDP over several years in the post-Cold War period. The deficit increase is driven primarily by a gradual expansion of spending initiatives rather than tax cuts. By contrast, in the aftermath of a fiscal restraint “shock” – an increase in restraint discourse from one election to the next, the gradual fall in deficits is first achieved by revenue increases.

These results tally well with recent public perceptions surveys which find that most respondents either want to increase spending or maintain it at current levels in their countries. People want more infrastructure, schools, hospitals, and services (education, health, safety), preferably at low or no additional cost. And politicians want people’s votes.

But voter preferences alone might not fully explain the secular increase in spending expansion discourse seen in recent decades, warranting deeper analysis into its underlying drivers. We were not able to find any comparable long-term increase in voters’ taste for more government intervention when studying international survey data along with vote shares based on a party’s discourse slant.

But how to pay for it?

Looking ahead, widespread calls for a bigger and more active government tasked with effectively addressing climate change, defense, and in particular the costs associated with aging societies (such as health and pensions) comes with the expectation of higher public spending. Our paper shows that to the extent that such expectations become entrenched in the political arena, spending biases can lead to more deficits and more debt. However, the crucial question of how to pay for this increased spending remains open.

Large fiscal deficits and elevated debt levels around the world call for greater fiscal prudence, but this might be hard when political forces pull in the opposite direction. Scholars, policymakers, and voters alike will need to rally around viable political strategies to keep fiscal sustainability at the center of the public debate, as uncertainty about the future of public finances mounts.

The next IMF Fiscal Monitor, due in October, will investigate the broad picture of growing global debt and discuss ways to address the problem.

![]()