– On August 29, 2023, the executive board of the International Monetary Fund concluded the consideration of the Article IV consultation with St Lucia. […] The authorities need more time to consider the publication of the staff report and the related press release. The last Article IV Executive Board Consultation was on August 25, 2023.

By Caribbean News Global ![]()

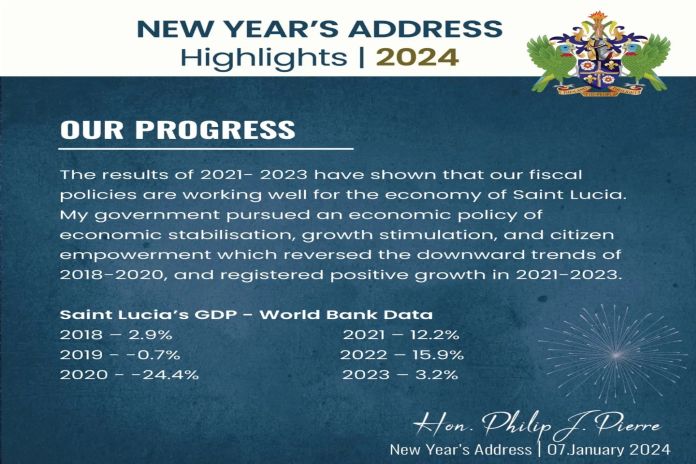

CASTRIES, St Lucia, (CNG Business) – Global financial monitoring agencies like the World Bank, ECLAC and the International Monetary Fund (IMF), says a statement from the Office of the Prime Minister, (OPM) Monday, January 15, 2024, “point to continued economic gains for Saint Lucia in 2024” and that “They all project positive GDP growth,” OPM stated.

“Positive GDP growth” in real GDP is a sign that the economy is doing well. Most observers and professionals, entrepreneurs and business executives share a different and real practicality.

The OPM acclamation advised that:

“This encouraging economic outlook means better-paying jobs will open up for more Saint Lucians. More businesses will have the confidence to expand operations and hire more people,” the OPM statement instructed. “Prime Minister Philip J. Pierre delivered consecutive years of double-digit GDP growth in 2022 and 2023. The national unemployment rate fell to 16.5 percent by the end of 2022, the lowest rate since 2013. But there’s still work to be done.”

Increasing GDP is a sign of economic strength, and declining GDP indicates economic weakness. Saint Lucia is below 4 percent (real GDP) with indifference and vague reporting on every opportunity. The unemployment rate was recorded at 16.5 percent in 2022 and is currently unavailable for reporting in January 2023.

“In broad terms, the use of visual effects and info-graphic for ease of reference currently used as “ flashing mirrors” may look good and sound appealing for the untrained mind,” said a regional economist, Caribbean News Global (CNG) referenced for expert, economic advice. On the other hand: “How can one claim positive things to happen in the economy based on mere projections?”

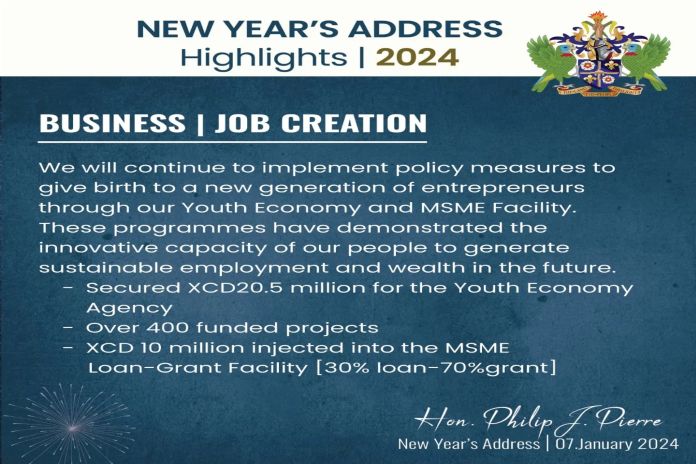

“Prime Minister Pierre’s strategic business development policies have unleashed the entrepreneurial spirit of our nation,” the OPM statement continued: “The government disbursed millions in grants and soft loans to hundreds of Saint Lucians who took advantage of the MSME Loan-Grant Facility and the Youth Economy Agency.”

According to a regional economist: “The government continues to be locked in irrational idealogy that the private sector [as configured] and now, the Youth Economy Agency, [a political hypothesis] will supercharge the economy. In quintessence terms, the combination is warped into fairytale prosperity.”

Conversely, concerns about economic growth, economic underpinning and development can now be examined.

Are MSMEs hitting optimization goals? Is there a return on investments (ROI)? Are there sustainable fundamentals to refinancing for onward lending and a sort of business central to erase red tape to doing business and the one window of opportunity to business development?

Currently, there is an overlap and duplication of agencies. Lest of course, a smart explanation may be forthcoming.

The OPM statement on Monday prefaced credit ratings, leadership and investments as economic instruments that continue to support economic gains for Saint Lucia in 2024, hitching at possible outputs:

- The prime minister’s management of the economy secured a BBB+ (Adequate) for Income and Economic Structure from the Caribbean Information and Credit Rating Services Limited (CariCRIS).

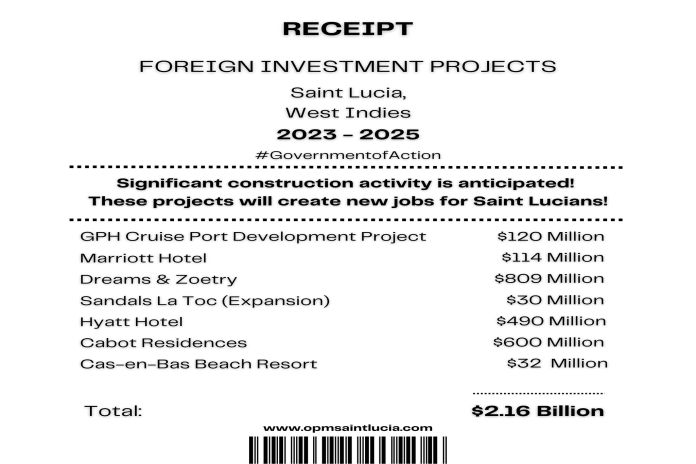

- Under Prime Minister Pierre’s leadership, the Chamber of Commerce is reporting improved profitability for 2023. Foreign direct investment (FDI) is set to exceed $2.5 billion.

St Lucia forecast 5.2 percent GDP for 2024 features ‘talking Kweyol’

In the article ‘St Lucia forecast 5.2 percent GDP for 2024 features ‘talking Kweyol’’ CNG explained speculative performance, and other economic factors. And that an annual GDP growth rate of 2.3 percent is considered normal, measured in terms of the increase in aggregated market value of additional goods and services produced, in capital goods, labor force, technology, and human capital.

A further article ‘St Lucia’s tax amnesty is working, says OPM, financial data redacted’ is also relevant to Revenue and cost adjustments presented by the OPM, and that inflation in Saint Lucia has practically increased by 3.8 percent with no end in sight. The situation can be termed walking inflation and harmful to the economy.

And notwithstanding ‘imported inflation’, there is limited action to counter red lights that are flashing at “domestic inflation” and “borrowing cost” at the same time.

The perception of economic growth in Saint Lucia, as ascribed to ‘continued economic gains for Saint Lucia in 2024’ OPM affirmed that: “The Pierre administration continues to shape the fiscal policies that will create the enabling environment to facilitate investment, accelerate job creation and keep Saint Lucia on course for sustained economic growth.”

St Lucia’s tax amnesty is working, says OPM, financial data redacted

A tale of great expectations

While the pressure is on to deliver big this fiscal year, the pressure on the Pierre administration to undertake populist measures, and the political-economic aggregate numbers are inadequate and indifferent to achieve the desired results.

There has been and there is currently no economic boost. Rural economic undertakings are non-existent. St Lucia’s exports are not creating a buzz. Bananas did not grow, and will not grow soon enough for export, while other viable export products pivot at market segments. On review, the pillars of the economy are invisible and abstract to support ‘continued economic gains in 2024’ in tandem with a hand-to-mouth economic theory.

The rudiments are commonplace. Tax and spend, [deficit economics] borrow and spend for operating expenditures, (including social programs, without recourse to upskilling).

The continuance to distribute incentives has little return on investment for the country and its people. Beyond, the initial cost of construction, taxes paid to the inland revenue department and low-paying jobs, exacerbate the buffoonery of investment and growth.

This is more damaging, without a minimum wage – cost of living adjustments and the need for employee certification and classification that is lost in translation. Several political policy initiatives are focused on boosting consumption to preface a feel-good attitude.

The new schematics with numbers gearing to the 2024/2025 budget are likely to infuse more funds into the hands of the public, and health care works, intended to placate. Other potential tax adjustments are standard politically achieving goals. The proposed ‘year of infrastructure’ represents political gamesmanship and economic theory, given that most of the superstructure and infrastructure of Saint Lucia is in shambles.

A different ethos

The restoration of the economy is becoming increasingly out of reach. The vague strategy heading into the third year suggests a narrow and low-intensity vision that is hardly compatible with a plan that not only strengthens but restores domestic and international financial proactive approaches.

The government must set a national goal and priorities for growth and development. Not political growth projects that mean nothing to business professionals and investment prospects.

Saint Lucia is not among the positive conversations that investors, diaspora professionals and business executives like to discuss. The economy and its social environment are signalling weaknesses rather than the strengths it has and should project.

Saint Lucia may be chasing an economic comeback but many variables are holding it back. Sustained growth above 6 percent is required from its current recovery mode, albeit, by imaginary projections, the economy is still relatively flat. [Nothing eh running].

The engine and pillars for development are not in-sink with bold leadership and a cast of competent minds. There are hitches and stagnant minds. The current cabinet of ministers exemplifies the performance unmistakable to a blindfold. The future of business is shrinking, while the government is inept at business development and private-sector innovation.

To accelerate growth, public investment and the private sector need new life, and commitment to infrastructure development.

A programme to lure innovative companies into Saint Lucia, train and hire workers, build homes, improve health care, and accelerate STEM, [science, technology, engineering and mathematics] to drive innovation, competitiveness and fuel economic growth across Saint Lucia, requires deeper reform in the public and private sectors, legislation and – one window option for business/entrepreneurial development.

“Without continual growth and progress, such words as improvement, achievement, and success have no meaning.” ~ Benjamin Franklin

CNG Insights

The agencies of economic development – infrastructure – commerce – investment – tourism – and agriculture are currently scattered and random. While others are defunct.

The governance and leadership of Saint Lucia require an economic revolution, a national fortress and an engaging narrative for real entrepreneurial development and sustained economic growth.

The current establishment is obsolete to advance leadership and quantum development. A re-prioritization effort to support growth and development is paramount. Perhaps, this is too consuming with the prerequisite towards innovative thinking.