– Better infrastructure and logistics can help the region increase trade and growth

By Flavien Moreau, Rafael Machado Parente

Most countries in Latin America and the Caribbean aren’t fully harnessing the potential of international trade, an important driver of growth for emerging market economies.

While the region has made some progress on trade openness, it continues to be held back due largely to poor infrastructure, burdensome customs clearance procedures, as well as relatively high tariff and non-tariff barriers to trade. One important measure for trade openness, the sum of exports and imports of goods and services, stands at just 47 percent of gross domestic product. That’s about 20 percentage points below the level for other emerging markets around the world.

Trade between countries in the region also lags and has stayed broadly flat at less than 20 percent of Latin America’s total trade. That amounts to just half the level of intra-regional trade in Eastern Europe and Central Asia and a third of the level in East Asia. Latin America’s participation in global value chains is also limited. That’s because many countries are more focused on exporting raw commodities rather than intermediate or final goods, though Mexico’s much more integrated economy is a prominent exception, mainly due to its close ties with the United States.

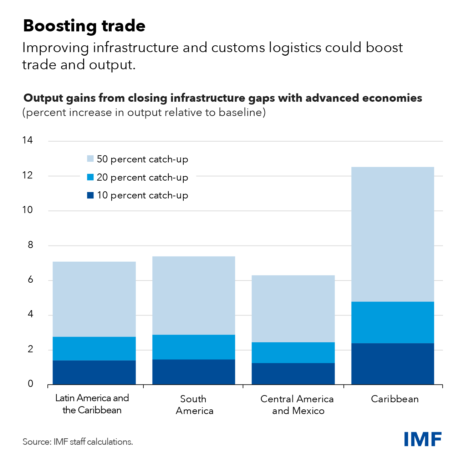

Latin America would likely enjoy large economic gains by improving important commercial infrastructure, such as transportation and customs, a new study conducted in our latest Regional Economic Outlook shows. Streamlining customs procedures, fostering public-private partnerships in the logistics industry, and lowering bureaucratic obstacles are examples of policies that can help.

Narrowing the infrastructure gap between the region and advanced economies by half, for example, would lower trade costs and result in a 30 percent increase in exports, our latest research shows. This larger demand for the region’s products in turn would boost GDP by as much as 7 percent, which underscores why policymakers should pay greater attention to improving trade-related infrastructure.

Because some countries may not be able to afford large infrastructure investments, progress requires prioritizing the biggest bottlenecks and attracting more private investment.

Against this backdrop, the energy transition is expected to profoundly alter global trade patterns. Latin American countries with large reserves of critical minerals – like Chile, Peru, Brazil, Mexico, and Argentina – could benefit substantially from rising demand for copper, lithium, magnesium, and other essential inputs for green technologies and decarbonization. With the appropriate policy frameworks, these resources could attract significant investments and may help develop opportunities for Latin American countries to increase their participation in global value chains.

Finally, nearshoring, where companies relocate parts of their supply chain operations to closer countries for resilience reasons, is also an opportunity for countries across the region to increase trade. Mexico is an example of a country that has been benefitting from more investment in manufacturing due to this trend.

Overall, closing infrastructure gaps, further reducing trade barriers, and putting in place policies that make Latin America a more attractive investment destination should be key elements of the region’s trade strategy going forward.

IMF BLOG