The country’s economic engagement with the region is evolving, with implications for growth, trade, and investment

By Hany Abdel-Latif, Wenjie Chen, Michele Fornino and Henry Rawlings

China has forged deep economic ties with countries in sub-Saharan Africa over the past 20 years, making it the region’s largest single-country trading partner. China buys one-fifth of the region’s exports – metals, minerals, and fuel and provides most of the manufactured goods and machinery imported by African countries.

However, China’s recovery from the pandemic has slowed recently due to a property downturn and flagging demand for its manufactured goods as global growth has also slowed.

This matters for Africa. A one percentage point decline in China’s growth rate could reduce average growth in the region by about 0.25 percentage points within a year, according to the latest Regional Economic Outlook. For oil exporters, such as Angola and Nigeria, the loss could be 0.5 percentage points on average.

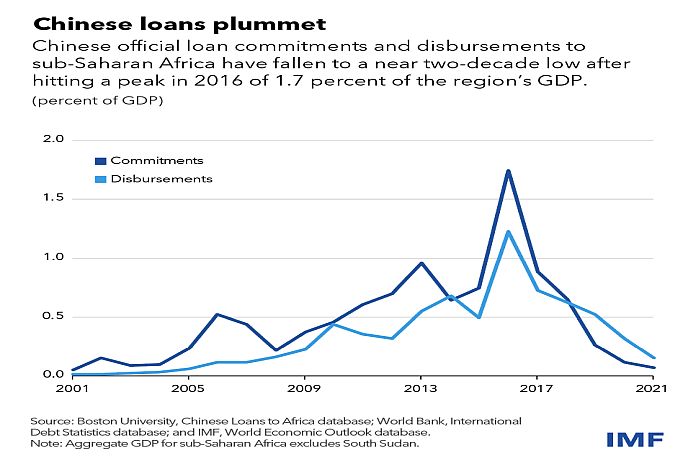

The ripple effects of China’s slowing economy extend to sovereign lending to sub-Saharan Africa, which fell below $1 billion last year – the lowest level in nearly two decades. The cutback marks a shift away from big-ticket infrastructure financing, as several African countries struggle with escalating public debt.

Chinese loans to the region rose rapidly in the 2000s, with the country’s share of total sub-Saharan African external public debt jumping from less than 2 percent before 2005 to 17 percent by 2021.

This makes China the largest bilateral official lender to countries in the region. However, the share of debt owed to China remains relatively small, at just under 6 percent of the region’s overall public debt and is mostly owed by five countries – Angola, Cameroon, Kenya, Nigeria, and Zambia.

Adapting to change

With geoeconomic fragmentation on the rise, sub-Saharan African countries will need to adapt to China’s growth slowdown and declining economic engagements by building resilience through increased inter-African trade and by rebuilding buffers, including through tax policy reforms and improvements to revenue administration.

Efforts to diversify African economies are also vital to sustain future growth. The strong demand for minerals that support renewable energy development could provide an opportunity for countries to forge new trade relationships and develop more local processing capabilities.

Countries can improve their competitiveness by creating a favourable business environment, investing in infrastructure, and deepening domestic financial markets.

Hany Abdel-Latif and Michele Fornino are economists in the IMF’s African Department, where Wenjie Chen is a deputy division chief and Henry Rawlings is a research assistant.