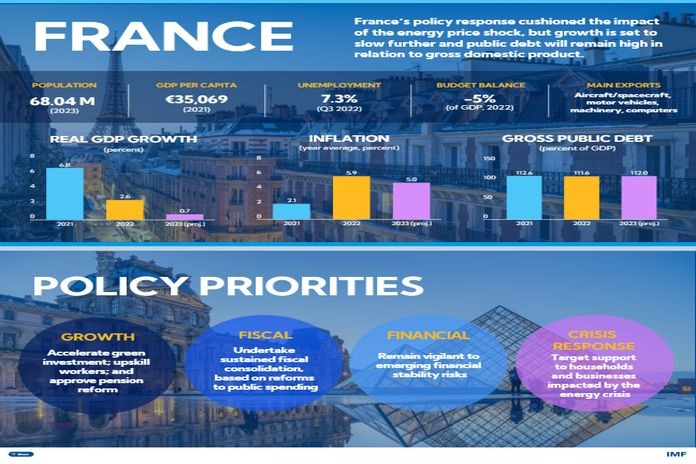

- Further measures to strengthen public finances could curb the budget deficit and check rising debt

By the France team, IMF European Department

After a strong economic recovery from the pandemic, France was hit by an energy shock driven by Russia’s invasion of Ukraine. Inflation rose and economic activity slowed. Nevertheless, the economy has remained resilient and inflation well below other EU countries due to more limited reliance on Russian gas and a strong policy response – including price controls on gas and electricity, tax reductions on fuel products, transfer payments, and measures to support businesses. This cushioned the impact of the energy price shock but has been costly for the government and not well-targeted.

Due partly to the support measures, France’s budget deficit has remained high and debt has risen in relation to gross domestic product. Public debt levels are also increasing relative to euro area peers. To move the budget closer to balance and set the debt ratio on a declining path, France should undertake gradual but substantial fiscal consolidation over the medium term. This could begin by taking advantage of the phase-out of pandemic support to start reducing the fiscal deficit modestly in 2023. It could then be followed by steady consolidation underpinned by expenditure reforms, while leaving space to accelerate green and digital investment.

The government has made significant progress putting forward reforms to boost growth potential while reducing fiscal costs, including revised unemployment benefits that will help raise labor supply, and a comprehensive pension reform that aims to balance the pension system and increase the employment rate of older workers by moving the effective retirement age closer to the EU average. Other areas for fiscal reform could include areas where expenditure far exceeds that of peers or where outcomes are substandard, including tax exemptions, social benefits, healthcare, and subnational spending.

Beyond fiscal measures, other reforms could boost growth potential, such as steps to accelerate the green transition, improvements to product and service markets to boost competitiveness, and efforts to upskill workers and increase the efficiency of the educational system.

The banking sector has weathered the crisis well and supported the economic recovery, but global financial stability risks are increasing. The authorities recently decided to raise the counter-cyclical buffer, a capital requirement, to increase the cushion against any sudden deterioration of financial conditions. Continued vigilance will be required to guard against any emerging weaknesses in banks’ lending portfolios.