PARIS, France – Tax revenues bounced back in 2021 as OECD economies recovered from the initial impact of the COVID-19 pandemic, according to new OECD data released today.

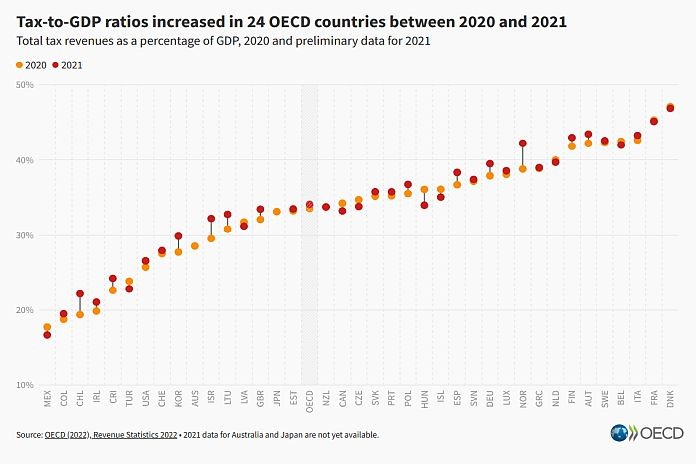

Revenue Statistics 2022, which presents tax revenue data for the second year of the COVID-19 pandemic, shows that the OECD average tax-to-GDP ratio rose by 0.6 percentage points (p.p.) in 2021, to 34.1 percent, the second-strongest year-on-year increase since 1990. The report also shows that tax-to-GDP ratios increased in 24 of the 36 OECD countries for which 2021 data on tax revenues was available, declined in 11 and remained unchanged in one.

Tax revenues increased by 12.8 percent in nominal terms on average across the OECD between 2020 and 2021 as economies rebounded from the pandemic, exceeding nominal post-pandemic GDP growth (10.5%).

Corporate income tax (CIT) and value-added tax (VAT) drove the recovery in tax revenues in 2021. CIT revenues increased by 0.5 p.p. of GDP, while VAT revenues rose by 0.4 p.p. of GDP. Revenues from personal income tax (PIT) remained unchanged as a share of GDP in 2021, while social security contributions declined by 0.2 p.p.

Tax policy in 2021 was geared towards promoting a recovery in consumption and investment. CIT measures implemented in 2021 aimed to stimulate investment and innovation, especially in the green economy, while changes to labour taxation were primarily intended to boost economic growth and promote equity. Many of the emergency tax measures introduced in 2020 to support households and businesses during the pandemic were withdrawn in 2021, as economies rebounded and employment recovered to pre-pandemic levels in most countries.

“The recovery in tax revenues in 2021 reflects the strength of OECD economies as they bounced back from the pandemic,” said Grace Perez-Navarro, Director of the OECD Centre for Tax Policy and Administration. “There is, however, concern that this rebound may prove to be short-lived, in the face of mounting global economic headwinds, driven by rising energy costs and inflation.”

This year’s edition of Revenue Statistics contains a special feature that examines changes in revenues from different tax types in 2020 and 2021, in light of changing economic conditions and evolving policy measures during the first two years of the pandemic.

It shows that the rise in CIT revenues in 2021 contrasts with 2020, when this tax recorded the largest decline of any major tax type. While PIT revenues and social security contributions did not increase in 2021, these two taxes underpinned the resilience of tax revenues in the OECD in 2020.

The rise in revenues from VAT in 2021 comes after VAT revenues remained unchanged in 2020. Excise taxes declined slightly in 2020 and 2021, and property taxes remained unchanged as a share of GDP in both years.

Most OECD countries reduced specific VAT rates in 2020 to facilitate healthcare responses and to support businesses and households during the pandemic. Most of these reductions were withdrawn in 2021, except for those related to medical supplies used to respond to the pandemic.

Consumption Tax Trends 2022, also released today, highlights that as e-commerce continues to grow, most OECD countries have implemented reforms to ensure that VAT is collected effectively on online sales, in line with OECD standards, ensuring a level playing field between bricks-and-mortar businesses and online merchants.

The report, which presents cross-country detailed comparative data on consumption tax rates, tax bases and design trends in OECD member countries, shows that 26 countries have introduced new solutions developed by the OECD to collect VAT on e-commerce sales of goods imported from abroad. These complement measures to collect VAT on online services – such as applications and video-streaming – which have now been adopted by almost all OECD countries that have a VAT.

Thirty-one out of 37 OECD countries with a VAT have now implemented digital reporting requirements, often requiring the electronic transmission of detailed transactional information in real time or periodically, to enhance VAT compliance.