By Dr Vaalmiki Arjoon

The global economy is at risk of an impending financial crisis given the surge in international debt levels, both during and in the years leading up to pandemic.

Like many emerging economies, Trinidad and Tobago is very much a part of this equation and could sink into a debt trap.

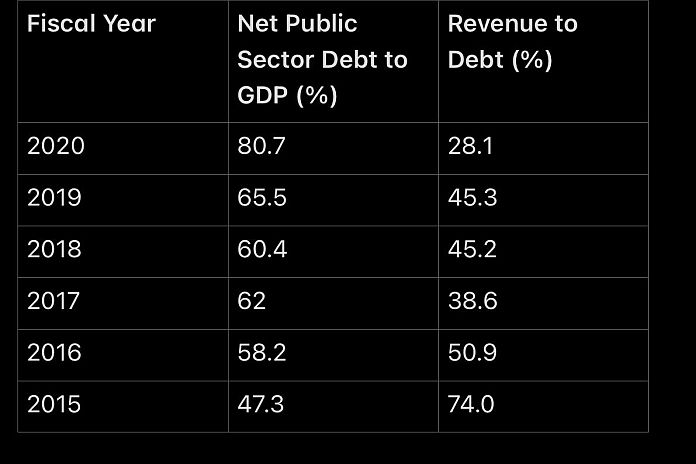

Immediately before the pandemic (March 2020), the debt to GDP ratio was 74.8 percent, and given the level of borrowings provoked by the pandemic, it stood at 80.7 at the end of the 2020 fiscal year – an increase of over 33 in the last six years. It is more instructive to consider the revenues to debt ratio, as we need to generate revenues to repay this debt. In fiscal 2015, 74 percent of our debt could have been covered by fiscal revenues.

This value fell to 38.6 percent in 2017, and most recently 28.1 percent at fiscal 2020 – a meager 28.1 percent of our debt could be met by the revenues earned in that year. This highlights that our abilities to repay our debt is distressing, as prior to the pandemic, we didn’t invest heavily in growth-enhancing projects to advance our revenue and foreign exchange streams.

This created mounting budget deficits and a BOP deficit of over US$4.57 billion over 2015 to 2019. Indeed, there were occasions where we used borrowed funds unproductively, for instance, to meet some of our recurrent expenditure like paying salaries in the public service. Whenever debt is used to finance productive capacity, the projects are marred with several difficulties including delays in completion due to overspending, bid-rigging and poor procurement, corruption, poor work ethic, etc.

By delaying the completion of these projects, it means that it takes much longer for them to generate cash flows for the state, enabling them to repay debt. Debt funded projects, like the recently opened Moruga agro-processing and light manufacturing facility, was ongoing and incomplete for years, while it will also be several years before the Toco port and La Brea drydocking facilities are operational to generate revenues.

This year, the debt to GDP ratio is likely to cross 85 percent especially since one of government’s major source of revenues – taxes on income and profits, will be sparse, and there aren’t any noteworthy investments to provide greater income streams for the state.

Over US$4.7 billion of our debt is owed to foreign entities which could also increase in the coming years, exposing us to further interest rate risk and making it more difficult to service this debt given our meagre forex earnings. We have to urgently grow ourselves out of debt, through faster completion of capital projects by eliminating the bottlenecks that delay them, encouraging greater FDI and investing in areas where we can develop a quick competitive advantage like the maritime and financial services sectors after we are inoculated with the vaccine.

We also need to cut the cost of doing business and increase capacity utilization for both agriculture and manufacturing activities. Indeed, the major way we can avoid being propelled into a debt crisis is to increase production levels and export earnings.

A substantial portion of government debt encompasses contingent liabilities (22% of GDP). This “safety-net”, some state enterprises will be less cognizant of making better investment decisions and lowering their operating costs, as they know that in the event that they are unprofitable (which many were even before the pandemic) and cannot repay their debts, the state is there to bail them out, or at least help to restructure their debt.

This creates less incentive for some of these firms to upgrade their competitiveness and perform in a more cost-efficient manner. It is imperative that this practice be mitigated, as it is likely that this spate of poor financial performance by state entities, will be exacerbated with the pandemic, creating even more reliance on the state for bailouts. In addition, the state also guaranteed loans to SMEs from commercial banks so this would have also compounded their contingent liabilities. We may, however, also find some state enterprises taking advantage of the low-interest environment both in the local and foreign markets and refinancing their debts.

The private sector debt is also worth considering, standing at 43 percent of GDP at September 2020. Although some of these debts may not be repaid given the burgeoning unprofitability of the private sector, banks are well-capitalized so the economic fallout may not be adverse on their financial system.

Despite the banks allowing customers to defer interest on loans in 2020, it does not negate the fact these loans will have to be repaid together with interest in the future, necessitating the private sector to improve their cash flows.