- Highlighting commitment to global tax good governance standards

BRUSSELS, Belgium – On 17 February, EU finance ministers updated the EU list of non-cooperative tax jurisdictions, highlighting the European Union’s commitment to implement tax good governance standards to fight against tax fraud, evasion, and avoidance globally.

Several changes have been made to Annex I, which identifies jurisdictions considered non-cooperative in tax matters.

Based on the latest review, the Council decided to remove Fiji, Samoa and Trinidad and Tobago from Annex I after these jurisdictions successfully addressed long-lasting deficiencies. This represents welcome progress and shows the impact that the EU list can have in supporting the uptake of international standards.

Additionally, the Council decided to add Viet Nam and the Turks and Caicos Islands to Annex I due to failure to comply with internationally agreed standards on tax transparency and fair taxation. The Council regrets these developments and has invited both jurisdictions to engage with the EU’s Code of Conduct Group and the other competent international fora to resolve the issues.

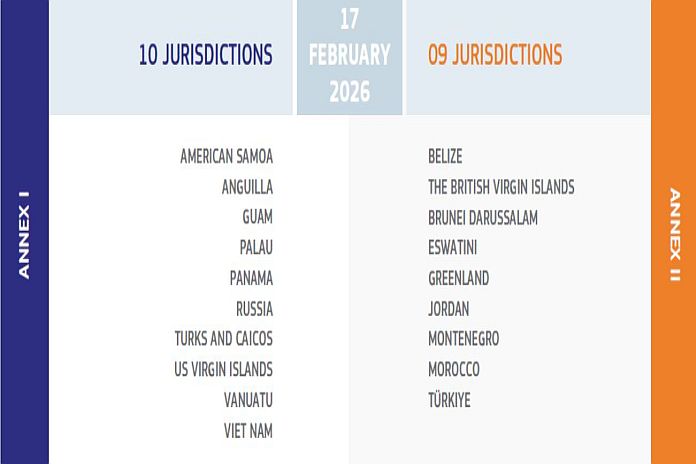

Following these changes, Annex I comprises ten jurisdictions: American Samoa, Anguilla, Guam, Palau, Panama, the Russian Federation, Turks and Caicos, US Virgin Islands, Vanuatu and Viet Nam.

Progress identified in Annex II

Annex II, the list of cooperative jurisdictions, reflects the ongoing EU cooperation with international partners.

The Seychelles and Antigua and Barbuda are being removed from Annex II after taking the necessary steps to ensure compliance with the international standard on exchange of information on request. In view of the steps already taken, Brunei Darussalam has been granted additional time to deliver on its commitment to amend its harmful preferential tax regime.

As a result, Annex II currently includes nine jurisdictions: Belize, British Virgin Islands, Brunei Darussalam, Eswatini, Greenland, Jordan, Montenegro, Morocco, and Türkiye. The EU will closely monitor these commitments.

Background

The EU list serves as a tool to encourage jurisdictions to adopt robust tax governance standards, combatting tax fraud, evasion, and avoidance worldwide. Based on objective, internationally recognised criteria—such as tax transparency and adherence to anti-BEPS (Base Erosion and Profit Shifting) standards—the list facilitates dialogue and cooperation between the EU and international partners.

The EU list of non-cooperative jurisdictions for tax purposes is an intergovernmental process led by the Council. The European Commission provides technical assistance to jurisdictions in the scope of the exercise seeking to improve their tax frameworks and collaborates with EU member states to revise and strengthen the listing criteria in line with international developments. Ongoing efforts include enhancing coordination among member states on applying defensive tax measures against listed jurisdictions.

The list is reviewed twice annually to ensure it remains relevant and accurate over time.

For further information