PORT OF SPAIN, Trinidad – On 22 January, 2026, the government of the Republic of Trinidad and Tobago successfully completed the issuance of a USD 1.0 Billion Sovereign Bond in the United States (US) market. The bonds were oversubscribed by approximately 2.5 times, underscoring strong and diversified investor demand for investment into this country.

PORT OF SPAIN, Trinidad – On 22 January, 2026, the government of the Republic of Trinidad and Tobago successfully completed the issuance of a USD 1.0 Billion Sovereign Bond in the United States (US) market. The bonds were oversubscribed by approximately 2.5 times, underscoring strong and diversified investor demand for investment into this country.

Minister of finance, Davendranath Tancoo said:

“The successful issuance represents a clear validation of the sovereign’s credit fundamentals and new disciplined policy framework”. He further added, “achieving pricing tighter than benchmarks, while also attracting an order book 2.5 times the final issue size in the US market, reflects sustained investor confidence in the credit and improved risk perception of the new government of the Republic of Trinidad & Tobago”.

On January 16, 2026, the Ministry of Finance (MOF) announced a three day roadshow comprising in-person and virtual meetings with key international investors. The delegation from Trinidad and Tobago met with 50+ fixed-income investors via one-on-one and group sessions to provide an update on the sovereign credit and the rationale for the transaction.

At the open of business in New York on January 22, 2026, with a favorable market backdrop, supported by strong indications of interest from the roadshow led by finance minister and the governor of the Central Bank of Trinidad & Tobago (CBTT), Larry Howai- the Joint Bookrunners recommended that Trinidad and Tobago announce the benchmark transaction, as a result, the orderbook climbed quickly throughout the morning with large orders from real money accounts.

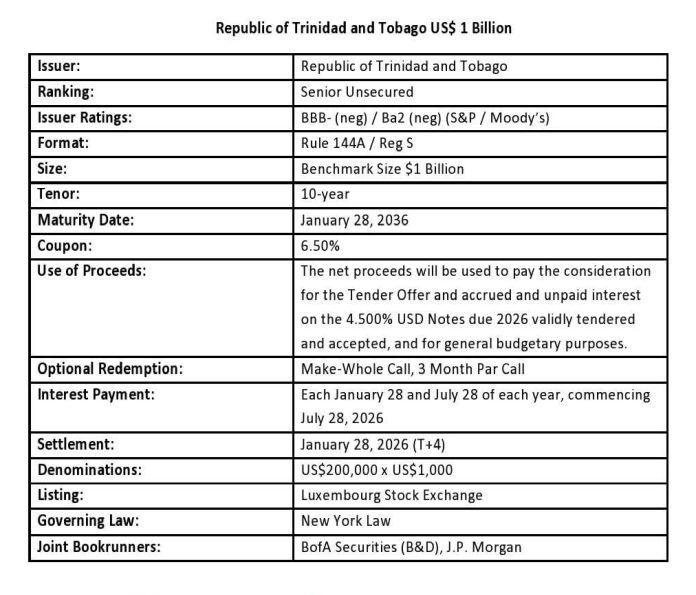

Leveraging over 140 orders from top accounts, Trinidad and Tobago took the book subject at 12:00 pm and shortly thereafter announced guidance. On the back of a solid orderbook that remained stable after the guidance announcement, this country launched the US$1.0 billion bond with a 20-bps (basis points) compression from Initial Price Talks (IPTs). The new US$1.0 billion ten-year senior unsecured bond successfully closed at a 6.500 percent coupon and 98.552 percent price. The notes will be listed on the Luxembourg Stock Exchange and will be governed by the laws of New York.

Key transaction highlights: US$1 Billion notes due 2036

✓ Achieved the largest bond transaction in the past ten years for the Republic of Trinidad & Tobago

✓ Achieved largest orderbook in the last five (5) years of US$2.4bn (despite 2 Negative Rating Outlooks)

✓ Increased participation in number of total investors (144 unique investors in 2026 vs 93 unique investors in 2024)

✓ Repositioned T&T’s credit with a large, diverse and high-quality investor base

✓ Compressed pricing by 20 bps from IPTs to Launch Level 18, Finance Building, Eric Williams Financial Complex, Independence Square, Port of Spain, Trinidad and Tobago, WI.

✓ Materially extended external debt maturity profile average life of the Republic (from 4.1y average life to 6.3y average life

✓ Fully addressed the August 2026 external bond maturity of US$1Billion. The transaction was priced at levels approximately 54.6 basis points tighter than the sovereign’s original issuance of this US$1Billion transaction, issued in 2016.

The transaction also achieved compression in spreads for IPT and priced inside benchmarks and prevailing emerging-market levels. This transaction meaningfully enhances Trinidad and Tobago’s sovereign’s funding profile, and further supports continued engagement with global investors on increasingly favorable terms.