The humanitarian catastrophe in Ukraine is reverberating across Europe. Some five million refugees have already fled the fighting in the largest exodus the continent has seen since the Second World War and millions more are internally displaced.

The greatest numbers have flowed across borders with Poland, Romania, Hungary and Moldova. The European Union swiftly embraced those displaced by Russia’s invasion, granting them permits to live and work and to receive social assistance for at least a year.

The war is a serious setback to Europe’s strong yet incomplete recovery from the pandemic, which left private consumption and investment well below pre-coronavirus forecasts, even as fiscal and monetary support underpinned an impressive rebound in employment almost to levels last seen before the pandemic.

Spiking energy and food prices are now cutting deeply into household consumption, and economic uncertainty is poised to restrain investment.

The war is a reminder, too, of how Europe must do more to improve energy security, notably by expanding renewable sources and improving efficiency.

Growth downgrades

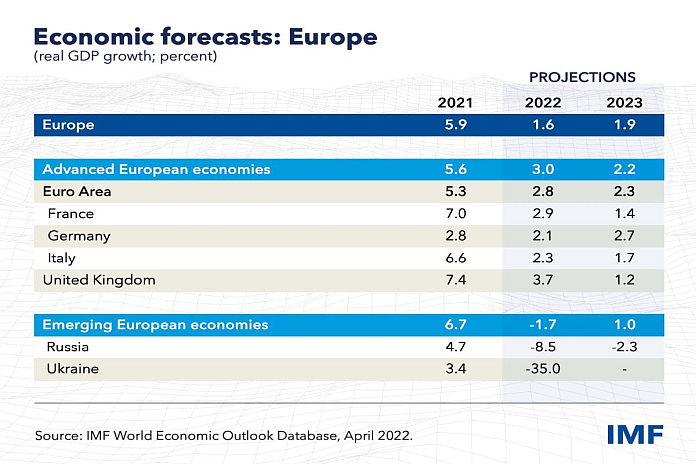

Our latest Regional Economic Outlook lowers the growth forecasts for Europe. For advanced economies we have cut our growth projections by 1 percentage point to 3 percent in 2022 from January projections, and for emerging economies, excluding Ukraine and Russia, we have cut projected growth by 1.5 percentage points to 2.7 percent. Several major economies – such as France, Germany, Italy, and the United Kingdom – are projected to barely expand or even contract for two straight quarters this year. Activity in Russia is forecast to shrink by 8.5 percent, and in Ukraine by 35 percent.

What should monetary and fiscal policymakers do? The war is a supply shock that reduces economic output and raises prices. Indeed, we forecast inflation will accelerate to 5.5 percent in advanced economies and to 9.3 percent in emerging European economies excluding Russia, Turkey, and Ukraine. Those forecasts are up by 2.2 and 3.5 percentage points, respectively, from our January projections.

Monetary policy must balance containing inflation with the need to limit losses in output. Much of the pressure on prices is driven by forces beyond the control of central banks – such as shocks to energy and food markets and supply chain disruptions. But monetary policymakers in many countries should still stay the course of normalizing lending conditions to help contain inflation expectations and anchor domestic drivers of inflation, such as wages and housing rents.

Where possible, governments should engage with social partners to prevent wage-price spirals, including by making sufficient support available to households and firms that are struggling to afford more expensive commodities. To cope with the supply shock, automatic fiscal stabilizers such as higher unemployment insurance and lower tax payments should be allowed to operate freely. These measures will widen fiscal deficits as growth prospects weaken – and it is appropriate that they should – and add to pressures on public finances in some countries. That said, fiscal policy may have to do more to support economies if major risks materialize.

Budgetary pressures will be more acute in several countries that are opening their borders to refugees, for example in Poland, which is hosting almost 3 million, or Moldova, where the number of refugees is very high relative to the population. This underlines the need to share the costs of humanitarian relief fairly among EU members. For non-member hosts, assistance by multilateral and regional partners should help manage costs, particularly where public finances are already stretched.

Reconstruction costs

Europe’s challenge will be to rebuild an economically strong Ukraine that encourages refugees to return. Rebuilding destroyed infrastructure will require extensive financing with a significant grant element. Reconstruction and resettlement will help refugees return and economic growth to rebound. The implementation of reforms to strengthen institutions and public policy will maximize the growth dividend of reconstruction.

This will take time and, as a result, some who fled are likely to stay in host countries for a while. Integrating refugees, mostly women and children, into jobs and schools will be critical.

Targeted labor market policies, such as temporary wage subsidies to incentivize hiring, can help. So too can facilitating skill recognition, providing language training, and fulfilling childcare needs.

![]()