By FocusEconomics Insights

TAIWAN / SPAIN – A resilient external sector and a successful handling of the COVID-19 pandemic led Taiwan’s economy to grow robustly last year, outpacing mainland China for the first time in 30 years. In 2021, growth is set to accelerate further, supported by rebounding private consumption and red hot foreign demand for Taiwanese goods and services.

Although a rise in COVID-19 cases led to strict lockdowns in Q2, the outbreak was handled swiftly and daily new cases are back to single digits. Easing restrictions, coupled with hefty stimulus measures revealed in September consisting of household coupons should see private spending increase steadily in H2 2021 and into early 2022.

Furthermore, as a global leader of the semiconductor industry, Taiwan’s external sector has reaped the benefits of the ongoing chip shortage and its current account to GDP ratio is seen hitting a record level in 2021.

Despite ongoing tensions with China and the spread of the Delta variant around the region, the current dreamland conditions supporting Taiwan’s economy should continue for the remainder of this year and into 2022.

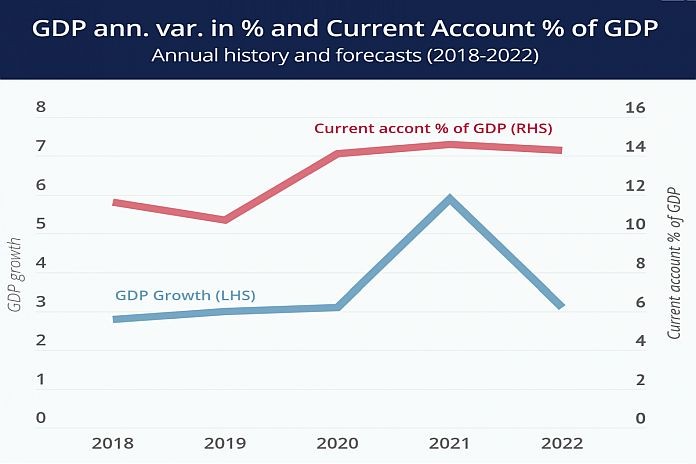

FocusEconomics Consensus Forecast panelists expect GDP growth to reach 5.9 percent in 2021, before slowing to 3.1 percent in 2022. Moreover, our panel of analysts see the current account balance reaching 14.6 percent of GDP in 2021 and 14.3 percent in 2022.

Commenting on the outlook for Taiwan’s economy, analysts at The Economist Intelligence Unit (EIU) noted:

“Even as pandemic-related disruption fades, we expect COVID-19 to accelerate global plans for technological upgrade among both corporates and governments in 2022–25. This will preserve demand for Taiwanese technology goods over that period, although real GDP growth will soften from 2022 as electronics demand tied to the pandemic normalizes, production overcapacity from chip investment worsens and as trade shocks tied to US-China tensions intensify.”

Moreover, reflecting on the current trend and short-term outlook for exports, analysts at Goldman Sachs said:

“Taiwan exports sustained expansion notwithstanding spikes in Delta variants in its major trade partners. While the gains moderated in August on a decline in electronic component exports, non-tech exports gained broadly and robust imports, especially acceleration in capital goods imports, indicate that manufacturers remained optimistic about demand. Higher prices of non-memory chips, where Taiwan companies have dominant positions, will likely support Taiwan exports further in the near term.”

Source: FocusEconomics