WILMSLOW, England – We know from conversations with some of our portfolio investors and financial advisers that the investing UK public is currently almost entirely focused on every twist and turn of the Brexit drama. However, with the ‘back-stops’ which parliament has forced upon the Brexit-determined Johnson government, there is in our view still only a fairly low probability that the ongoing process will lead to an economically disruptive no-deal withdrawal scenario. Until matters become clearer on that front, global developments are therefore far more relevant for professional investors

For the last four weeks, we have been saying that markets are broadly in balance. Equities have gone as far as the current economic environment will let them while yields are no longer declining to push up their relative attractiveness any further. And from here on, we will need to see an improvement in the underlying economy to see markets push higher. Fortunately, this week saw the release of some key data points which help us assess the health of the global economy. Unfortunately, they pointed in very different directions. We are seeing considerably diverging fortunes in two of the world’s most important economies: the US and China.

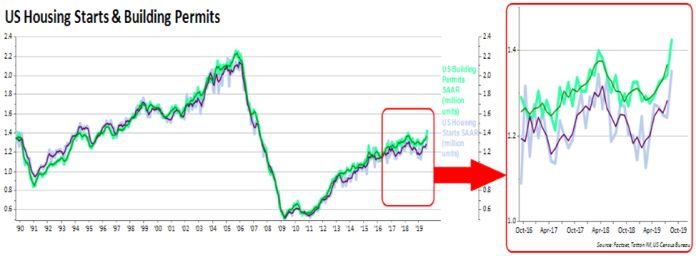

In the US, things look positive. The number of housing starts (new homes being built) has notably picked up. And this is significant for a number of reasons. It shows both that companies are willing to invest in building and that consumers are willing to buy. Furthermore, that consumer strength most likely comes from both job stability (thanks to a strong labour market) and easier access to credit through lower interest rates. The fall in interest rates on mortgages is mainly due to the fall earlier in the year in long-dated US government bonds – as US mortgages tend to be long-term fixed interest. In fact, the increase in housing starts has tracked, near enough, what you would expect from the earlier fall in yields.

That unfortunately means that they will probably slow from here. The increased demand for borrowing will most likely stop those long-term rates from falling any lower – as well as the recent rise in 30-year Treasury yields. But regardless, it paints an overall healthy picture.

When we combine that with the enormous corporate bond issuance seen over the last few weeks, it looks even better. Estimates are that US businesses have raised around $128bn in debt over the last month – a staggering amount. The hope is that this glut of new credit will be put to work as some much-needed corporate investment. But that hope may be a little premature. Judging from company statements, only around 5% of the total debt raised will be used for investment – almost all the rest will just be used to refinance old previous loans. Even within the $6.5bn earmarked for investment, nearly half is set to be used as working capital (expanding regular operations like building inventory) with just under $3.4bn set aside for actual business/capital investment (capex). Still, even without a significant bump in business investment, economic fundamentals in the US look good.

In China, it is a completely different story. The world’s second largest economy has been going through an economic slowdown for some time now, and despite substantial stimulus measures from the government, all the signs suggest that the squeeze is continuing. Wherever you look, activity is dropping off (as shown by the fall in fixed asset investment and industrial production in the chart below).

The private (business) sector seems to be going through a similar episode to earlier in the year, when enterprises were finding it difficult to get access to credit. The worrying part is that this is happening in spite of Beijing’s efforts to get more funding to small and medium sized businesses. Their earlier clampdown on the shadow banking sector seems to have had a bigger effect than they can handle – as shown by the continued struggles of regional banks and local state-owned enterprises. China is undergoing a classic credit crunch, where businesses cannot find money and the economy suffers as weak businesses go bust and the expansion of stronger businesses stutters.

The private (business) sector seems to be going through a similar episode to one earlier in the year, when enterprises were finding it difficult to get access to credit. The worrying part is that this is happening in spite of Beijing’s efforts to get more funding to small and medium sized businesses. Their earlier clampdown on the shadow banking sector seems to have had a bigger effect than they can handle – as shown by the continued struggles of regional banks and local state-owned enterprises. China is undergoing a classic credit crunch, where businesses cannot find money and the economy suffers as weak businesses go bust, and the expansion of healthy businesses stutters.

Those struggles might explain another one of the week’s biggest news stories. On Monday, US repo rates – the interbank lending rate financial institutions borrow at when they need short-term cash – spiked to around 10%, prompting the US central bank (Federal Reserve) to directly enter money markets and inject $75bn into the financial system. The Fed has not had to do that since the Financial Crisis, suggesting there is a worrying shortage of available cash. This can happen when certain big players are in serious trouble and need cash to cover their positions, but struggle to get it as other financial institutions are reluctant to lend to them. There are many good reasons originating in the US for this sudden liquidity squeeze, but it could also be that Chinese banks are in exactly the position described above. We cover this in more detail in a separate article below.

For now, it suffices to say we are stuck with a mixed bag. On the one hand, growth (and thus demand) coming from the US could be just what the global economy needs to get it out of its 2019 ‘go-slow’ state. On the other, deflation and credit troubles in China could be just the thing to push it the other way.

One positive to draw from this is that the weaker China becomes, the more likely they are to push for an end to Donald Trump’s trade war. That would remove one of markets’ biggest worries, and potentially pave the way for yet another bump-up in equities. Thankfully, things seem to be heading that way. China have appeared conciliatory in recent weeks, and electoral pressures at home could convince Trump he needs to make a deal. Certainly, the removal of China hard-liner John Bolton from the Trump administration makes this more likely.

Until such a deal does happen, however, the mixed data will largely determine where markets go. We are, yet again, in a balance.

Tatton Asset Management plc published this content on 23 September 2019 and is solely responsible for the information contained therein.