Takeaways from IMF statement

-

-

- Declining GDP – 12.2; 9.1; 5.8; 2.1;1.7;1.5 %

- On current policies, public debt is projected to remain close to 90 percent of GDP – currently 90.6%

- Medium-term potential growth estimated at 1-2% per year

- Inflation is expected to reach 6.4%

- Vulnerability to liquidity pressures

-

By Caribbean News Global ![]()

TORONTO, Canada, (CNG Business) – While it may be unpleasant and difficult to read ‘Saint Lucia’s economy ‘pose significant near-term risks’, and/or analyse the context of “St Lucia’s difficult fiscal space” it is unbecoming to escape, the takeaways from the June 1, 2022, IMF statement.

While many domestic politicos may not like the report, publication and public discussion, and the need to level with the people of Saint Lucia on a “difficult fiscal outlook”, the IMF statement on Saint Lucia is equally distressing to armchair politicos, internal and external financial interest.

St Lucia’s economy ‘pose significant near-term risks’, says IMF report

Background

CNG Business article ‘St Lucia faces challenges to economic recovery and development’ noted: “In the 202/23 budget, prime minister and minister for finance, economic development and the youth economy advised that “we recognize that to become globally competitive we need to address the following areas: (1) speeding up the process of technological transformation, (2) strengthening entrepreneurial capacities, (3) continuing promotion of innovation, and (4) strengthening our human capital through skills training.”

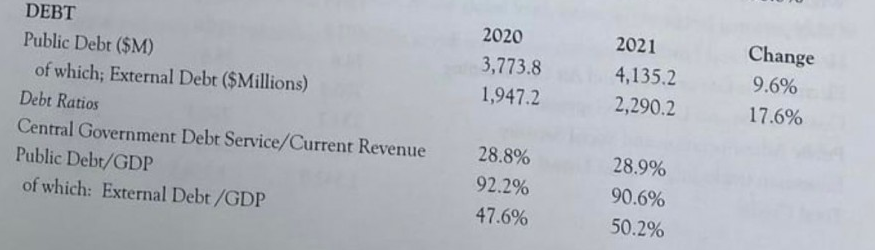

And meanwhile, Saint Lucia’s pregnancy is in labour hands awaiting delivery, many are not amused that “available estimates show that the overall unemployment rate was 21.9 percent in 2021, (with over 15,000 young people unemployed), while the youth unemployment rate stood at 37.0 percent. The current level of public debt now stands at 90.6 percent of GDP of EC$4.13 billion.”

Debt ratios

On debt ratios above – central government debt service/ current revenue; is it important to diagnose the increase from 2019 – 26. 4 percent; 28.8 and 28.9 percent 2020/2021 respectively.

Notable, a fiscal consolidation strategy is vital to Saint Lucia’s difficult fiscal space and outlook, is necessary for a U-Turn to sustainability.

The IMF has already noted that, “it is critical to prepare a fiscal consolidation strategy that credibly sets public debt on a downward trajectory that is resilient to shocks. Specific measures and composition could be designed to be growth-friendly and include fiscal space to support the most vulnerable segments of the population. Implementation should start once the recovery is well entrenched and phased over the medium term to ease its impact on domestic demand. The size of consolidation should be anchored on the regional debt target of 60 percent of GDP by 2035, which would require fiscal saving measures of about 2 ½ percent of GDP.”

On further analysis by a renowned Saint Lucian economist, “a lower debt/GDP means nothing if that indicator keeps increasing,” adding “current revenue must remain strong to absorb debt levels.” He further indicated that, “GDP value can be adjusted with rebasing; however, current revenue is what it is!”

Another analysis of Saint Lucia’s debt portfolio recons that a dedicated and persistent effort should pursue debt forgiveness, debt restructuring and consolidation, given that 5-7 percent interest rates are unsustainable. Historically, “on this path, bankruptcy and sustained poverty is the end result.”

The goal here should be 3-4 percent reduction that would allow fiscal space for social and infrastructure investments, and proficiency for a Sovereign Wealth Fund (SWF), to provide benefits for Saint Lucians.

Thus, consider ‘St Lucia’s budget projection vs. reality‘ subtitle – debt service payments:

“A total of $169.53 million is forecast as the outturn for interest payments while principal repayments are anticipated to come in at $123.8 million which is slightly below the approved estimate.” And – transfers: “Based on the current expenditure trend for transfers, total spending on this category is forecast to increase by $26.6 million when compared to the approved estimates of $149.76 million for the period under review.”

‘Forward’ to St Lucia’s estimates 2022-2023’ – subtitle – economic recovery, reads:

“Notwithstanding these challenges, expenditure priorities for the 2022/23 budget will focus primarily on economic recovery and sustainable growth through initiatives geared towards youth enterprise, medium and small businesses and building economic resilience, addressing the needs of the poor and vulnerable in the society, citizen security and good governance, reads the forward, to the estimates [2022/23].”

Taxation

The IMF statement has interestingly advised that, “over the medium term, value-based property taxation could be reinstated, and the tax incentives to the tourism sector could be reviewed.”

The Saint Lucia Labour Party (SLP) 2021 Manifesto, subtitle housing says: “Remove the current Property Tax on residential buildings.”

The IMF says: “Introduction of a well-designed carbon taxation regime, potentially to replace the existing fuel taxation framework, could ease the pass-through of oil prices to consumers while also aligning incentives to meet St Lucia’s carbon emission targets’ commitments.”

A recent domestic news report presumably gives guidance to a renewed policy and more ambitious tourism expansion.

According to the IMF statement: “Output is projected to recover … by 2024 as tourism returns … but thereafter, growth is expected to decline gradually to 1.5 percent per year.”

However, it is particularly important to note in the highly competitive global marketplace, and despite precious counter-arguments, the proliferation of deals and special offers to tourism-related projects, continues to appeal to the desires and fancy of Saint Lucia’s economic pillar of growth.

The SLP Manifesto reads:

“In an effort to reaffirm a Labour government’s commitment to the importance of tourism, we will enhance efforts to ensure that our tourism product is more reflective of our unique strengths of natural beauty, culture and people, and that a greater share of the tourism dollar remains in Saint Lucia. Mindful of the impact of the Covid-19 pandemic on ancillary service providers to the tourism sector, we will seek creative ways of assisting entrepreneurs and SMEs, badly affected, to adjust and reorient their businesses to take advantage of new opportunities and to getting back on their feet.”

Inflation in Saint Lucia is expected to reach 6.4 percent to compound one external shock after another. Adjusting to the market environment requires major modification and diversity for challenging times and the future. However, it is important to remain focused on long-term goals, risk and tolerance.

Socio-economic models of Saint Lucia’s economy continue to be constrained by critical mass, relative to the size of the economy, debt levels and sustainable levels of economic growth.

“High public debt and large refinancing needs, reflecting large issuance of short-term instruments in recent years, pose significant challenges. On current policies, public debt is projected to remain close to 90 percent of GDP in the medium term, which would not provide sufficient fiscal space for social spending and infrastructure investment.” ~ IMF.

Currently, the vulnerability to liquidity pressures, will continue, absent revised models, diversity, a shift in the investing landscape (capital investment, higher fiscal multipliers) and improvements in Saint Lucia’s export potential.

“Risks to the outlook are skewed to the downside due to the external and domestic challenges. Given Saint Lucia’s import dependency and tourist exposure, the main risks include persistently high global food and energy prices and a resurgence of the pandemic in the main tourist source countries or locally—in part due to vaccine hesitancy by Saint Lucians,” says the IMF. “Medium-term potential growth would remain low, estimated at 1-2 percent per year.”

It can be argued that increased inflation and taxation are a ‘burden on aspects of growth’.

Prime minister and minister for finance Philip Pierre, recently, noted:

“Do we not know that right now we are making negative income as far as the fuel surcharge is concerned? This has never happened in the history of Saint Lucia’s economic life,” furthermore, explained: “We have just reduced the service charge on price-controlled goods, 6.5 percent”.

Conversely, the IMF statement speaks to revised economic policies, fiscal consolidation, financial sector reforms, decisive policy, leadership and transformative action – to unlock Saint Lucia’s growth potential.

The downside to the IMF current strategies and other recommendations, in this very tough environment, suggests that Saint Lucia could have been better placed. A review of related links below may rejuvenate thinkers and strategists that have now come to age with newness.

“I believe the prime minister of Saint Lucia, Pierre, can and has the proficiency to turn things around, given his “conservative approach to finance and economics,” said an avid economist. But, in the absence of “reasoning, beyond the armchair politicos, humdrum bureaucrats and hopeless policy-makers, constraints are likely to persist.”

Related Links: