These 2022/23 estimates aim at:

- Providing the platform for sustained growth;

- Supporting the continued robust performance of our tourism industry;

- The expansion of construction in the public and private sector;

- Encouraging prudent, responsible, and transparent fiscal management;

- Implementing tools that will assist in significantly reducing waste and unnecessary spending;

- Developing institutional frameworks designed to eliminate corruption, and

- An environment where there is a substantial reduction in revenue from fuel.

By Caribbean News Global ![]()

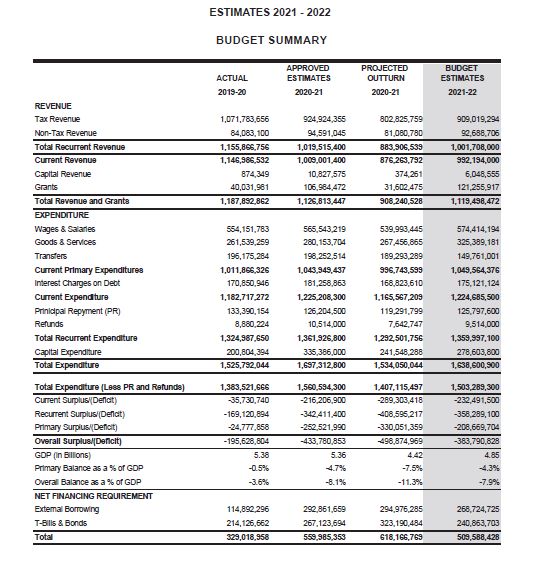

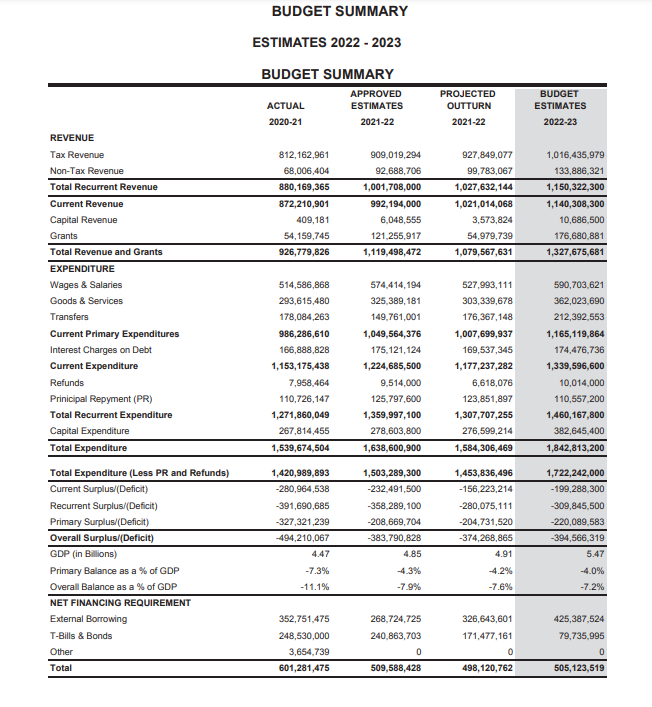

TORONTO, Canada, (CNG Business) – In keeping with the ethos of “the largest budget in Saint Lucia’s history” styled “the peoples budget”, it is important to understand government various projects, the implementation rate of projects, domestic and external revenue, and the borrowing mechanism the government employs. And in the interest of St Lucia’s budget projection vs. reality, a historical view of the budget summary is noted as outlined in the summary of the 2021/22 budget performance, by the prime minister and minister for finance, economic development, and the youth economy, Philip Pierre, March 29.

In the interest of clarity and the expected policy statement [April 26] on how the government intends to execute the estimates 2022/23, the probability of recovery from the pandemic of Covid-19, financial disruption and rising interest rates, inflation, the odds of a recession, energy prices, reduced global economic growth and trade tension/ supply chains difficulties will determine the outcome of the estimates 2022/23.

“The COVID-19 pandemic’s persistence and the Russia/Ukraine war present considerable downside risks, which warrant innovative and transformative policy interventions,” reports prime minister Pierre.

Summary of 2021/22 budget performance

Budget implementation performance for the 11-month period based on the latest available data, has generally been satisfactory, notwithstanding the fact that we continue to face several challenges, including the current COVID-19 pandemic, the recent international developments in Eastern Europe, and the internal administrative constraints that we intend to address.

In the resources area, uncertainties concerning timely receipt of budgetary support funds complicated the government’s cash-flow management and managing the growth in the stock of payables.

Notwithstanding the fundraising challenges, my government anticipates that by the end of March 2022 total resources that would have been used to finance the budget would have amounted to $1.584 billion comprising $1.031 billion in domestic revenues, $54.98 million in external grants, $326.6 million in loan disbursements and $171.4 million in treasury bills, notes, and bonds.

2021-2022 expenditure performance

Preliminary data suggest an expenditure outturn of $1.584 billion indicating underspending by some $54.29 million or 3.3 percent below the approved estimates for the fiscal year 2021-2022.

Of the total amount projected to be expended by the end of the fiscal year 2021-2022, recurrent expenditure is forecast to achieve a utilization rate or an outturn of 96.1 percent of the approved estimates of $1.359 billion for the current fiscal year. This outturn is influenced primarily by the deferment in payment of salary increases to public sector workers, and lower than programmed outlays for project management expenses.

Wages and salaries

Employee compensation which includes the cost of wages and salaries to employees and retirement benefits to pensioners is expected to fall short of its target by $46.4 million based on the expenditure trend for the past 11 months. As stated previously, this outturn is attributed to the continued deferment of salary and wage increases coupled with the impact of delayed recruitment to fill funded vacancies in the budget. A notable change that impacted this expenditure line is the reclassification of salaries for some employees of Victoria Hospital who were seconded to the OKEU hospital.

Debt service payments

With respect to debt servicing, the government of Saint Lucia benefited from debt service suspension by bilateral agencies such as the Agence Francaise De Development (AFD) and the reduction in the variable interest rates, such as the LIBOR rate on loans from the EXIM Bank.

As a consequence, preliminary data indicates that total spending on debt servicing is likely to register a reduction of approximately $7.5 million to reach a total of $293.38 million by the end of this fiscal year.

A total of $169.53 million is forecast as the outturn for interest payments while principal repayments is anticipated to come in at $123.8 million which is slightly below the approved estimate.

Based on the projected outturn, interest payments and principal repayments are expected to fall below the 2021-2022 approved estimates by 3.19 percent and 1.55 percent respectively.

Transfers

Based on the current expenditure trend for transfers, total spending on this category is forecast to increase by $26.6 million when compared to the approved estimates of $149.76 million for the period under review.

This increase was primarily influenced by the reclassification of compensation expenditure as Grants and Contributions to allow for payment of commitments under the Millennium Heights Complex. Additionally, various initiatives in response to the COVID-19 pandemic namely, income support granted to the Bus Drivers are also expected to contribute to the positive variance for this expenditure line.

The payment of school facility fees by the government and the reinstatement of the subvention to the St Lucia National Trust are also contributors to the projected increase.

Goods and services

With respect to the goods and services, which is the largest category, expenditure is expected to fall below the approved estimates for the fiscal year 2021-2022 by $22.05 million or 6.8 percent. This performance is attributed to the combined effects of higher spending on training, supplies and material, operation and maintenance, and consultancy services, which offset increased expenses for rental and hire.

The outturn under the rental and hire vote indicates an increase of $3.6 million to reach a total of $74.9 million by end of the fiscal year.

Development and capital expenditure

Based on the current rate of implementation of some major projects over the past 11 months, we now estimate an outturn on the development side of the budget of $377.06 million representing a utilization rate of 95.5 percent of approved resources for the fiscal year 2021-2022. This is unprecedented given that implementation rates in the past have been well below 70 percent.

Some of the major contributors to the expected outturn include:

- Vieux Fort Water Sector Redevelopment Project;

- Disaster Vulnerability Reduction Project;

- Jude’s Hospital Reconstruction Project;

- Constituency Development Project;

- Road Improvement Maintenance Programme;

- PROUD (SUP) Project;

- Emergency Response COVID-19 Project; and

- The National Roads Rehabilitation Programme.

It is worth noting that despite significant underspending for some grant-funded projects, this has been offset by higher than programmed expenditure on others, owing to more rapid execution and disbursements for major loan funded projects such as the Vieux Fort Water Sector Redevelopment Project and the Road Improvement Maintenance Programme.

Of the total amount projected as the outturn for projects, $276.6 million is expected to be expended on capital acquisitions, buildings (schools,human resource centers, and hospitals), and infrastructure (roads and utilities).

Related: The ‘Forward’ to St Lucia’s estimates 2022-2023

2021-2022 revenue performance

On the revenue front, there was an improvement in domestic revenue performance during the 11-month period of the current fiscal year, surpassing the outcome for the entire 2020-2021 fiscal year by $45.48 million or 5.2 percent. Based on this development, domestic revenue is expected to generate a surplus of $23.44 million, equivalent to 2.3 percent over the approved target of $1.007 billion. This is expected to result in a 2.1 percent increase in tax revenue to an outturn of $927.85 million and a 7.7 percent increase in non-tax revenue reflecting a projected outturn of $99.78 million.

Despite the better performance against the approved estimates for 2021-2022, total revenue and grants are projected to fall short of the forecast by an estimated $39.93 million as the projected shortfall in grant receipts is expected to outweigh the improved recurrent revenue performance. Notwithstanding the shortfall projected for the year, the outturn for total revenue and grants is anticipated to result in an increase of $152.79 million relative to the outcome for the fiscal year 2020-2021.

Preliminary figures for recurrent revenue indicate that since the COVID-19 pandemic was declared in 2020 collections have been much stronger than expected and have produced positive results in all tax revenue lines save for Excise Tax – Imports and Stamp Duty.

We now estimate the outturn for recurrent revenue to be in the region of $1.027 billion compared to the approved estimates of $1.002 billion. This is $25.92 million higher than our initial target for the fiscal year and $147.46 million higher than the outturn for 2020-2021.

This positive performance is expected to come mainly from the following major revenue categories:

- Taxes on income and profits are forecast to achieve a surplus of $16.91 million compared to the estimate;

- Taxes on goods and services – An overage of $11.3 million is projected by year-end, the main contributor being $17.50 million and $10.12 million surpluses from import duties and service charge, respectively.

Notwithstanding, a modest improvement in receipts from import duty, which is expected to achieve a surplus of approximately $10.12 million, the performance is likely to be offset by a significant shortfall in collections from Excise Tax – Imports.

Customs and Excise Tax-imports is expected to register a shortfall of approximately $19.1 million reflecting the gradual erosion of the $4 per gallon charged on unleaded gas from the start of the fiscal year.

Related: St Lucia increases gasoline and diesel prices to sensible levels

On the Inland Revenue side, a shortfall of $13.85 million is forecast by year-end for stamp duty owing to the lack of success in defending the government against a legal challenge to payment of the tax from the sale of the Bank of Nova Scotia to the Republic Bank Ltd.

Grants

Grant receipts from friendly donors and partners are expected to register a significant shortfall, estimated at $66.28 million when compared to the approved target of $121.26 for the fiscal year 2021-2022. The underperformance is influenced primarily by non-receipt of funds owing to delays in implementing key projects such as the Millennium Highway/West Coast Road Upgrade, Reconstruction of Bridge – Cul de Sac, Generation of Employment through Private Sector, and Building Resilience for Adaptation to Climate Change and Climate Vulnerability, just to name a few.

Financing

Based on the developments outlined previously, the government’s fiscal operations are expected to indicate a narrowing of the fiscal deficit from a target of $383.79 million or 7.9 percent of GDP in the approved estimates to an estimated $374.27 million or 7.6 percent of GDP by year-end.

When added to principal repayments, a total of $498.12 million is projected to be disbursed from loans and treasury bills, and bonds. The projected outturn anticipates total disbursements toward expenditure in the following manner:

Loans – $326.64 million; Treasury Bills and Bonds – $171.47 million.

CNG Insight

The result of Saint Lucia’s estimates 2022/23 and the policy response is consequential to improving the government/project implementation rate, entrepreneurial capacity in the new economy and capital investments to accelerate the economy, towards projected targets.

Improved conditions to healthcare, national security (food/crime) fiscal deficits, are primary for job creation to influence new housing stock [social programme/the middle class] infrastructure development, inclusive of government identifying its main economic pillars.

Notwithstanding economic globalization and uncertainties, stabilisation of the Saint Lucian economy and the actualization of increased spending, while maintaining fiscal prudence are significant and of an unexpected nature as previous, hitherto, it becomes more pronounced.