By Caribbean News Global ![]()

CASTRIES, St Lucia – The parliament of Saint Lucia will convene Tuesday, May 26, 2020, at 10:00 am to extend emergency powers, albeit, the island is advertised in international markets – open for business June 4. Other substantive matters on the order paper includes, “Citizenship by Investment (Amendment) Regulations; National Insurance Corporation Annual Report July 2017 – June 2018; Alien Landholding (Licensing) Regulations.

In a request for comment, opposition leader, Philip J Pierre said, “The people of Saint Lucia cannot trust the Allen Chastanet-led government. We have no idea what they are planning to do under the cover of COVID-19. We do not agree that a three-month extension is necessary.”

Motions on the order paper, “authorizes the minister for finance to borrow by means of advances sums not exceeding eighty-five million dollars from commercial banks, for a period of six months from the date hereof, which sums shall be charged on and paid out of the Consolidated Fund. Parliament authorizes the minister for finance to borrow the sum of SDR$21,400.000.00 or US$29,000,000.00 by way of a Rapid Credit Facility (RCF) loan from the International Monetary Fund (IMF) for the purpose of capital and recurrent expenditure.”

Is Saint Lucia in the hands of the IMF?

Last month the executive board of the IMF approved disbursements to Saint Lucia following their requests under the Rapid Credit Facility (RCF) mechanism, SDR 21.4 million or US$ 29.2 million, “to help cover their balance of payment needs stemming from the outbreak of the COVID-19 pandemic.”

IMF approves disbursements to Dominica, Grenada, and St Lucia to address COVID-19 pandemic

“IMF emergency support under the Rapid Credit Facility will help fill the three countries’ balance of payments needs and create fiscal space for essential health expenditures, income support to workers, and cash transfers to households. Fund financing will also help catalyze further donor support to close the remaining balance of payments needs. The IMF will continue to be engaged with Dominica, Grenada, and Saint Lucia, and stands ready to provide policy advice and further support as needed,” Tao Zhang, deputy managing director IMF.

Of note is the divergent explanations by the government of Saint Lucia “for the purpose of capital and recurrent expenditure”, and that of the IMF “to help cover their balance of payment needs stemming from the outbreak of the COVID-19 pandemic.”

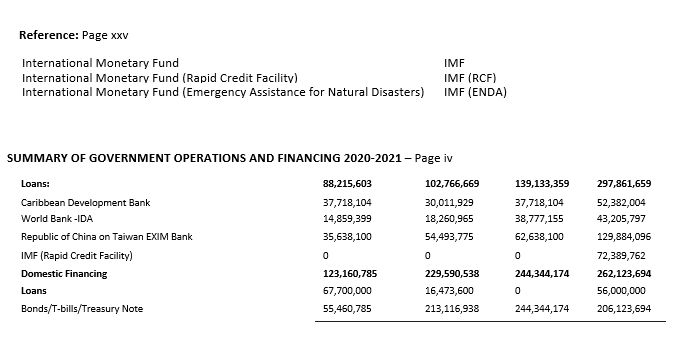

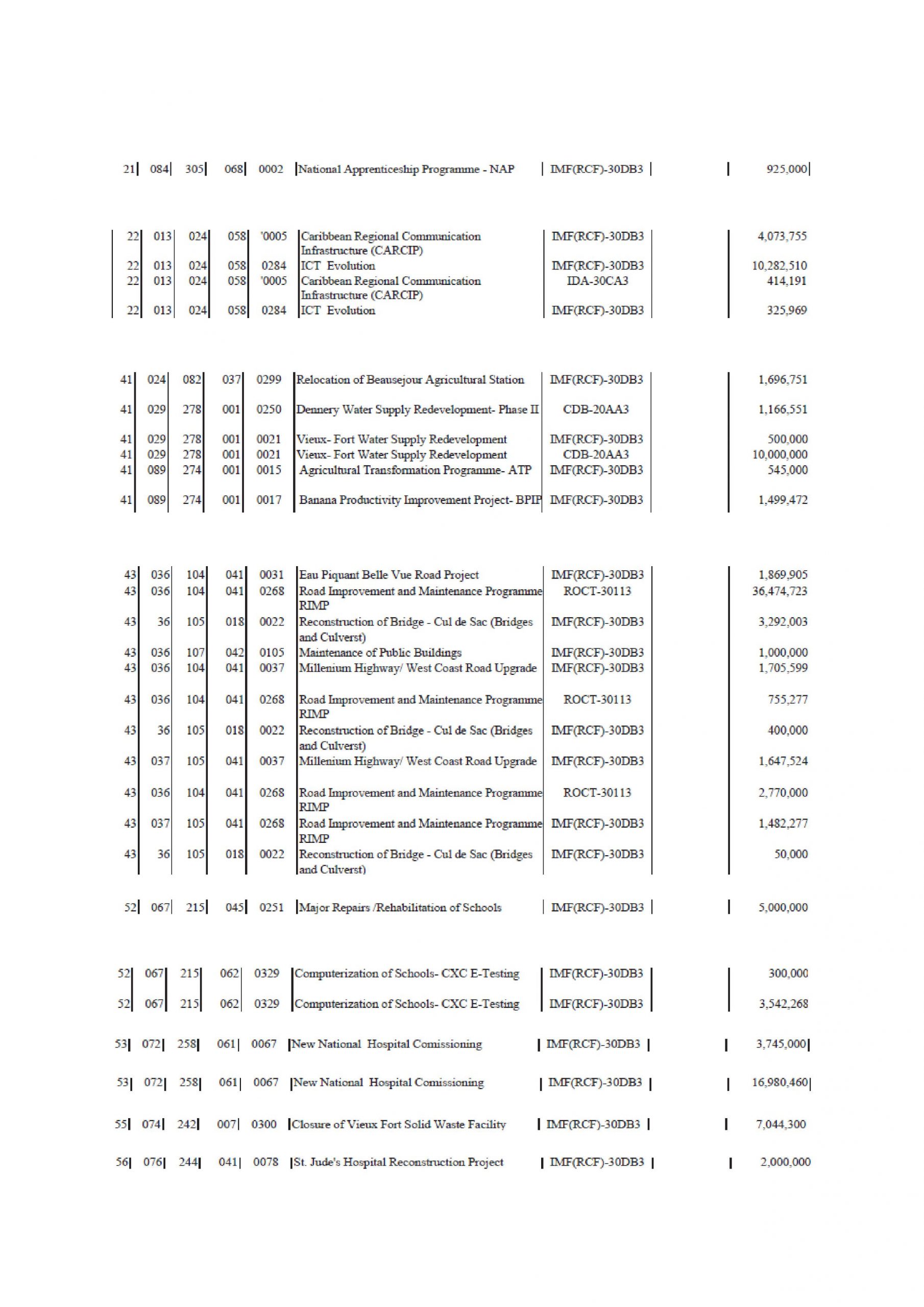

This calls to question the use and /allocation of the fund’s vs the government of Saint Lucia 2020/21 budget estimates in a masked economy per extracts from the 2020/2021 estimates of expenditure and revenue SLU 2020 21 expenditure pgs 611-617 reference IMF Rapid Credit Facility (RCF) $72, 389, 762 million.

Several line items call for explanation from seemingly “duplication of language, double-entry and meaning (errors expected)”, with the same source of funding for example;

A review of the estimates questioned whether the classifications accompanied with allocations and explanations, accurately reflect the conditionalities of the IMF facility.

Notable, forty-one percent (or approximately) $29,769, 760 is allocated to health-related projects. The remaining 59 percent is diverted to projects, not related to the conditionalities of the IMF.

Despite the minister of finance inability to formulate national issues and provide public finance information with specificity, it is fitting to inquire – whether the IMF $72 million-plus borrowing is taking-over the economy.

The interpretation is such that the 2020/2021 estimates of expenditure and revenue – is void of any economic underpinning and is essentially masked. Without the support of the IMF, the government of Saint Lucia is bankrupt.

The 2020/2021 estimates of expenditure and revenue portray a “disturbing and conflicting” scheme that underscores the need for corrective policy.

If the country is truly operating like a business (Friends, Family and Foreign ‘onclaves’ (FFF) and the chairman of the board presented such a bankrupt report to executives and shareholders; the chairman/financial director, etc, (in this case, the prime minister and minister for finance) would be asked to voluntarily resign or gracefully fired.