WASHINGTON, USA – South Asia’s growth prospects have weakened due to tightening financial conditions, with large downside risks in most countries given limited fiscal space and depleting reserves, says the World Bank in its twice-a-year regional update. The report stresses the need to roll back market distortions introduced during the pandemic and address debilitating socioeconomic divides that constrain South Asia’s potential.

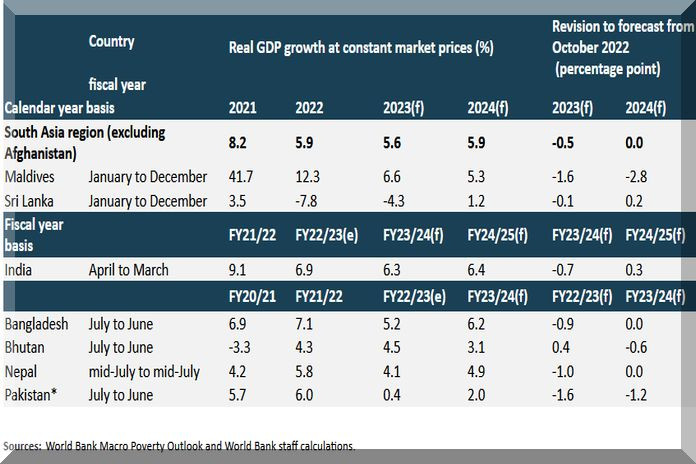

Released today, the latest South Asia Economic Focus, Expanding Opportunities: Toward Inclusive Growth, projects regional growth to average 5.6 percent in 2023, a slight downward revision from the October 2022 forecast. Growth is expected to remain moderate at 5.9 percent in 2024, following an initial post-pandemic recovery of 8.2 percent in 2021.

South Asia’s outlook is shaped by a combination of good and bad news in the global economy. Lower commodity prices, a strong recovery in the services sector, and reduced disruptions in value chains are aiding South Asia’s recovery, but rising interest rates and uncertainty in financial markets are putting downward pressure on the region’s economies.

“South Asia’s economies have been scarred by a combination of extreme shocks over the past three years, and the recovery remains incomplete,” said Martin Raiser, World Bank vice president for South Asia. “Countries should use the opportunity of lower energy prices and improving trade balances to move away from ad hoc measures, such as fuel subsidies and import restrictions implemented to address these shocks, and focus on reforms needed to build resilience and boost medium-term growth.”

All countries in the region except Bhutan have downgraded their forecasts. In India, South Asia’s largest economy, high borrowing costs and slower income growth are expected to dampen consumption and lower growth to 6.3% in FY2023/24. Growth in Pakistan – which is still reeling from the impacts of last year’s catastrophic floods and facing supply chain disruptions, deteriorating investor confidence, and higher borrowing and input costs – is projected to drop to 0.4 percent this year, assuming agreement on an IMF program is reached.

In Sri Lanka, GDP is expected to contract by 4.3 percent this year reflecting the lasting impact of the macro-debt crisis, with future growth prospects – following last month’s IMF program approval – heavily dependent on debt restructuring and structural reforms. The resumption of tourism and migration has supported growth in Maldives and Nepal. But high external debt and tightened global financial conditions pose risks to Maldives’ fiscal and external accounts, and in Nepal, external shocks, domestic import restrictions, and monetary tightening are expected to hamper growth.

Inflation in South Asia is set to fall to 8.9 percent this year, and to below 7 percent in 2024. However, weaker currencies and delayed domestic price adjustments are contributing to a slower-than-anticipated decline in inflation. Elevated global and domestic food prices are contributing to greater food insecurity for South Asia’s poor who spend a larger share of income on food.

To go from recovery to sustained growth, South Asia needs to ensure economic development is inclusive. The region has among the world’s highest inequality of opportunity. Between 40 and 60 percent of total inequality in South Asia is driven by circumstances out of an individual’s control such as place of birth, family background, caste, ethnicity, and gender. Intergenerational mobility is also among the world’s lowest. Data highlighted in the report shows that less than 9 percent of individuals whose parents have low levels of education reach education levels of the upper 25 percent. Such disparities lead to differences in access to jobs, earnings, consumption, and welfare and to calls for redistributive policies.

“South Asia’s stark socioeconomic divides are both unfair and inefficient. They keep talented individuals from contributing to society, reduce incentives to invest in human capital, and derail long-term economic growth,” said Hans Timmer, World Bank chief economist for South Asia. “Addressing these structural issues is vital to ensuring the region can achieve its full potential.”

The report recommends continuing to improve the quality of primary education and expanding access to secondary and higher education, evaluate and strengthen affirmative action policies targeted to “low opportunity” groups, and policies to improve the business climate for small and medium enterprises, who account for the bulk of job opportunities for the less well-off. In addition, reducing barriers to labor mobility can have a powerful equalizing impact as urban areas tend to offer more opportunities for social mobility.