By Assistant Secretary for Economic Policy Benjamin Harris and Economist Sydney Schreiner Wertz

This summer the Treasury Department initiated a blog series focusing on economic issues surrounding racial equity. This post is the second blog entry in this series, focusing on the racial wealth gap as a key component to assessing economic security. Indeed, racial differences in household wealth are some of the most visible and impactful manifestations of racial inequality in the United States. Unfortunately, as we describe below, racial wealth gaps continue to persist – threatening the economic security of impacted families and weakening the economy as a whole.

The importance of wealth for economic security

Wealth is defined as the total financial value of what an individual or household owns (assets) minus all debts (liabilities). Assets include the value of a home and other physical assets, retirement savings, other financial investments, cash, and money in the bank. Liabilities include home mortgages, auto loans, credit card debt, student debt, and other types of debt and money owed. Wealth is distinct from income received from working or investments. Households can turn income into wealth by saving or investing.

Wealth is essential for economic security because it can be used for consumption, which is directly connected to well-being. Wealth is also a resource household can draw from in times of economic hardship, enabling them to smooth consumption over time despite temporary income loss or instability. Moreover, wealth is necessary for individual economic mobility and growth of the economy as a whole. Wealth gives households the ability to pursue an education, take employment or investment risks, move to new neighbourhoods, buy a home, and start a business. The ability to take these risks and be resilient to economic shocks has positive spillovers to the entire economy.

Research indicates that there are long-lasting advantages of wealth accumulation for families. For example, there is a strong correlation between the wealth of parents and their children,in part because intergenerational wealth transfers make up a substantial share of total wealth. Empirical evidence also shows that gains in household wealth increase the probability that children enroll in and graduate from college, which increases their lifetime earnings from employment. These findings call attention to the generational benefits of wealth accumulation and the harms that come from its absence: family wealth boosts future wealth potential, and low-wealth families struggle to progress without it.

Furthermore, the benefits of wealth extend beyond economic security to health and psychological well-being. Negative wealth shocks have been shown to significantly reduce physical and mental health and survival rates among elderly adults, with psychological stress stemming from wealth loss as a key mechanism. Wealth may also affect health through access to the high-quality healthcare it affords.

Racial wealth gaps today and over time

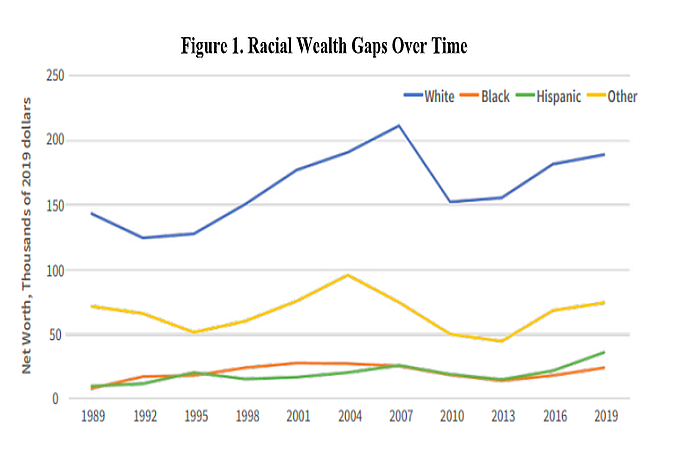

The fundamental importance of wealth for economic security and general well-being makes the large disparities in wealth by race a serious concern for the economic health of families and the US economy as a whole. Using data from the Survey of Consumer Finances (SCF), researchers at the Federal Reserve Bank of St Louis find that the median white family had $184,000 in wealth in 2019 compared to just $38,000 and $23,000 for the median Hispanic and Black families, respectively. Moreover, their analysis shows that the median wealth gap between white and Black families has hardly changed over the last 20 years. Meanwhile, the gap between white and Hispanic families has improved slightly, but it remains large.

Several key contributors to the racial wealth gap are racial differences in home equity, financial assets, and income, all of which are necessary for economic security in their own right and because they facilitate the accumulation of wealth over time. In addition to differences in asset values and composition, differences in the amount and type of debt held by households contribute to racial disparities in economic security. In particular, the number of households with zero or negative net worth—debts that equal or exceed the value of assets—is large and varies by race and ethnicity. In 2016, nearly 20 percent of Black families had zero or negative net worth compared to 9 percent of white, 13 percent of Hispanic, and 14 percent of other race families.

Moreover, while the typical white household has more mortgage, vehicle, and credit card debt (which, in the first two cases, is due in part to the higher-valued collateral underlying the loan), the value of student loan debt was 30 percent higher for the typical Black household than for the typical white household in 2019. This disproportionate burden of student loan debt suggests the important role educational debt relief can play in addressing the racial wealth gap.

Concerningly, research indicates that, under current conditions, the racial wealth gap will continue to widen. Economists Ellora Derenoncourt, Chi Hyun Kim, Moritz Kuhn, and Moritz Schularick write in their recent paper on the evolution of the Black-white wealth gap, “In the absence of policy interventions or other forces leading to improvements in the relative wealth-accumulating conditions of Black Americans, wealth convergence is not only a distant scenario, but an impossible one.” This research highlights the importance of structural solutions in reducing racial disparities in economic security.

These solutions may include policies that seek to reduce discrimination and bias in the housing and labor markets, to better support households in times of financial distress, and to decrease gaps in access to retirement accounts or liquid assets. As Derenoncourt and her coauthors note, more research is needed to better understand what combinations of policies are most effective at reducing racial disparities in economic security.

Research on this and other important questions related to the wealth gap requires better data on wealth and the differences in economic outcomes by race and ethnicity. Wealth is inherently difficult to measure, and race has become more challenging to measure over time as Americans are increasingly likely to self-identify as belonging to more than one race. In conjunction with more research, more high-quality, publicly available data are needed to help craft well-informed policy solutions aimed at reducing these persistent disparities.

Addressing racial differences in wealth will benefit all Americans

The racial gaps in economic security in the United States are stark and have been exacerbated by policies that hinder people of color from building wealth. Moreover, inequitable policies and practices that prevent wealth-building by some groups have been shown to negatively impact economic security for all.

More unequal societies are less likely to invest in public goods that enhance productivity, including education, infrastructure, public transportation, and technology. Policies that address racial wealth disparities, therefore, have the potential to benefit all Americans not only by spurring economic growth but also through public investments that benefit everyone.

As the United States becomes more racially and ethnically diverse, the persistence of racial wealth disparities has the potential to do increasing harm to all Americans. When a significant share of the population is unable to fully participate in the economy, private consumption and investment suffers, stifling GDP growth. The basic economic premise that returns to investment exhibit diminishing returns suggests that the largest gains to our economic potential as a nation come from addressing disparities that hinder the ability of the least advantaged families to invest in their future.