CASTRIES, St Lucia, (OECS) — The goal of digitizing the Organisation of Eastern Caribbean States (OECS) economies will be one small step closer on March 30, 2021, as Micro and Small Medium-Sized Enterprises (MSMEs), Financial Institutions, Financial Technology (Fintech) Firms and interested consumers operating and living in the OECS region increase their awareness and knowledge about digital financial services and in particular digital payment solutions available and operating in the region.

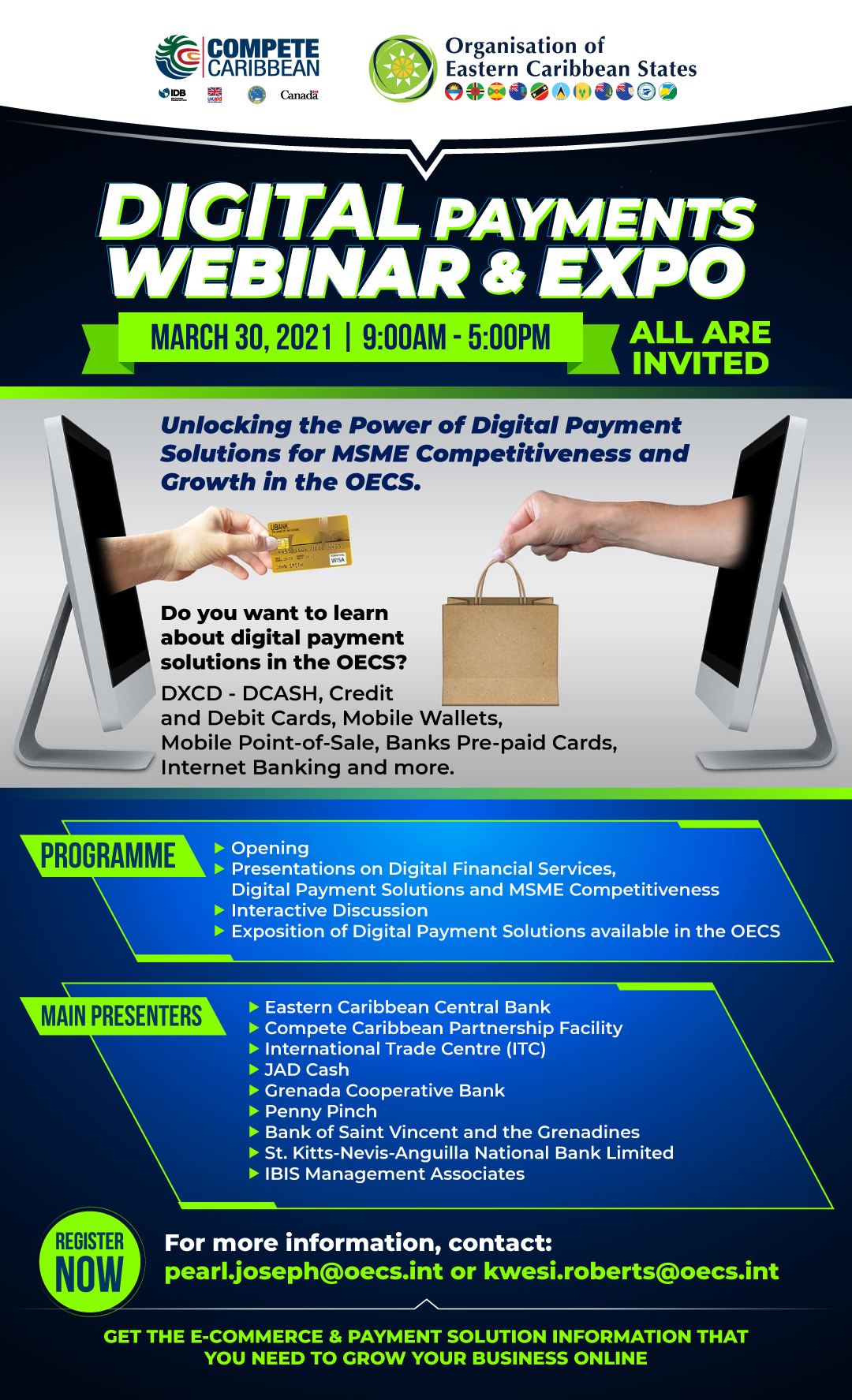

This will be achieved as the OECS Commission in partnership with the Compete Caribbean Partnership Facility hosts a Digital Payment Webinar and Expo. The theme of the event is Unlocking The Power Of Digital Payments For the Growth of Micro Small And Medium Enterprise (Msme) The OECS.

During the webinar presentations and Fireside Chat participants will learn about digital financial services (DFS) which are financial services that rely on digital technologies for their delivery and use by consumers, and digital or electronic payments solutions that facilitate transactions to take place via digital or online modes, with no physical exchange of money.

The Digital Payment Expo segment will provide an opportunity for digital financial service providers operating or whose solutions are available in the OECS to present and promote their existing or upcoming digital payment services to MSMEs and interested consumers in the audience.

Presentations and discussion will include the International Trade Centre, the Compete Caribbean Partnership Facility, the indigenous OECS Banks, MSMEs and the Eastern Caribbean Central Bank (ECCB). The Expo will also see presentations from several banks and Fintech firm operating in the OECS.

The imperative for this event is can be found in a revelation from the ECCB who suggests that paper-based transaction (cash and cheques) accounted for about 80-90 percent of all payments and 44 percent of the volume of transactions in the Eastern Caribbean Currency Union. This means that OECS MSMEs are still conducting most of their sales transactions to consumers using cash. Confining payments to cash only, however, can limit the potential of MSMEs to be more competitive, innovative and to experience growth.

Also, in a study conducted by Compete Caribbean titled Understanding the Role of Fintech Companies and Regulations in Enabling Caribbean MSMEs to Innovate and Grow, the constraints to MSMEs in accessing electronic payment channels from traditional banks and FinTech, digital payment systems were identified and included accessibility, high transaction costs, lack of awareness and resistance to change.

The World Bank indicates that Digital Financial Services (DFS), enabled by financial technology, has the potential to lower costs, increase speed, security and transparency and allow for more tailored financial services that serve marginalised communities. The International Finance Corporation (IFC) also suggests that disruptive technologies and new entrants are radically changing the financial services industry thereby forcing traditional business models to adapt and transform economies.

In the OECS, the current COVID-19 pandemic has accelerated the need for businesses to digitise and provide contactless solutions to customers thus magnifying the importance of strengthening the regional framework for digital payments.

The event is part of a broader project to strengthen the ecosystem for entrepreneurship and innovation in the OECS and will be followed by a programme to provide technical assistance and capacity building to several OECS MSMEs to onboard digital financial services and payment solutions in their business operations.